Legacy Card Tech: The 6 Hidden Risks of Status Quo

For card program executives, the real competitor is their own legacy card technology. Every discussion on competitive card strategies inevitably becomes a discussion about what their tech stack will allow. With feature launches extending into several-month-long projects, and budgets for new developments being constrained by maintenance and upkeep of legacy software, we’re seeing a growing recognition of the risks and limitations of aging card technology.

IDC Insights projects that by 2028, the global spending on maintaining outdated payment systems will swell to a staggering $57 billion1. And this is at a time when banks and credit unions are facing growing competition on payments revenue; non-bank digital payments in the US are expected to surpass bank-based digital payments, reaching $24.8 trillion.

A new report from Datos Insights, Escaping the Legacy Tech Hamster Wheel looks into the growing competitive gap faced by issuers with legacy tech-backed card programs. In this blog, I summarize the reports’ insights into the six market risks that are driving modernization of competitive card programs.

6 Market Risks for Card Programs

Card programs are facing pressures on revenue growth and profitability due to a range of shifts: consumer preferences, talent availability, regulatory forces and more. Image 1 organizes these risks as having cost and efficiency (push) or revenue (pull) impact on card programs.

Image 1

Push factors with cost and efficiency impact

1. COBOL programmers are retiring

A significant portion of the financial industry’s legacy systems is built on COBOL, a programming language with a diminishing pool of experts. In 2017, Reuters noted that the US banking industry runs 220 billion lines of COBOL code, facilitating 80% of in-person and 95% of ATM transactions. The Reuters report also found that COBOL programmers were most likely to be between 45-55 years old.6

As COBOL programmers retire, maintaining and updating these systems becomes increasingly challenging and extremely expensive. This skills gap heightens operational risks and underscores the urgent need to adopt systems based on modern programming languages.

2. Branch networks are no longer a growth driver

The traditional branch network model is no longer the primary growth driver for financial institutions. Digital-first banks, through advanced technology, can acquire and serve customers without the overhead of physical branches.

According to the fourth edition of the Digital Banking Performance Metrics study by Cornerstone Advisors, the percentage of new accounts opened at banks through digital channels fell for the second consecutive year.4

BBVA, on the other hand, exemplifies the impact of early modern tech adoption. 65% of BBVA’s new customer acquisition is from their own digital channels. Over 78% of total sales transactions in 2023 were digital, while mobile customers account for 72% of all active customers. 5

3. State and fed regulatory updates require frequent system updates

The regulatory landscape is continually evolving. With new rules and compliance requirements emerging frequently, the challenges of updating these rules on legacy systems and stretched timeframes—spanning several months—make it difficult to make quick changes. Image 3 highlights the responses of compliance executives across the US in our recent webinar on next-gen compliance.

Modern card systems designed with flexibility enable financial institutions to meet regulatory requirements more efficiently and effectively, reducing compliance risks and costs.

Pull factors with revenue impact

1. Consumers demand digital experiences

In 2023, fintechs and digital banks accounted for 47% of new account openings2. Consumers are increasingly drawn to the convenience and personalization provided by digital platforms, especially for services like person-to-person payments and credit cards.

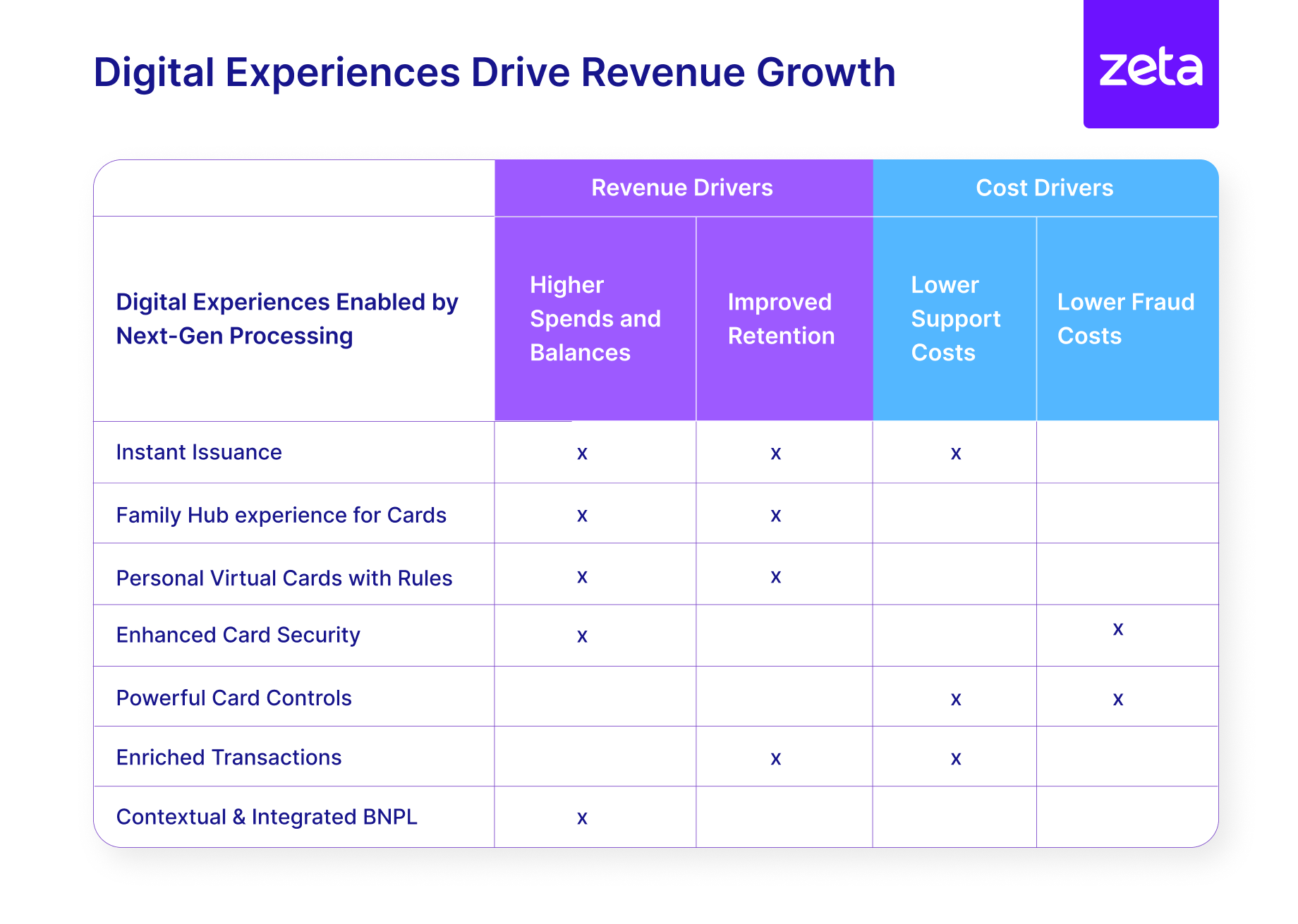

While this may not dramatically impact banks’ DDA growth today, its revenue impact is evident. Image 2 highlights the leading digital card capabilities in the market and their revenue impact:

Image 2

2. Real-time data access is critical to seamless card experiences

The demand for real-time data access in modern financial services is crucial for improved decision-making, embedding contextual nudges in customer journeys, and targeted offerings. Legacy systems that rely on batch processing fall short of providing the necessary speed to offer modern experiences.

Adopting modern card technology enables financial institutions to process and utilize data instantaneously, which leads to accurate and timely insights.

3. AI is becoming a prerequisite

Artificial intelligence (AI) is a game changer. Its ability to offer personalized customer interactions, optimize decision-making processes, and enhance fraud detection across functions makes it an indispensable part of a modern payment experience.

However, AI’s effectiveness hinges on the underlying technology infrastructure, which must support real-time data processing and quick iteration. Banks that persist with legacy systems will struggle to leverage AI effectively, risking their competitive edge.

According to a report by the American Banker, AI-driven personalization can boost customer engagement metrics by up to 45%. The report also found that 73% of banking executives plan to increase their investment in AI technologies to enhance customer experience and back-end operations. 3

A Case for Modernization

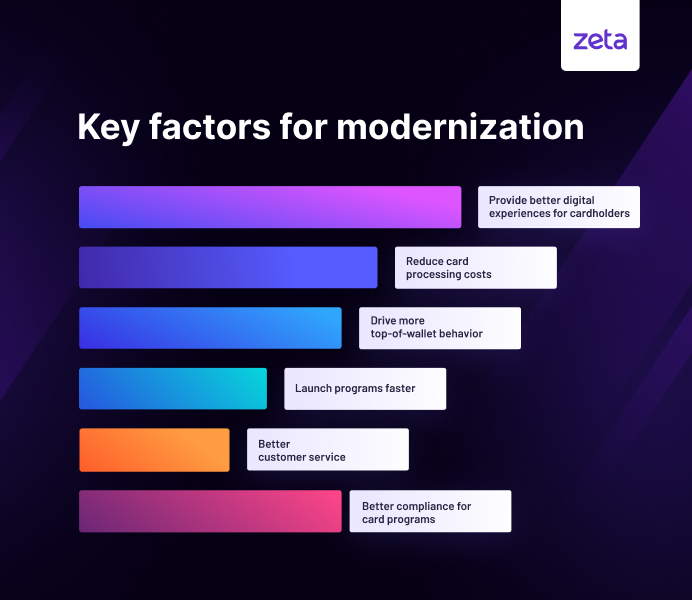

The Datos report surveyed 12 card program executives from US financial institutions about the top reasons for migrating to modern card processor stacks.

Image 3

An overwhelming majority of executives said that offering a better digital experience is the primary reason they upgraded to modern tech. Following closely was the need to reduce card processing costs, while driving positive top-of-wallet behavior and launching programs faster stood at the 3rd and 4th spot respectively.

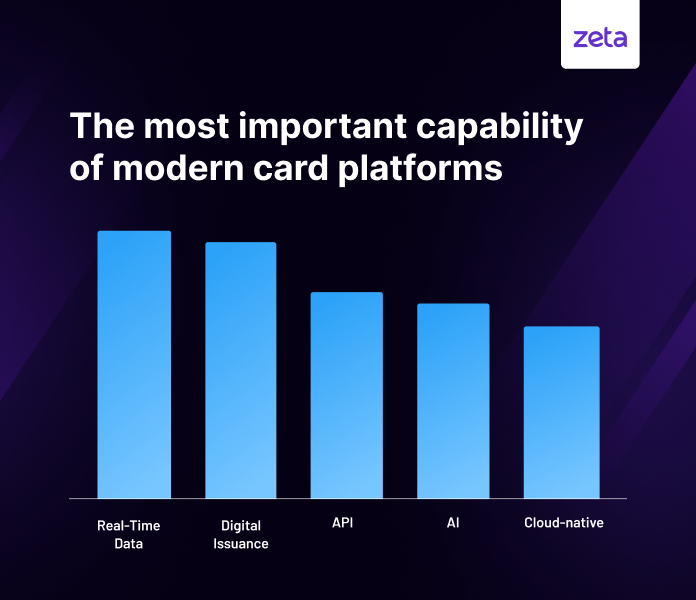

In the same survey, the issuers were asked to rank various benefits related to modern card processing platforms. Here are the results:

Image 4

The executives pointed out real-time data access as the most important benefit of upgrading to modern technology, emphasizing its role in providing immediate insights that are crucial for personalized customer interactions and proactive fraud detection. Digital issuance came in a close second, highlighting the growing demand for instant customer onboarding capabilities and slashing operational costs that enhance customer experience and reduce wait time.

Closing Analysis

The Datos Insights Group estimates that revenue at risk for retail banks not focusing on modernization could be 10% to 15% of retail bank payments revenue annually, translating to $100 billion to $150 billion globally. 7

The new Datos Insights report also highlights that while a hybrid approach, or incremental upgrades, to modernization, can help issuers offer modern digital experiences on new card programs, those relying solely on it will lag behind more innovative competitors and incur higher costs for managing hybrid systems.

Banks must weigh the trade-offs between incremental upgrades and comprehensive transformation. Investing in a fully modern digital infrastructure offers greater efficiencies and stronger competitive positioning in the long run.

For a comprehensive guide to advancing card program maturity, we recommend reading Datos Insight’s report, which lays out the four stages of card program maturity and delivers a practical framework for banks and credit unions to advance their portfolio maturity.

Footnotes

- Paymentscardsandmobile.com, Global Banks to Spend $57 Billion on Legacy Payments Technology | June 2023

- Forbes, Digital Banking Metrics: Troubling Trends For Banks And Credit Unions | April 2024

- American Banker, Exclusive Research Preparing for Banking’s AI Revolution | March 2024

- Forbes, Digital Banking Metrics: Troubling Trends For Banks And Credit Unions | April 2024

- Shareholdersandinvestors.bbva.com, BBVA, 3Q23 Results | October 2023

- Reuters Graphics, COBOL Blues | 2017

- Datos Insights, Payments Modernization in Retail Banking | December 2020