Key Takeaways from Datos Insights report: 4 Stages of Card Program Maturity

Over the last 3 years, my team and I at Zeta have had the unique privilege of speaking with 100s of leaders at 50+ card issuers in America about their aspirations for their card programs.

During that time, we heard the same questions repeatedly – how to efficiently manage a portfolio on legacy systems, how to migrate to a modern card program with a crawl-walk-run approach, what other card executives are thinking about, and more. And, we began to realize that many of these topics were thematically related.

And so earlier this year, we collaborated with Datos Insights (formerly Aite-Novarica) to conduct an in-depth and independent study involving a dozen executives managing significant card programs. The result is a comprehensive report titled Card Program Evolution: Escaping the Legacy Card Tech Hamster Wheel (23 pages, 18 minute read)

The Datos Insights team, led by Senior Analyst David Shipper, has excelled in creating a report that not only outlines the current industry state but also provides a practical framework to aid issuers in their transformation journey.

I’ve provided my notes on this report below and I would love to receive your feedback or comments.

7 key takeaways

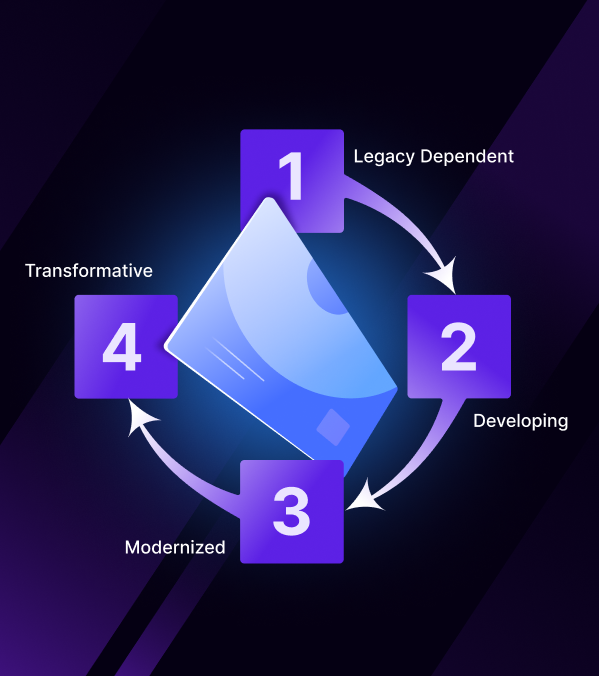

There are four stages of card tech modernization

- Stage 1: Legacy Dependent

- Innovation is difficult and slow, dependent on processor

- CX is limited to banker interaction or basic mobile app

- Data access is poor and slow

- Costs are high for both service and maintenance

- Stage 2: Legacy with APIs or Sidecar Programs

- Innovation is slightly faster but limited control over roadmap

- CX lags in leading programs

- Data has limited real-time access, slow reporting

- Costs are reduced but may require parallel systems

- Stage 3: Modernized with Some Legacy

- Innovation in-house except where legacy-dependent

- CX can be personalized, and some AI capabilities

- Real-time data but limited in scope

- Costs are lower except legacy maintenance and changes

- Stage 4: Fully Modern

- Innovation and changes are almost fully in-house

- CX has lower wait times, highly personalized and predictive, maximized AI capabilities

- Data has real-time access across internal and external streams

- Low CX and maintenance costs, simpler billing

- Getting from Stage 1 to Stage 2 is possible through incremental changes to existing tech and that’s where most of the industry is today, but creating true impact requires more than that

- Staying in Stage 2 exposes issuers to significant compliance and regulatory risk – both from rapidly changing regulatory postures but from meeting existing compliance, control and audit requirements

- The majority of issuers struggle to go from Stage 2 to Stage 3 because it requires true platform modernization. Legacy systems are so complex and entangled with each other that it’s difficult to gain efficiencies from simply changing a single system, adding API layers or updating user interfaces. This ironically is also why it takes so long to launch new products, innovate, or react to regulatory changes

- Access to data is a critical variable in transformation and difficult one to resolve without considering modern tech

- AI has the potential to be a game changer and it is closely tied to technology platforms, which must enable real-time data access, allow rapid iteration of new/refined customer experiences, and support decision optimization across functions.

- A staged approach to modernization may be the answer for most financial institutions, given the change required across so many areas of the organization to rip and replace technology

Six risks bankers identified in legacy platforms

In developing the new report, Datos Insights interviewed bankers about the challenges they face with their legacy systems and the limitations that it places on their card programs. These interviews yielded six primary risks that bankers see in maintaining their legacy systems.

- Consumer demands show they want the same experiences from their financial institution that they receive from other companies, such as transparency, control, immediacy and intuitive interactions that are seamless across touchpoints.

- Retiring COBOL programmers pose an increasing risk for financial institutions trying to react to regulations, make product changes and even run their portfolios day-to-day.

- Artificial intelligence will place new demands on data access and platform flexibility

- Real-time is replacing batch as the default for processing, data access and innovation

- Digital incumbents are increasingly challenging traditional financial institutions as branch networks become less of a competitive advantage

- Regulatory changes have become a challenge to implement and manage on legacy platforms, taking time away from innovation and adding risk for issuers

Over 50% of the surveyed card execs want to modernize for

- Better digital experiences

- Lower costs

- Driving top-of-wallet

- Real-time data

- Digital issuance

What exactly is a next gen processing platform?

Datos Insights identified eight key functionalities that issuers should look for from their next-gen card technology provider.

- Cloud native: Datos Insights highlights not only the power of the cloud, but the differences and advantage of cloud-native vs cloud-based.

- API-first: Similarly, API-first is different from simply having APIs tacked on as an afterthought, resulting in easier implementation and faster development.

- Real-time data: Bankers ranked real-time data as the top benefit of moving to a modern card processing platform.

- Low-code/no-code design: Simple graphical interfaces and low-code environments free staff from green screens and COBOL, enabling them to develop solutions or make product configuration changes that typically require change requests or technical expertise on legacy platforms.

- Microservices architecture: By creating independent services linked to the overall platform, you greatly increase the flexibility, scale and speed to market your card products.

- Modern user interface: Issuers are often still using green screens in product configuration, customer service and more. A thoughtful modern UI allows users to navigate without knowing special codes or commands, greatly reducing the training needed to manage a portfolio or serve cardholders.

- Modern programming language: COBOL programmers are retiring and schools are not even teaching it as part of their curriculum. Modern programming languages like Java, Python, JavaScript and JSON are much more robust with large talent pools of programmers.

- Broad card program controls: Modern platforms allow issuers much more control, for example making changes in-house rather than opening a ticket to change a rate or fee. They can also allow the issuer to build products in-house, minimizing change requests and gaining control over their product roadmap.

The 4 stages of card program maturity in more detail

Datos Insights acknowledges that modernization is a journey and has created a four-stage maturity model for card programs based on the capabilities enabled by technology and the experiences provided to cardholders, along with a map for moving to the next maturity stage.

Stage 1: Legacy Dependent

- Legacy dependent with limited or no ability to innovate or control program direction.

- Long lead times make innovation difficult or prohibitive

- Customer experience is driven primarily by banker interactions

- Data access is limited and delayed

- Costs are higher, limiting profitability and investment in innovation and customer incentives

- Higher attrition and limited ability to improve customer experience

Stage 2: Developing

- Still legacy dependent but with the ability to access modern middleware such as APIs and launch sidecar programs to innovate.

- Customer experience is improved, but lags expectations from tech savvy customers

- Costs are lower than purely legacy systems but still high, particularly with sidecar platforms

- Data access is inconsistent, with some data easily and quickly accessible and other data requiring long wait times

Stage 3: Modernized

- Most changes are handled internally, but can be limited where connected to legacy systems.

- Customer experience can be personalized though less interactive than Stage 4 (coming up)

- AI can be integrated, though with limitations

- Costs are lowered for service and operations where legacy systems can be sidestepped

- Access to card data in real-time

Stage 4: Transformative

- Issuers are empowered to innovate and handle changes internally, with few limitations.

- Decisioning AI/ML is maximized to optimize profitability

- Conversational AI improves customer experience, lowers wait times and anticipates customer needs

- Costs are minimized and simplified

- Access to data across cards, products and external datasets in real time

- Ability to connect to best-of-breed providers for value-added services