Breaking the Status Quo with Transformative Card Experiences

Contents

- Reimagining Digital Experiences with a New Generation of Cards

- Understanding the Impact of Next-Gen Card Experiences

- Moving the Needle for Issuers and Cardholders

- Imperative to Modernize and Build Transformative Experiences

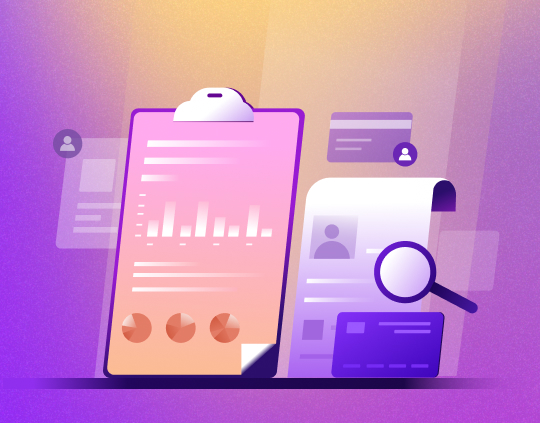

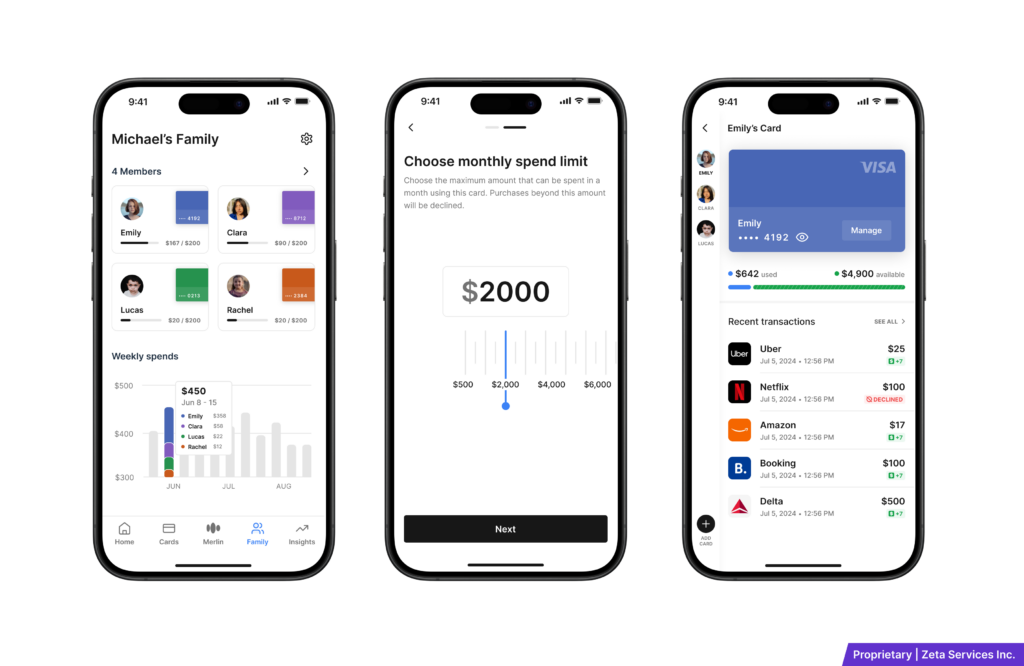

In the current competitive financial landscape, merely acquiring customers is not sufficient; financial institutions (FIs) must foster active customer engagement. Zeta’s research indicates that card usage dominates customer interactions with their FIs, surpassing all other banking interactions. Cards are used 25X more frequently than other interactions such as visiting branches or writing checks (Image1).

However, despite their potential for driving customer engagement, digital experiences tied to cards are often buried within banking apps.

Image 1

Source: Zeta internal data

Card experiences today are undifferentiated. 60% of cardholders feel their rewards program is indistinguishable from those of competitors1. While other areas of financial services have evolved, most credit card programs continue to rely heavily on cashbacks, travel perks, and introductory low-interest rates, missing the opportunity to create modern and competitive experiences.

Our conversations with scores of card issuers reinforce our belief that the imminent need to adopt next-gen card processing capabilities goes beyond merely cutting costs or accelerating feature delivery. There is an equally vital focus on creating innovative card experiences that have now become essential to maintain competitiveness.

Our latest eBook, The Future of Cards is Now, showcases 12 innovative card experiences that can drive significant benefits for issuers and cardholders. Powered by next-gen card technology, these card experiences offer a glimpse into what’s possible when card program managers can conceive, iterate and launch new features rapidly, unfettered by their legacy stack.

In this blog, I summarize the eBook’s core insights and explore 4 transformative experiences and their impact on issuer and cardholder outcomes.

Reimagining Digital Experiences with a New Generation of Cards

Credit cards have remained largely unchanged for decades, with minimal innovation in their core features. Next-generation card processing platforms are ushering in a radical reimagination of credit cards. We’ve identified three distinct phases in this evolution, with Gen 3 representing the emerging paradigm.

The transformative experiences made possible by Gen 3 cards are characterized by 5 central attributes:

- AI-powered intelligence,

- Hyper-personalization,

- Augmented configurability,

- DIY controls, and

- Fail-safe security

Image 2 outlines the evolution of credit cards over the years highlighting how these 5 attributes are redefining them in Gen 3.

Image 2

Gen 3 cards, enabled by advanced processing platforms, provide issuers with unprecedented opportunities for swift innovation without hefty development costs. Crucially, these cards allow issuers to boost customer satisfaction, foster deeper engagement, increase revenue, and achieve top-of-wallet status.

Understanding the Impact of Transformative Card Experiences

Next-gen card processors empower issuers to build innovative, never seen before card experiences.

This eBook showcases 12 innovative card experiences that can significantly enhance modern card programs.

Highlighted below are 4 of these experiences that improve the card experience for both consumers and businesses while substantially impacting issuers’ business performance and engagement metrics.

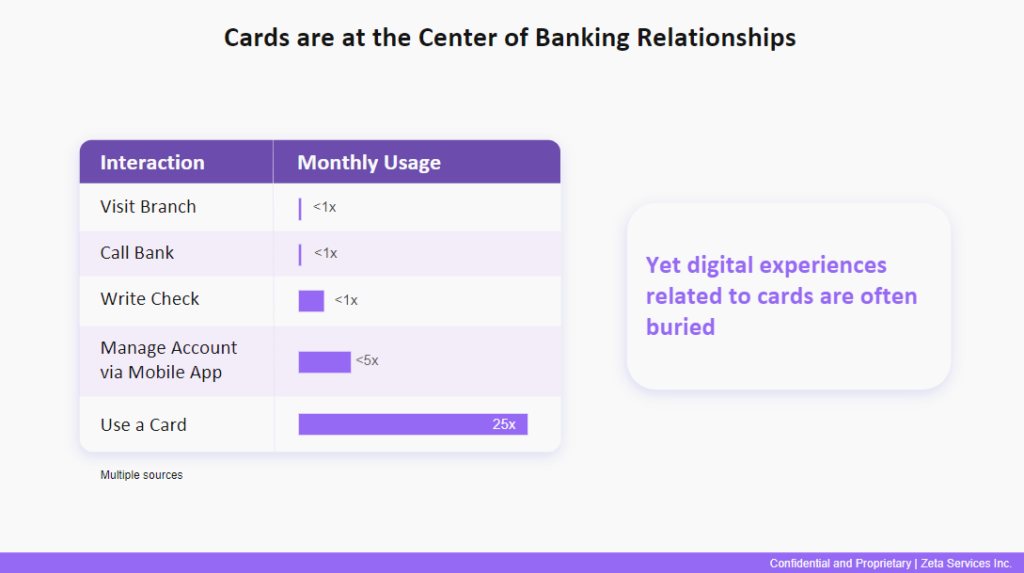

1. Cards for the whole family

A family hub experience that goes beyond traditional add-on cards, allowing primary cardholders to digitally issue cards, set dynamic transaction controls, and track spending at both individual and household levels in real time.

Image 3

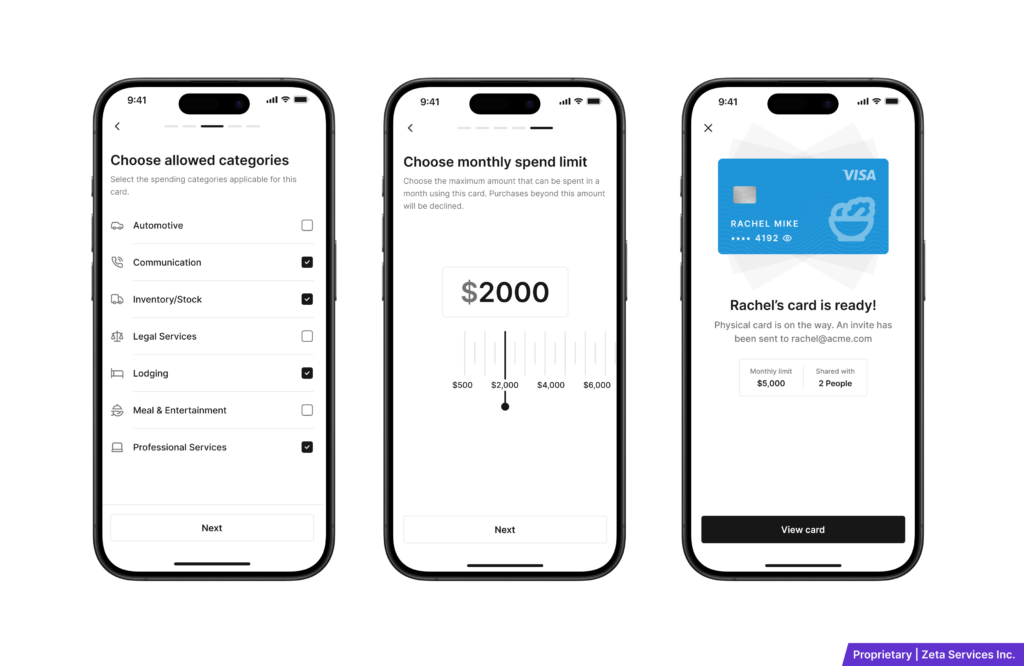

2. Expense Management for Business

Business owners can easily link employee accounts to their existing credit card, streamlining business spending. Cardholders can set usage controls at the account, card, and transaction levels, with spend limits based on date, time, merchant category, or transaction type.

Image 4

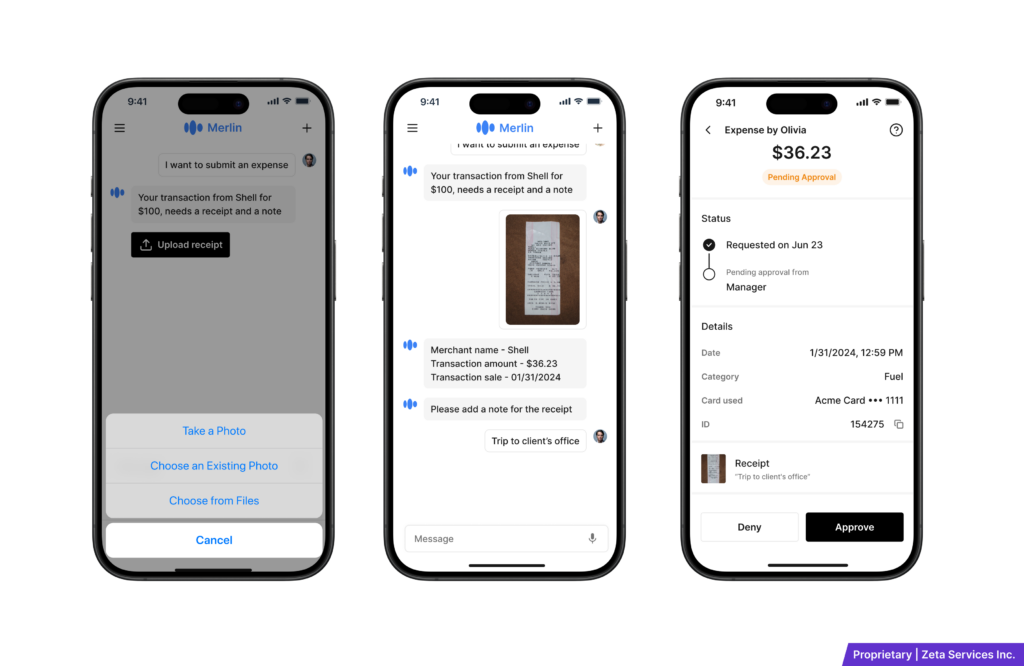

3. AI-Powered Business Reporting

A conversational AI assistant lets employees easily scan and submit receipts for business expenses, using OCR to autofill and enrich expense details. Business owners or managers receive real-time notifications and can review and approve expenses on the go.

Image 5

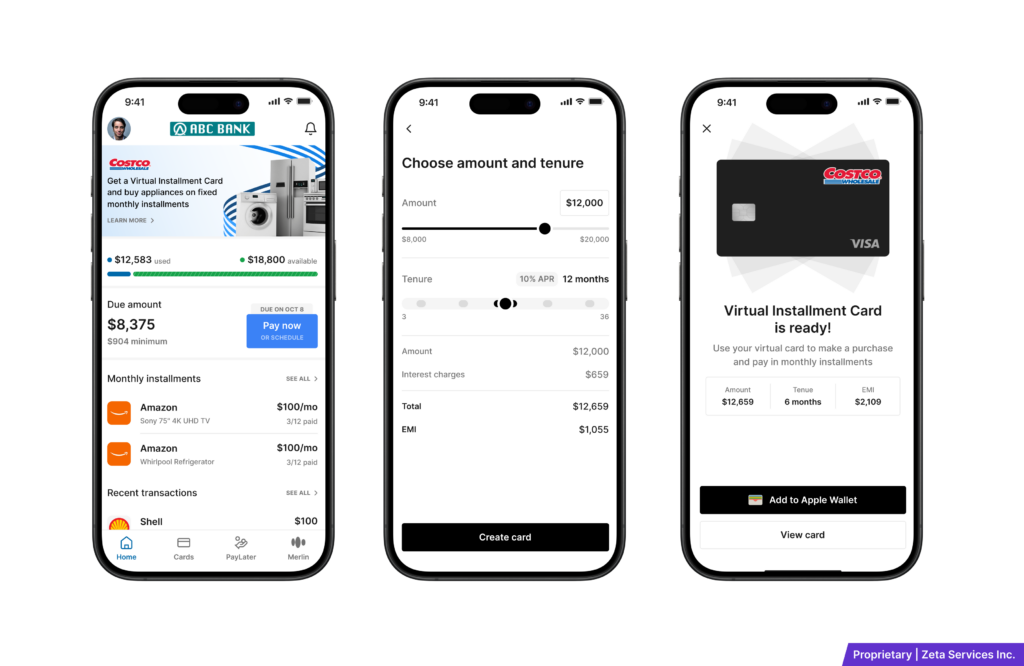

4. Virtual Installment cards

Cardholders can create virtual, merchant-specific cards linked to their primary credit card. Spend limits are set at the merchant level, and purchases are automatically converted into installment loans with flexible repayment terms, including adjustable tenure and interest.

Image 6

Moving the Needle for Issuers and Cardholders

Transformative experiences powered by next-gen card programs can impact issuer outcomes significantly. These innovations drive:

- Faster user acquisition

- Increased customer loyalty

- Higher lifetime value

- Higher card utilization and spending

- Potential reduction in default rates

- Improved top-of-wallet position

- Opportunities for targeted cross-selling and upselling based on rich customer insights

Operationally, these features can reduce support costs through AI-powered assistance and self-service options. They may also lower fraud-related expenses and chargebacks through enhanced security controls. The personalized and value-added services can improve customer satisfaction and reduce churn. Additionally, the ability to offer instant virtual card issuance can drive usage fee revenue, while features like expense management for businesses open new market segments.

Cardholders benefit from these unique experiences in several ways:

- Improved financial oversight

- DIY card controls

- Budgeting tools

- Comprehensive spend insights

- Enhanced security

- Granular transaction controls

- Advanced threat protection

- Increased confidence in card usage

- Personalization

- Tailored rewards

- Custom pricing

- Greater convenience

- Subscription management

- AI-powered assistance

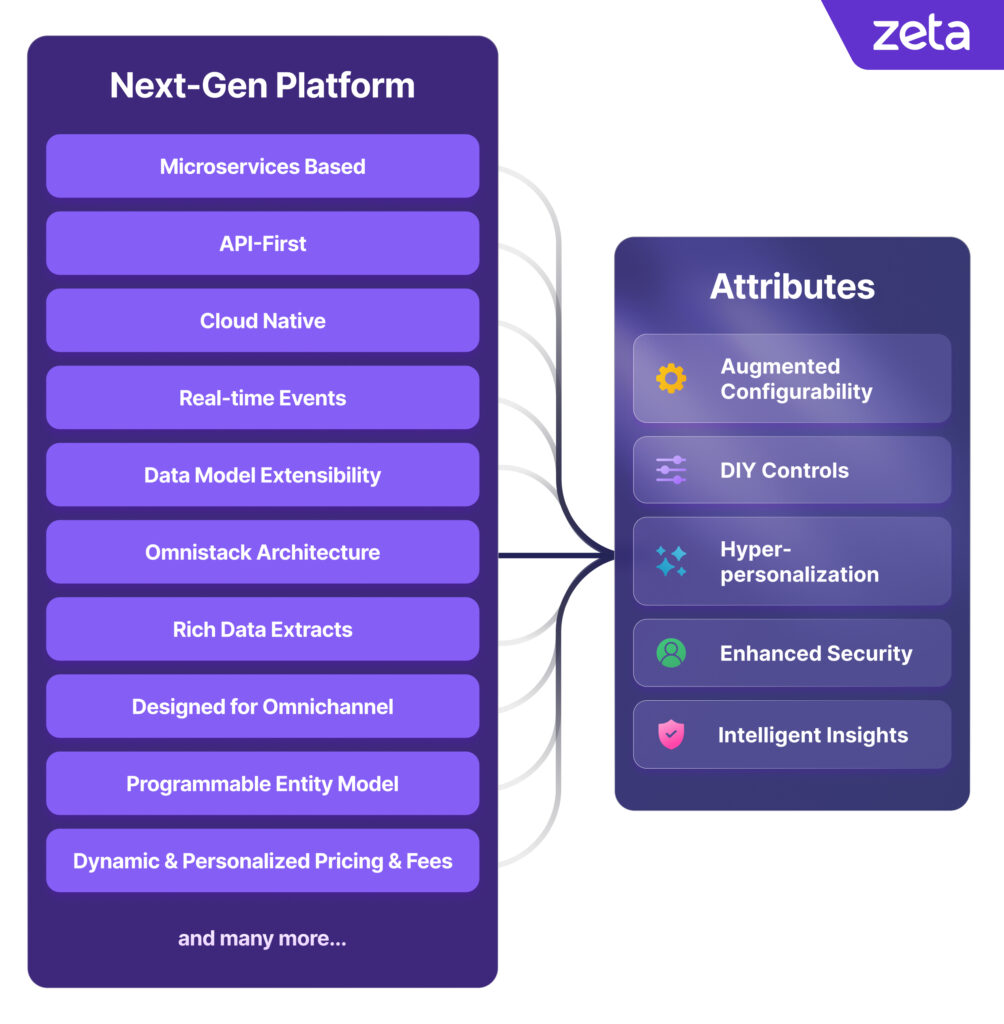

Imperative to Modernize and Build Transformative Experiences

As the competition for cardholders’ share of wallet intensifies, card program managers are prioritizing card platform modernization, with a focus on creating digital and personalized card experiences powered by real-time data and AI. There is also a notable uptick in interest from credit unions and smaller FIs in launching their own cutting-edge, digitally focused card programs.

Issuers know they need to differentiate, but legacy systems are holding them back. These outdated platforms weren’t built for rapid experimentation, leaving issuers unable to keep pace with market demands. Next-gen processors give card managers the freedom to innovate and deliver truly differentiated experiences leveraging the following characteristics.

Image 7

As you move towards building effective card programs, download the eBook, The Future of Cards is Now to explore how digital card experiences can deliver game-changing results for you and your cardholders.

References:

- J D Power, 2024 US Banking and Mobile App Satisfaction Studies | May 2024