6 Reasons Why Credit Line on UPI Will Transform Retail Lending in India

India’s economic boom has been fueled by innovation, particularly in the sphere of digital payments. The Unified Payments Interface (UPI) is the go-to platform for millions, facilitating seamless cashless transactions. However, a significant portion of the population, exceeding 160 million credit-eligible individuals1, remains underserved by traditional credit channels.

Several concrete challenges around access and distribution of credit have made the inclusion of this group a challenge and limited their economic participation. In September 2023, the National Payments Corporation of India (NPCI) launched its groundbreaking new initiative, Credit Line on UPI (CLOU) that allows a bank’s customers to access pre-approved credit lines directly from their preferred UPI app.

CLOU addresses the key challenges of discovery, access and cost, especially for new-to-credit and thin-file customers. By leveraging UPI’s extensive reach – over 34 million QR codes servicing 300 million users2 – CLOU is set to make credit accessible even in the most remote corners of the country.

Let’s dive a little deeper into the way CLOU is structured and why we believe it is a once-in-a-generation opportunity that will transform the credit landscape in India.

The 6 Reasons Why CLOU is Transformative

Credit Line on UPI isn’t another credit product – it’s a veritable distribution superhighway for all credit products, enabling consumers to borrow precisely what they need, when they need it.

And, given that 80% of credit-approved bank customers are already on the UPI network3 – CLOU gives these customers instant access to pre-approved credit lines without the need for establishing new channels, or engaging in complex formalities of loan disbursals.

Specifically, we believe that 6 unique features will drive tremendous adoption of CLOU transactions:

- Seamless integration: Users can effortlessly discover and link their credit line accounts from the issuer bank using their registered mobile number on any UPI app.

- Secure authentication: Transactions are authenticated with a dedicated UPI PIN for credit lines, ramping up security and blocking unauthorized access.

Ease of transactions: Whether online or offline, customers can pay any merchant by scanning the UPI QR code. This makes the process as ubiquitous as scanning to pay at your local coffee shop. - On-demand credit: Customers can get instant access to their approved credit lines at the point of need without lengthy procedures.

- Unmatched convenience: Customers can easily access credit easily through any UPI app they already use for daily transactions.

- Enhanced affordability: Competitive interest rates on credit lines through UPI, compared to traditional short-term loans, can make borrowing more affordable for customers.

With all of these factors, we believe there will be a significant shift in existing UPI transactions towards credit. Our estimations show that by 2030, 10% of all UPI transaction value will be driven by CLOU4.

Benefits for Banks: Embracing the Coming CLOU Era

CLOU allows banks to leverage the entire UPI apps ecosystem to engage with its customers. This offers several immediate benefits to the Bank:

- Higher activation: Utilize the existing UPI user base to activate dormant pre-approved credit lines, significantly increasing customer engagement

- Higher utilization of credit limits: Users can conveniently access CLOU from their favorite UPI app for their everyday transactions, and this seamless and frequent usage of CLOU will drive higher utilization of their credit limits

- Higher operational efficiency: Streamlined processes and integrated systems reduce the need for manual interventions, lowering operational costs

- Lower collection costs: The digital ecosystem reduces the cost of collections through automated reminders and digital payment channels

- High quality lifecycle management: Customers can manage their credit lines, make repayments, and check eligibility directly through UPI apps

What’s Next

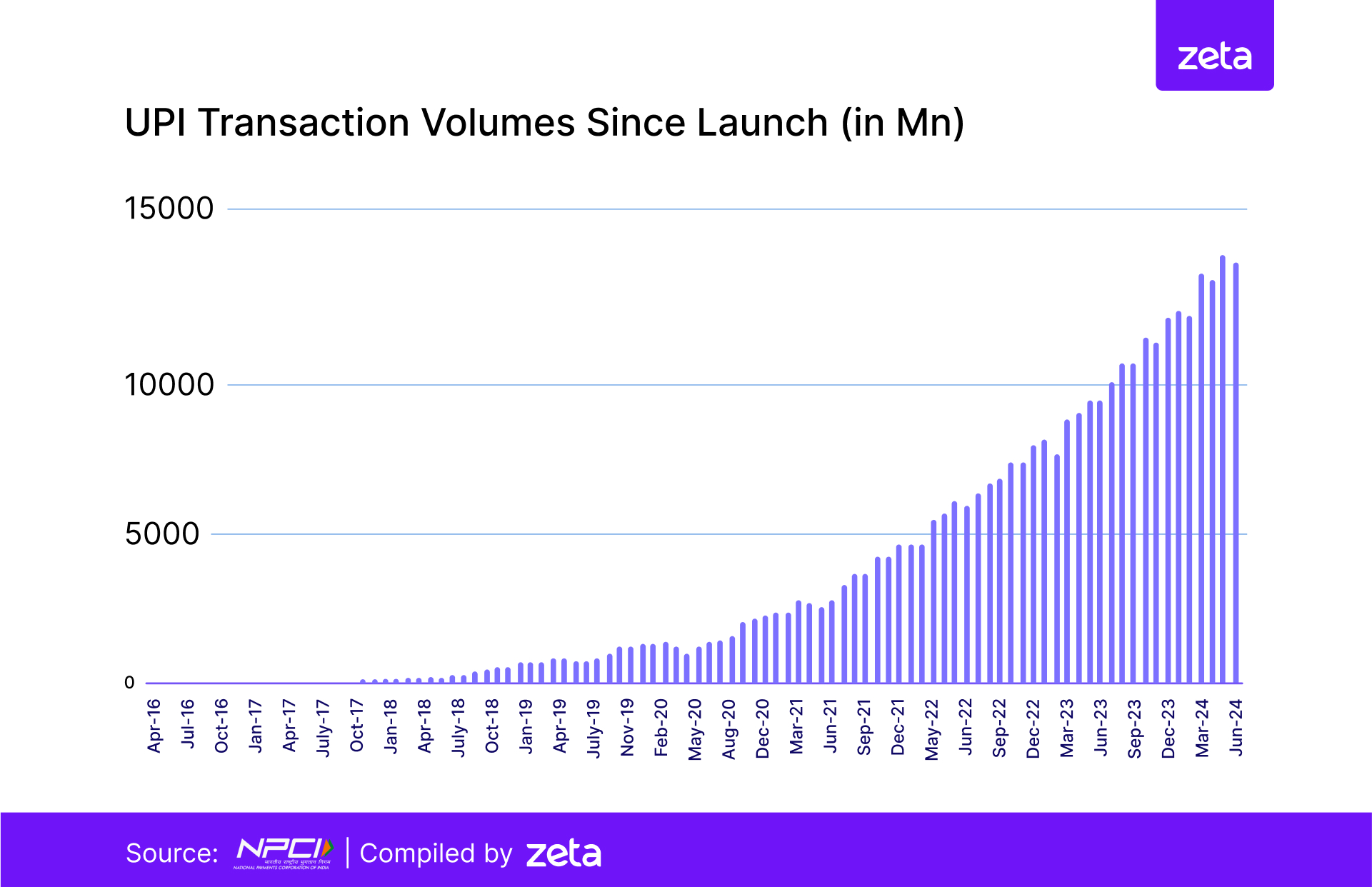

After it was first launched in August 2016, UPI took a little over 3 years to reach 1 billion transactions in a month. Less than 5 years later, UPI clocked almost 14 billion transactions in June 2024 alone 5 (Image 1).

Image 1

It’s early days for Credit Line on UPI currently, but I believe it represents a potential $1 Trillion in transaction spends by 2030.

CLOU represents a paradigm shift in India’s credit landscape. It empowers millions with financial inclusion, fosters economic participation, and offers significant benefits for both customers and banks. By embracing CLOU and adapting to this digital-first approach, financial institutions can position themselves at the forefront of this transformation, contributing to a more inclusive and prosperous future for India.

Over the past few weeks, we have been privileged to engage with scores of banking leaders to discuss how to launch new, digital-native credit programs leveraging this new paradigm. As we continue to evangelize the possibilities, my team and I welcome your comments and thoughts and we look forward to engaging further on this topic.

References:

- Transunion: More than 160 Million Indians are Credit Underserved | April 2022

- RBI; Bankwise ATM/POS/Card Statistics | March 2024

- Zeta internal estimates

- Zeta internal estimates

- NPCI, UPI Product Statistics | June 2024