A Definitive Blueprint for Digital Credit: The $1T Opportunity With Credit Line On UPI

When we saw RBI’s announcement allowing banks to link credit lines to UPI (CLOU), our immediate reaction was that credit, as India knows it, is going to undergo a paradigm, once in a generation shift. Since then Zeta has been at the forefront of imagining this future and engineering the building blocks to enable banks to launch exciting credit products on UPI and scale them.

The excitement about connecting credit in an underpenetrated market like India to UPI, the world’s largest payment rails, is one that’s shared by almost every senior banker I’ve met this year.

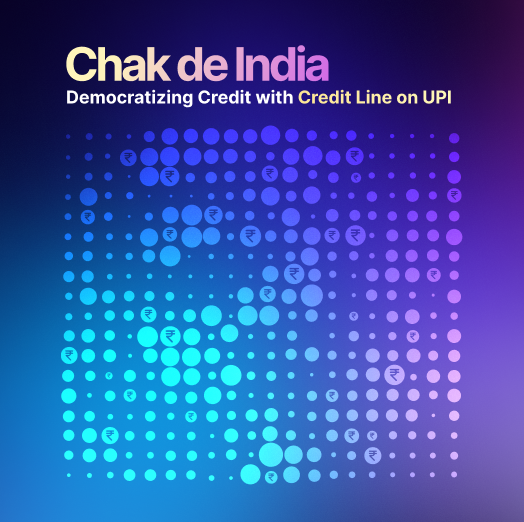

We are witnessing the birth of digital credit in its truest form with credit line on UPI and the implications are not lost on the banks. There is, however, a severe lack of information and thought leadership on how banks should plan, launch, and scale CLOU products. In response, Zeta has produced a definitive guide for bankers to navigate their CLOU-led digital credit strategy: Chak De India: Democratizing Credit with Credit Line on UPI (28 pages, 23 minute read).

This paper serves as a playbook to implementing and running a CLOU program and how it can drive a re-imagination of digital credit delivery at large. Among other interesting perspectives, the paper presents:

-

6 strategies that banks can adopt to differentiate themselves with CLOU

-

A 6-point implementation readiness catalog for CLOU

-

A recommended framework to look at CLOU from market analysis to performance metrics

Headwinds and challenges to credit inclusion

First, for some familiar facts. Despite the staggering progress India has made in access to digital payments and digital services as a whole, credit penetration remains abysmally low. UPI, easily the largest real-time payments network in the world, clocked over 14 billion transactions in June1 and has an active user base of over 350 million2.

In comparison, transactional credit is minuscule by volume. As per a TransUnion survey, over 160 million eligible individuals are credit underserved3. Retail credit penetration is at a lowly 11% compared to 55% in China4. The most important barriers to wider credit inclusion are dependency on physical distribution, high cost of formal credit delivery, and lack of credit data to underwrite thin-filed borrowers.

Credit Line on UPI, by design, has the ability to tackle these problems and drive the propagation of digital credit forward.

A $1T digital credit opportunity

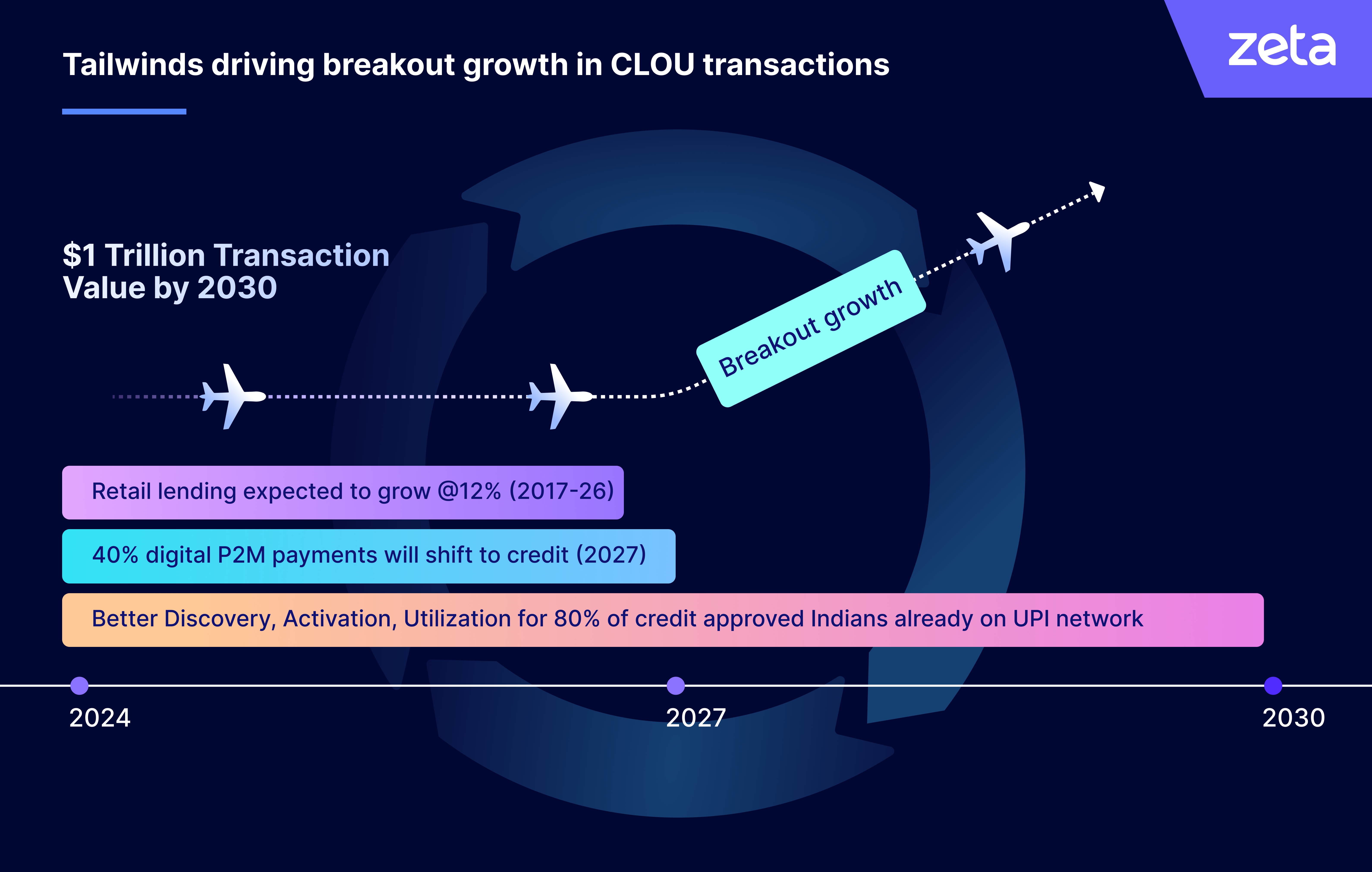

Our internal estimates point to CLOU growing to be a $1 Trillion opportunity by 2030. There are a number of factors that, we believe, will act as tailwinds to create the perfect storm to achieve this number:

- Anticipated growth in retail credit demand, expected to grow at 12% YoY

- Transactional credit expected to touch 40% of digital payments

- Overall, the better discovery and utilization of credit through the superhighway of distribution that is UPI

Image 1

Plotting the blueprint

The massive digital lending opportunity that CLOU presents requires banks (and hopefully other lenders soon, subject to the central bank) to assess their readiness and implement strategies for bringing these programs to market and scaling them.

In this whitepaper, we have called out 6 implementation readiness prerequisites that cut across the following aspects:

-

Platform components adaptable and responsive to evolving CLOU products and processes

-

Well-integrated and yet autonomous system components allowing them to scale at different speeds

-

The right set of partnerships for distribution and servicing of credit lines over UPI

-

Readiness of products, processes, and technology infrastructure to perform at population scale

CLOU challenges the status quo across all aspects of traditional lending in banks, like the technology landscape, operational fabric, distribution, compliance, and monitoring. For instance, the expected volume and velocity of CLOU transactions make it necessary for data analytics to be embedded across the entire value chain driving decision-making, monitoring, and reengineering, as opposed to being an afterthought.

Over the long term, the success of CLOU will be determined by its influence on other digital credit products. Therefore, current investments to support CLOU programs must account for the possibility that multiple credit products and processes will converge onto a unified technological and operational fabric.

Through this whitepaper, we have called out 6 strategies that anticipate such evolutions in credit products and allow lenders to position their CLOU programs for ongoing success. Image 2 gives you a sneak peek into them.

Image 2

These strategies broadly fall into 3 buckets – Foundational, Product Optimization, and Innovation – each in a perfect interlock with the others to create strong levers to launch and scale digital credit programs anchored on CLOU. You can read about these strategies in more detail in the white paper here.

In Conclusion

A potentially rigorous program like CLOU requires a well-thought-through, framework-driven implementation to ensure that all aspects across the target market, products, processes, systems, and compliance are stitched together.

Leveraging our pedigree for launching industry-first digital credit products and insights gathered from industry conversations, we have recommended a rollout framework in the paper that orchestrates the planning, assessment, development, launch, and optimization of a CLOU program. This framework intends to provide an unambiguous and practical direction to your CLOU journey.

I hope your find the white paper insightful and useful. As we continue engaging with banking and ecosystem leaders on this exciting initiative, I look forward to your thoughts and comments. Please connect with us to discuss your CLOU or digital credit programs, learn more about what we’re doing, or even share any interesting perspectives you may have on this topic.

References:

- RBI, RBI Payment System Indicators, June 2024

- European Payments Council, UPI: Revolutionising real-time digital payments in India | June 2024

- Transunion, More than 160 Million Indians are Credit Underserved | April 2022

- Ernst & Young, Next Phase of Digital Lending in India | September 2023