Building The Cards of Tomorrow: 10 Capabilities of Next-Gen Issuer Processing

Recent data on US credit card holders tells us that they value flexibility and control more than rewards and fee-based offers. In light of rising interest rates and debt, consumers view credit cards as ‘liquidity management’ tools and expect them to serve various purposes1. And with close to half American credit card holders now revolving their debt2, higher flexibility in payment plans is valued more than traditional rewards.

All of this points to a new set of credit card use cases that issuers need to compete on. From on-card BNPL to digital wallets that link seamlessly with debit and credit products, fintechs or big techs with no dependence on legacy systems are already touching 4 out of 10 US customers3 by offering more flexibility and control.

Issuers cannot deliver these use cases on legacy issuer processor systems in an economically or operationally sustainable way. This is driving urgency around the issues of modernization of issuer processing cores, and what kind of capabilities they should be building. In this blog, we help clarify the capabilities that differentiate the next generation of issuer processor technology, and how it can help future-proof an issuer’s business lines.

Watch our CEO Bhavin Turakhia highlight the 5 pain points that issuers need to solve today.

10 must-have capabilities in a next-gen card issuer processing platform

Like any new technology offering, the landscape of modern issuer processing platforms can seem like a forest of buzzwords. Cloud-based, API-first, microservices driven—most modern platform providers use the same descriptors. However, the real test of a next-gen card issuer processing platform should not be its technology enablers but the capabilities it offers issuers.

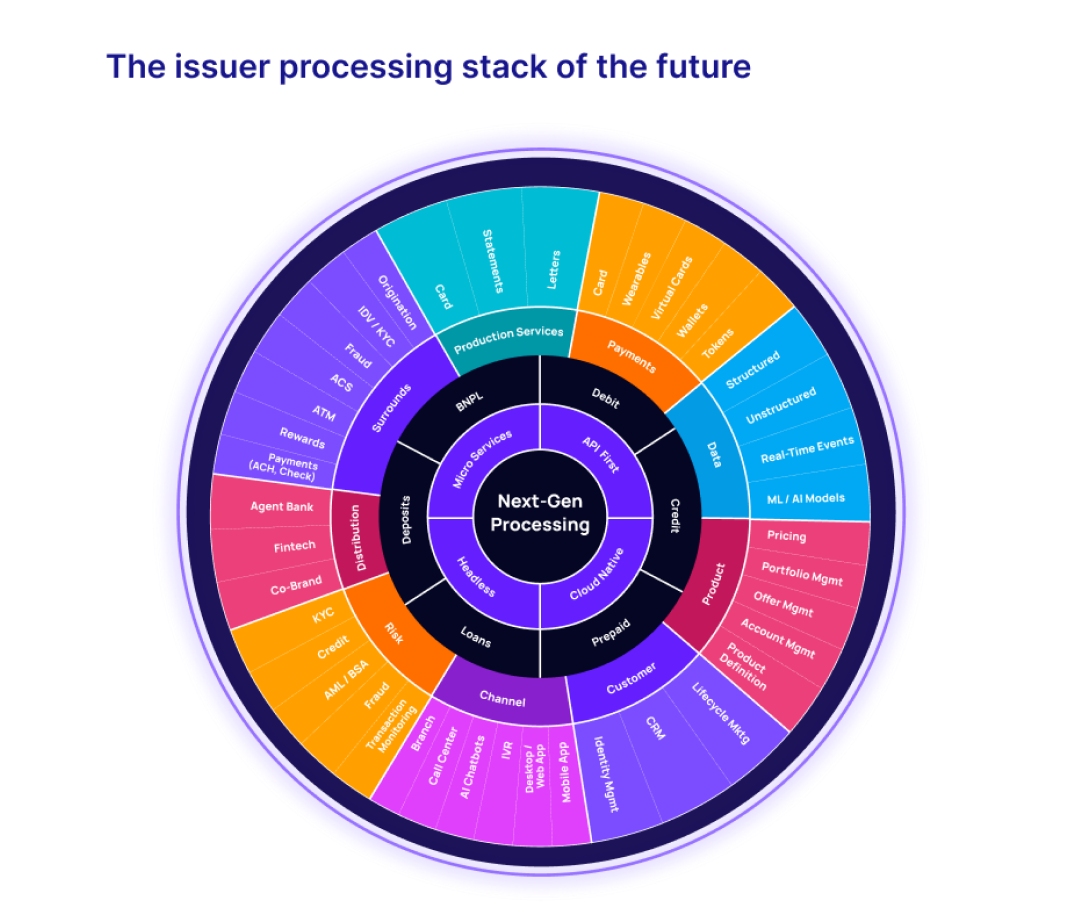

Image 1 illustrates the broad scope of functional elements that need to be incorporated in a next-gen card issuer processing platform, with a view to future-proof a bank’s payments platform and resulting business lines.

Image 1

Next-generation technology is inherently connected, scalable, and composable, which allows issuers to orchestrate a unified customer experience across product types (debit, credit, prepaid, or BNPL), and customer touchpoints (transactions, services, distribution, etc.) Let’s look at the 10 key capabilities that differentiate next-gen processing and help issuers overcome shortcomings of legacy systems to achieve this vision of next-gen processing.

- Microservices-driven headless architecture with API-first, extensible object models

- Cloud-native infrastructure with near-infinite scalability

- Omnistack for asset and liability products, enabling the construction of both asset and liability products on the same platform

- Config-as-code through web-based interfaces and modern intuitive UX for real-time changes via configuration and not code, unleashing significant speed in product creation

- Extreme integrability using APIs, events, webhooks, interceptors

- Real-time transaction processing and settlement with almost no downtime

- Flexible data models supporting supporting one-to-many, many-to-many, and many-to-one relationships between entities

- Rich and multi-modal data access to enable real-time analytics that improve decision-making, embed contextual nudges in customer journeys and build segmented offerings

- True ‘segment-of-one’ product construction using hyper-personalized pricing (fee and interest) at program, customer, account, or transaction level

- Native embeddable banking support to allow building distribution ecosystems via agent banks, fintechs, and co-brands

Read our white paper on modernizing card technology platforms for a complete overview of the 10 key capabilities of next-gen processing and how they unlock business value for issuers.

Building competitive card portfolios with next-gen capabilities

As American cardholders demand greater control and flexibility in their credit cards, digital-first disruptors and early adopter banks are changing the competitive landscape by delivering newer experiences. A next-gen card issuer processor platform can help issuers accelerate their transformation journey and rapidly introduce new features in response to market needs or regulatory changes.

Let’s look at some of the innovative use cases in the cards market today, which can be enabled by next-gen processing:

- On-card BNPL like Citi Flex Pay, Chase My Plan, and American Express Plan It, that helps customers control their payment schedule

- Seamless provisioning of digital cards into digital wallets for easy online and offline transactions

- Enriched transaction statements with real merchant names, additional merchant details, and the ability to add personal notes for more meaningful spend insights

- Digital cards with enhanced controls to allow cardholders to set location controls, spend limits, and even merchant-level controls

- Aggregated visibility and control across related accounts and products (for example, a family hub that allows primary cardholders to control features & access for dependent cardholders)

- One-time or limited validity virtual cards for enhanced security for online transactions, one-time payments, or to avoid accidental recurring charges on subscriptions

- Enhanced card security features, such as support for multiple methods of authentication, including PINs, OTPs, device tokens, etc., in response to Strong Customer Authentication (SCA) requirements

In the near term, we also see a significant case for AI-driven use cases, whether for alternative credit risk assessment or as tools/virtual coaches for consumers who want to build up their credit scores. Next-gen processing systems deliver the fundamental building blocks that enable AI-driven banking experiences.

A call for bold, not incremental transformation

Accenture’s modeling of global profitability data shows that leapfrogging digital maturity stages to become future-ready can enhance EBITDA4 profits by 48%5 compared to a 17% rise with incremental improvement. As banks undertake the expense and risk of modernizing their issuer processor cores, they need to ensure that the strategy goes deeper than lift-and-shift to the cloud or adopting digital solutions in individual functions.

Fundamentally, the adoption of a next-gen issuer processing platform is about changing the way a bank runs its cards business, reimagines business models, and launches products for the future. This is not possible with approaches like hollowing out legacy cores or layering on top of legacy technology.

McKinsey identifies the future opportunities for banks in their 2023 Global Payments Report as follows:

“In the Decoupled Era (of payments), banks will no longer be able to rely solely on the account ownership paradigm. They will need to build new businesses to keep clients within their service ecosystem. The transformation will require technology changes in the form of core modernization and the application of generative AI. Furthermore, because the independent actors in decentralized systems pull toward their advantage, banks and nonbanks will experience a heightened need for security as avenues for fraud and financial crimes increase.”

Connect with us to know how we help banks launch next-gen cards.

Footnotes

[1] YouGov, Global consumer perception on credit cards | December 2022

[2] CNBC.com, 56 million Americans have been in credit card debt for at least a year | January 2024

[3] McKinsey, The great divergence – McKinsey Global Banking Annual Review 2021 | December 2021

[4] EBITDA: Earnings Before Interest, Tax, Depreciation and Amortization

[5] Accenture, Elevate Decisions: Future Ready Banking Operations | April 2021