Winning with Digital Issuance: Lessons from Issuing 1000s of Credit Cards in Minutes

Digital credit card issuance promises instant gratification, but real competitive advantage comes from converting instant approval into instant spend. On September 10, 2024, this was put to an unprecedented test. When HDFC Bank’s Pixel credit card partnered with artist Diljit Dosanjh for his Dil-Luminati India tour, thousands of fans rushed to sign up for the Pixel card to access the exclusive pre-sale. The bank’s digital issuance infrastructure faced its ultimate test – and achieved:

- 100,000 concert tickets sold out within 15 minutes, with a staggering 8,000-10,000 card authorizations processed per minute1

- Majority of concert tickets purchased with freshly issued Pixel cards through the campaign

- Instant issuance to new users, allowing them to activate their Pixel cards and buy concert tickets immediately

This wasn’t just a successful marketing campaign; it was a demonstration of what’s possible when digital issuance is reimagined from the ground up. The Pixel card transformed the traditionally lengthy and complex onboarding process into a swift, completely digital flow, allowing existing bank customers to receive and activate their cards in minutes. More importantly, it showed how well-designed digital issuance can dramatically accelerate customer acquisition and card activation, turning a moment of high demand into a high impact customer experience.

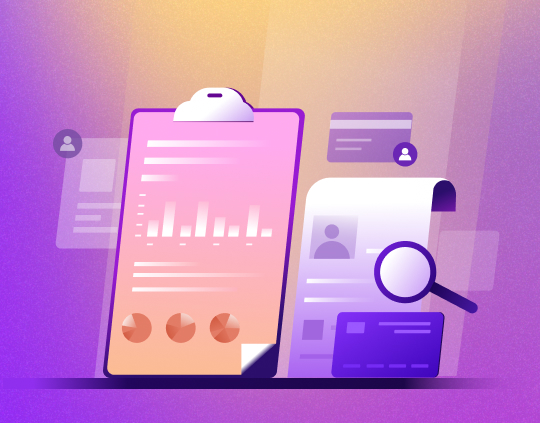

The Digital Issuance Imperative

Digital card issuance has been proven to have far reaching impact on key performance metrics across the card lifecycle. Traditional card issuance typically takes 5-7 days from application to first use, while digital issuance reduces this to minutes. Studies show that cards issued digitally see 10% higher activation rates3 compared to traditional methods and demonstrate a 5% increase in transaction volumes4. Importantly, digital issuance has unlocked capabilities like instant push provisioning to digital wallets that drive high frequency and size of spend on a card.

Image 1 offers an overview of the biggest benefits of digital issuance.

Image 1

Card program managers recognize digital issuance as an important capability for their card programs; in fact, in a recent survey of managers conducted by Datos Insights, digital issuance ranked a close second in importance to real-time data2. However, when adopting digital issuance, issuers commonly choose to digitize existing issuance processes, which were designed for offline acquisition and are not digital first. Customers encounter familiar frustrations in new channels, and, as a result, program managers don’t see improvements in key metrics like dropout rates during onboarding, activations or spend.

Maximizing Wins in Digital Issuance

As competition for cardholder acquisition and retention intensifies, issuers should move beyond viewing digital issuance merely as an efficiency play. They should focus on identifying avenues for improvements to pre-empt drop-offs and disengagement and drive growth.

For example, instead of one-size-fits-all application flows, issuers could consider personalized acquisition funnels that help different customer personas, like reward seekers, travel lovers or food lovers, experience the value proposition of the card in a customized manner, as illustrated in Image 2.

Image 2

Similar rethinking can help solve some of the most persistent challenges in achieving scale and driving distribution, activation, and top-of-wallet use of cards. The following sections highlight five key digital issuance strategies that can drive growth in card programs, and the key technology capabilities required for each.

Five Critical Success Factors for Digital Issuance

1. Preparing for Velocity and Scale in Issuance

Credit card acquisition often occurs in concentrated bursts driven by:

- Launch campaigns and promotional events

- Partnership activations and co-brand opportunities

- Seasonal spending peaks (holiday seasons, travel periods)

- Limited time offers and flash sales

During these peaks, application volumes can surge 400-500% of normal daily volumes. For larger issuers, this can mean processing upwards of 10,000 applications per day during campaign periods5. Without scalable digital issuance, these moments of high intent become bottlenecks rather than opportunities.

Building digital issuance for reliable and efficient scale requires three core components.

- The technology foundation must use cloud infrastructure that can scale on demand, be microservices first for independent upgrade and scaling of components and enable asynchronous processing for speed.

- The issuance system needs automated decision-making capabilities that can handle applications end-to-end without manual intervention, including automated handling of exceptions.

- Finally, the integration layer must support seamless connectivity with partners through APIs, enable real-time data flows, and maintain stability even when errors occur.

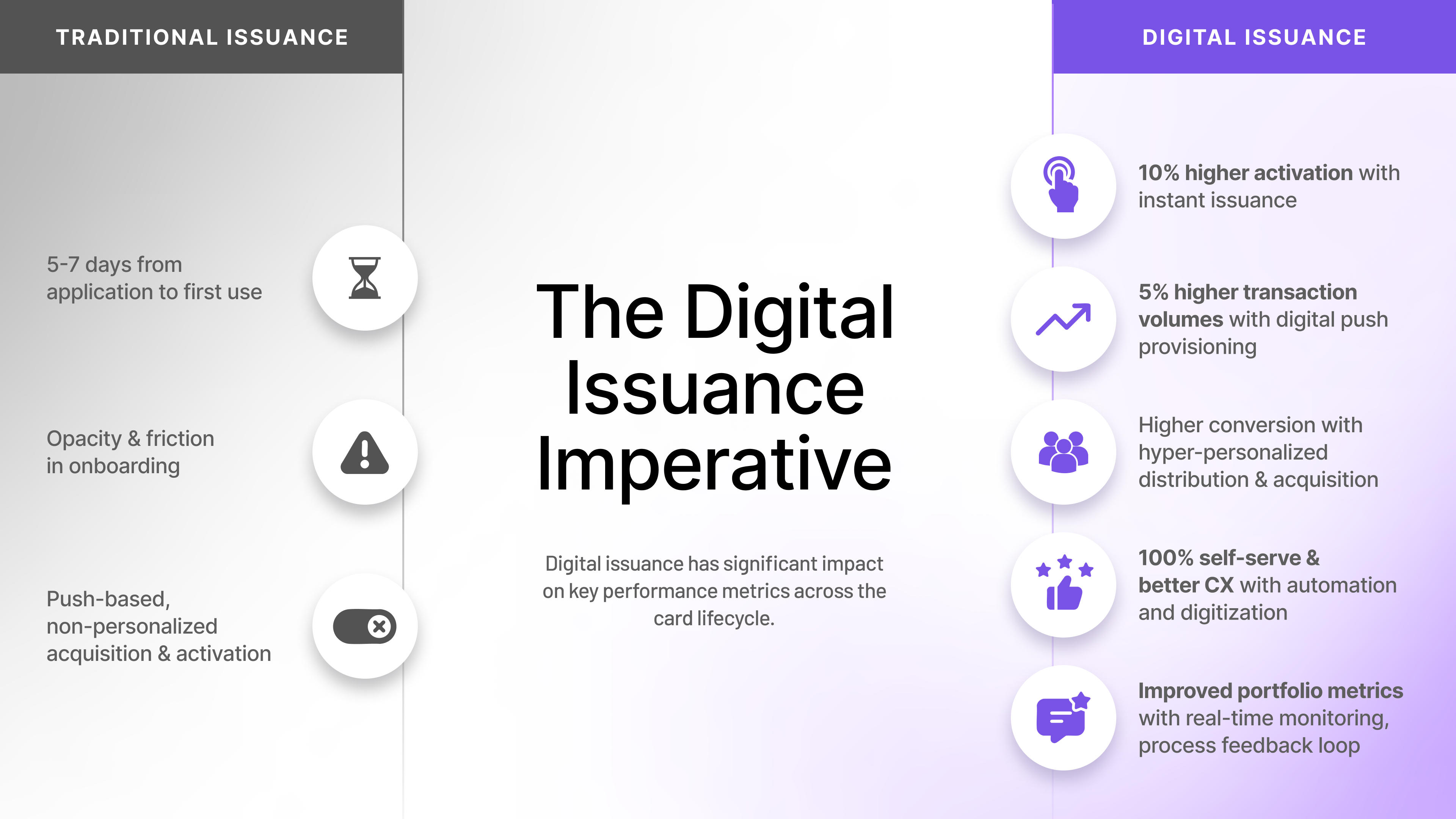

2. Driving Growth with Digital Omnichannel Distribution

Issuers can maximize growth with digital issuance by surfacing offers across various touchpoints where customers already spend their time. With the ability to present relevant value propositions at the point of need across digital channels, banks have reported impressive results across financial products: doubling of digital sales, 300% increase in cross-sell opportunities, and 40% rise in customer activity6. Furthermore, this approach can reduce service costs by up to two-thirds by leveraging digital channels effectively7.

Image 3 presents how similar digital orchestration can be used to maximize acquisition across the existing online and physical channels of an issuer.

Image 3

The key is creating deeply embedded targeting and initiation flows within native platforms like mobile banking apps and internet banking interfaces. These should be complemented by integrations that allow seamless onboarding from partner systems.

3. 100% Self-Serve Onboarding

Successful self-serve onboarding starts with removing opacity and friction; for example, lack of visibility into their card application status often leads customers to drop out and apply elsewhere. Overall, issuers need to re-think onboarding from first principles to eliminate steps that don’t add value, automate what’s necessary, and maintain momentum from application to provisioning. Critical elements for successful self-serve onboarding include:

- Pre-eligibility checks presented early in the process to set clear expectations and gamify the journey

- Automated application pre-fill by integrating the onboarding process with relevant customer data sources, to reduce manual entry and errors

- Income verification through digital surrogates

- Real-time application tracking to help issuers intervene where necessary and ensure quicker passthroughs or rejections

- Instant provisioning capabilities, enabling the customer to receive, activate and transact with their digital card immediately on approval

- Hyper-personalized activation journeys allowing customers to customize their card design, rewards, billing cycle and even choose their preferred network

The goal should be to process applications in minutes, not hours or days, while maintaining necessary security measures.

4. Built-In Growth Tools Across the Onboarding Cycle

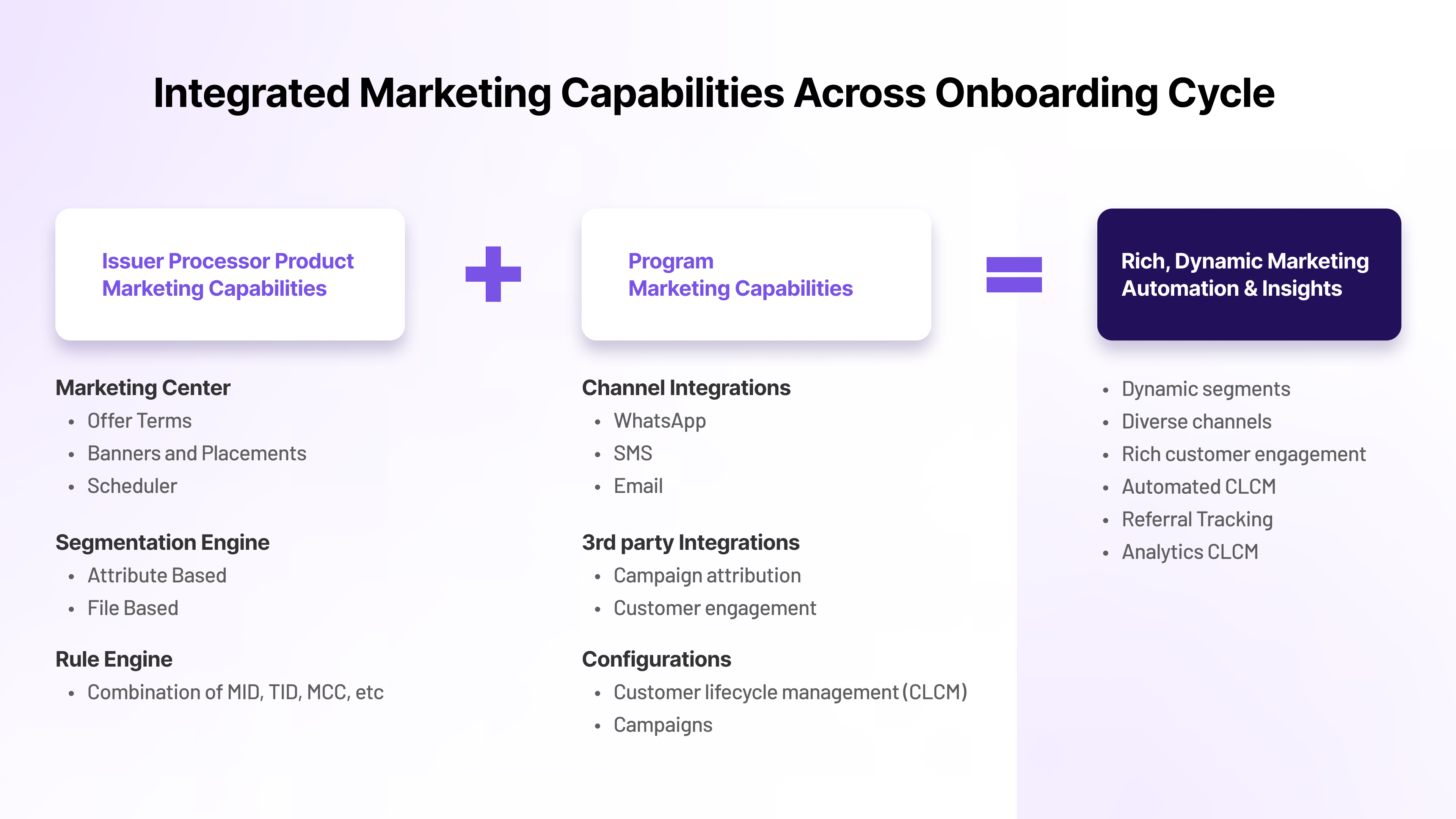

Modern digital issuance platforms need to go beyond basic card issuance to incorporate sophisticated marketing and engagement capabilities at every stage of the onboarding journey. This requires three integrated layers of marketing capabilities as depicted in Image 4.

Image 4

The three integrated marketing layers help issuers to drive more effective growth initiatives across onboarding compared to standalone marketing efforts. For example, issuers can enhance outcomes of targeting, onboarding and activation as follows:

- Targeting:

- Target prospects with personalized offers based on their profile and transaction patterns

- Deploy targeted and contextual card offers across mobile, banking and partner apps

- Track and optimize conversion based on customer response across channels

- Onboarding:

- Enable faster eligibility checks and instant credit line assignments

- Deploy targeted welcome journeys

- Track and reduce drop-off points

- Activation:

- Encourage instant digital wallet provisioning

- Orchestrate merchant partner welcome offers

- Gamify activation milestone completion

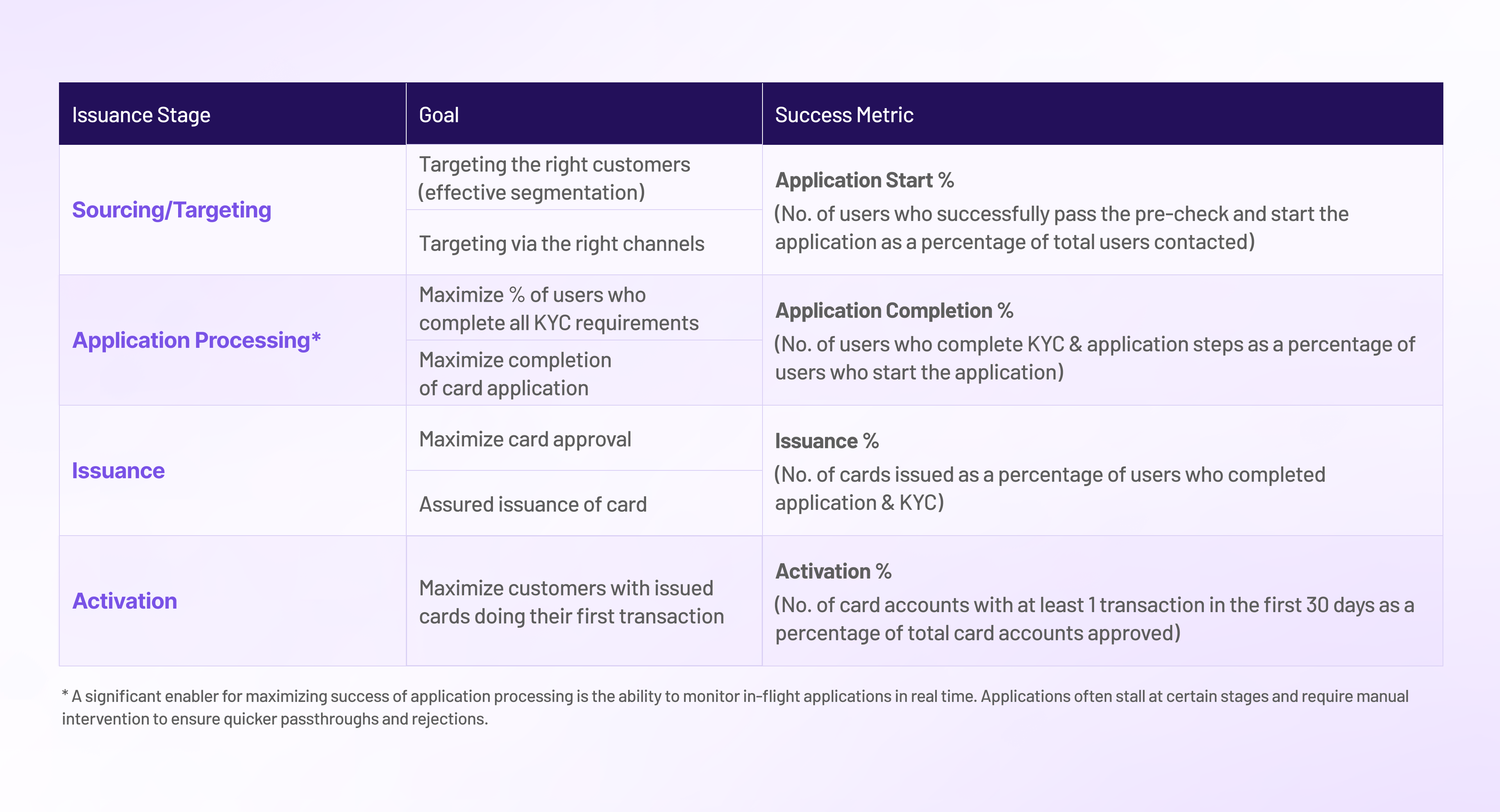

5. Performance Monitoring and Process Feedback

Successful digital issuance requires robust monitoring and analytics with a comprehensive overview of performance across the issuance value chain, which, in turn, requires robust operations capabilities. The goal is to help issuers set up process feedback loops that will help identify and tighten any deviation from key metrics.

Image 5 illustrates a sample set of performance metrics that can be tracked to measure effectiveness across various issuance stages.

Image 5

The Economic Impact

For larger issuers with significant retail banking customers, digital issuance offers compelling economics across the following dimensions.

Effective Cost of Acquisition

The cost of acquisition of a credit card customer is around $150-200 in the US8 and ₹2500-4000 in India9. However, if you consider the high ratio of inactive cards in every portfolio, the effective cost of acquisition almost doubles. Apart from enhancing acquisition efficiency through automated assessment and straight-through processing, digital issuance reduces the effective cost of acquisition for a portfolio by enabling at least 10% higher activation.

Transaction Value Impact

Digital issuance enables immediate card provisioning in native and third-party digital wallets, driving early spending momentum. According to Worldpay research, digital wallet transactions in the US show 25% higher average transaction values compared to physical cards10.

Channel Growth Opportunities

Digital issuance enables new acquisition channels that traditional processes cannot support, like:

- E-commerce checkout integration driving instant applications

- Partner app integrations for contextual card offers

- Social media campaign integration with instant issuance

- QR-code based instant card applications

The impact is particularly significant in partnership channels, like travel merchants, where instant issuance can capture high-intent moments.

Conversion Efficiency

Digital issuance eliminates the 5-7 day gap between application approval and first transaction potential. If we assume an average daily card spend of $50*, not adopting digital issuance can mean significant lost revenue. For example, for a card program issuing 10,000 cards monthly:

- Lost transaction opportunity per card: $250-350 (5-7 days × $50)

- Monthly revenue impact: $2.5-3.5 million (10,000 cards × $250-350)

- Assuming 2% interchange revenue: $50,000-70,000 in monthly revenue opportunity

Looking Ahead

The future of credit card issuance is not just digital – it’s intelligent, personalized, and seamlessly integrated into every customer touch point with their issuer. Digital issuance – reimagined and powered by next-generation capabilities like unlimited scaling, integrated marketing and hyper-personalization – can create new opportunities for growth and customer engagement.

Read more to learn how Zeta’s next-generation platform Tachyon delivers growth engines for modern card programs.

- References:

- NDTV; Exclusive: Diljit Dosanjh’s Dil-Luminati Tour General Sale Tickets Sold Out In 30 Seconds | September 2024

- Datos Insights; Escaping the Legacy Card Tech Hamster Wheel | July 2024

- Zeta internal estimate

- Visa, Instant Digital Issuance: Best Practices on Fraud Management | July 2022

- Zeta internal data

- McKinsey, Integrated channels: The next frontier beyond omnichannel distribution | May 2023

- McKinsey, Integrated channels: The next frontier beyond omnichannel distribution | May 2023

- Banking & Payments Group, Co-Branded Credit Cards: The Allure and The Reality | August 2023

- Economic Times, India’s digital revolution is pushing credit cards out of the arena | April 2022

- Worldpay, Advantages of digital wallets help them rise above card-on-file payments | Nov 2024