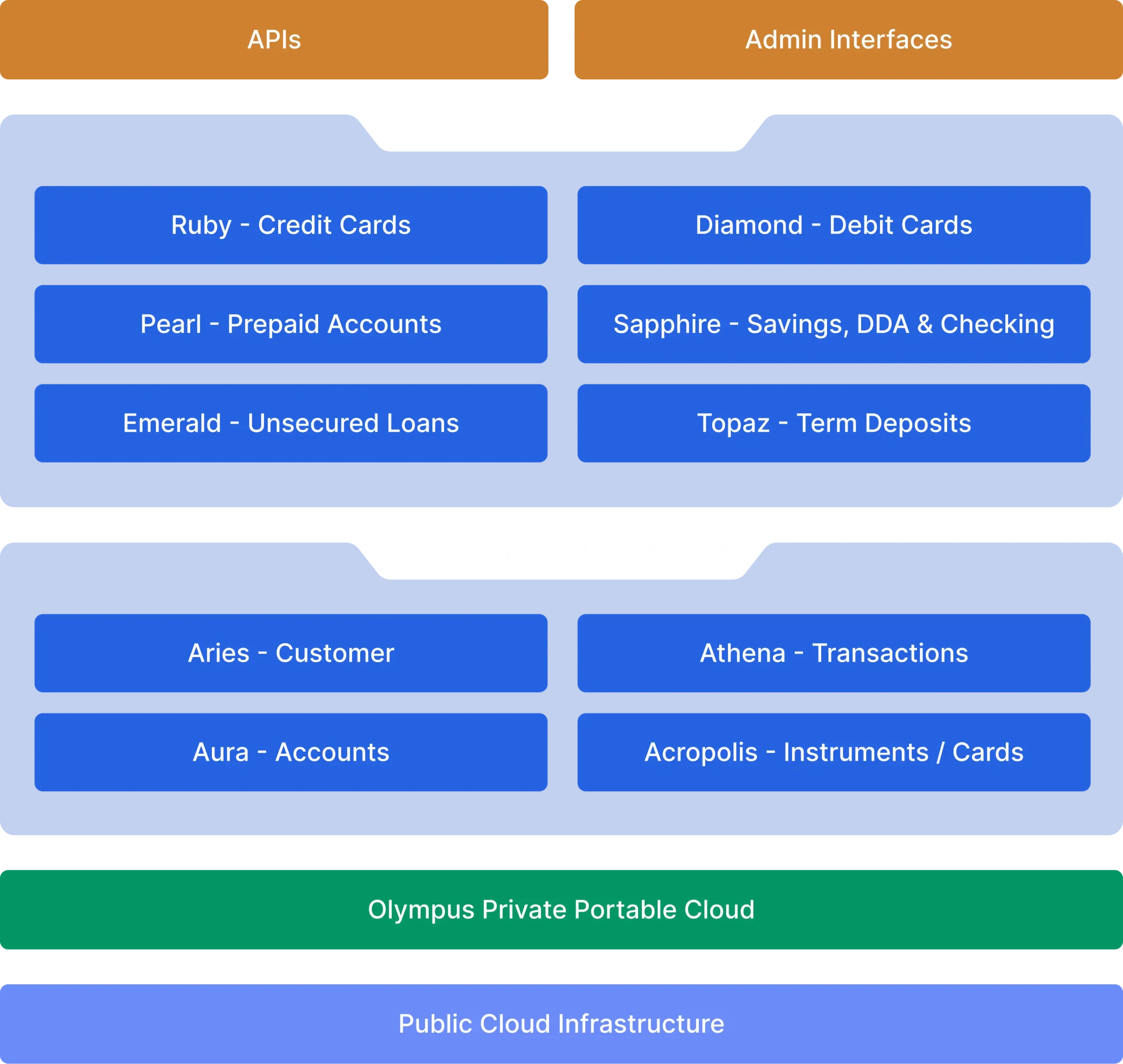

Event Driven and Real-Time

Built from the ground up to be event-driven and real-time, with every process - transaction processing, account processing, card management, and digital experiences - emitting 100s of real-time messages. This allows issuers to:

- Track every event such as end customer actions, customer state change, or transaction/instrument/account state change in real or near real-time

- Send real-time notifications to customers, populate data lakes, power real-time decision engines, and more