Unlocking Business Potential with Next-Gen Processing Platforms: A Comparative Insight

Banking technology is broken. That’s not a controversial statement even inside the walls of successful financial institutions. The problem is that there hasn’t been a realistic alternative until recently. As a new slate of next-generation card processors comes of age, banks and credit unions finally have options. But what does it mean to be a next-gen processor? As legacy processors move more platforms to the cloud or enable features via APIs, will that be enough?

As it happens, three new reports in the last year have covered what it means to provide next-gen processing and what outcomes financial institutions should expect in adopting them.

- Datos Insights: The first report, authored by Datos Insights (formerly Aite Novarica), addresses card maturity through the lens of modernization. It explores how card issuers can advance the maturity of their card programs across four stages, highlighting the expected customer experiences and benefits of doing so. The report builds on the firm’s deep expertise in payments advisory and intensive qualitative interviews with card program executives from leading US financial institutions. For a quick low down into key insights from the Datos Report, check out our previous blog on Key Takeaways from Datos Insights report: 4 Stages of Card Program Maturity.

- Celent report: The second report, created by the advisory firm Celent, examines the landscape of next-gen processing platforms specific to the US. It outlines the strategic focus of key providers and highlights their unique value propositions.

- When the Levee Breaks: In the final report, Zeta, as a leader in next-gen processing, highlights the critical elements that differentiate modern processing from simply enabling APIs and migrating systems to the cloud. The report identifies key differentiators and aligns them with business objectives, showcasing how they set modern processing apart.

All three reports highlight innovation, agility, and superior customer experiences as the defining principles of next-gen processing platforms, and describe the significant benefits they can provide to issuers looking to stay ahead.

What Defines Next-Gen Processing? Common Themes and Business Impact

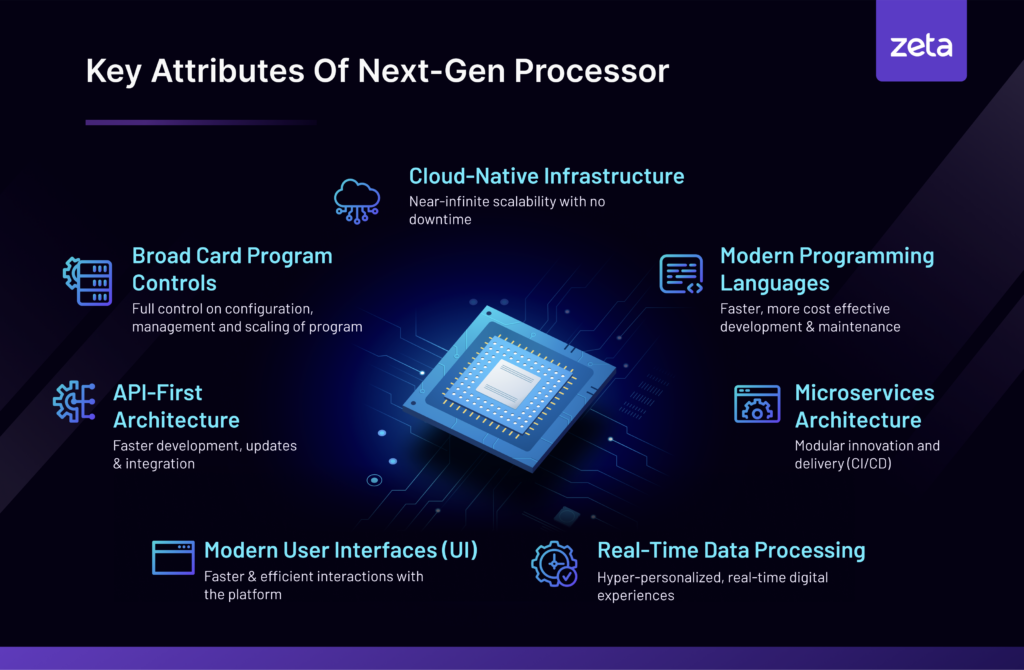

Across these reports, several common themes emerge in defining next-gen processing platforms, all of which have profound implications for business success. Image 1 illustrates key attributes that a next-gen processor must possess.

Image 1

1. Cloud-Native Infrastructure

- Across the reports—When The Levee Breaks, Datos Insights, and Celent—there is a strong emphasis on the pivotal role of cloud-native infrastructure in defining next-gen processing platforms. The reports collectively agree that transitioning to a cloud-native environment is not just about shifting from on-premises systems to the cloud; it’s about designing platforms ground-up to leverage the inherent advantages of cloud technology. Whether it’s near-infinite scalability discussed in When The Levee Breaks or the benefit of scaling with little to no downtime highlighted in Datos Insights, cloud-native platforms represent a fundamental shift in how financial institutions manage their IT and operational resources.

- Business Impact: By adopting cloud-native infrastructure, financial institutions can scale their card portfolios without any downtime, optimize IT spending, and significantly enhance operational agility. This shift enables banks to operate as truly digital-native organizations, reducing costs and delivering services with enhanced security and reliability.

2. API-First Architecture

- The reports uniformly advocate for an API-first approach as a cornerstone of next-gen processing platforms. Datos Insights and Celent both emphasize that APIs should no longer be an afterthought but a primary focus in the development process. This architecture is central to creating a flexible and adaptable platform that can easily integrate with other services and evolve over time. The When The Levee Breaks report aligns with this by showcasing how APIs are integral to the platform’s extreme integrability, enabling seamless connections with modern banking ecosystems.

- Business Impact: An API-first architecture enables rapid development and deployment of new applications, offering financial institutions the agility to respond to market changes and customer needs. This approach also facilitates better integration with external systems, enhancing interoperability and reducing the complexity of managing multiple services. The When The Levee Breaks report further supports this by highlighting the importance of APIs in enabling the real-time flow of data and actions across systems, significantly enhancing issuers’ ability to craft innovative product behavior.

3. Microservices Architecture

- The reports consistently describe microservices architecture as a key attribute of next-gen processing platforms. According to Celent and Datos Insights, microservices enable platforms to be broken down into smaller, independent services that can be developed, deployed, and scaled independently. This modular system design thus enables faster innovation and continuous feature releases with greater flexibility and resilience, as highlighted in When The Levee Breaks.

- Business Impact: Microservices architecture offers significant benefits, including enhanced scalability, faster time-to-market for new features, and improved system resilience. By decoupling services, financial institutions can minimize the impact of changes on the overall system, and thus run more focused innovative projects to quickly adapt to changing market conditions and customer demands.

4. Real-Time Data Processing

- The ability to access and process data in real time is a defining feature of next-gen processing platforms. For example, the Datos Insights report highlights the importance of real-time data about customer accounts and payment transactions in enabling robust self-serve solutions. Real-time data is also critical for issuers to identify and respond to fraud events effectively.

- Business Impact: Real-time data processing allows financial institutions to make immediate, informed decisions, greatly enhancing their ability to serve customers effectively. This capability is crucial for improving operational efficiency and ensuring that financial institutions can provide timely, context-aware services.

5. Modern User Interfaces (UI)

- Modern, intuitive user interfaces are highlighted as essential components of next-gen processing platforms in the Celent and Datos Insights reports. These UIs move away from the outdated greenscreens still prevalent in legacy systems, offering a more user-friendly and customizable experience to stakeholders like card program executives and operations executives. When The Levee Breaks similarly stresses the importance of modern UI design in enabling faster, more efficient interactions with the platform.

- Business Impact: The adoption of modern UIs increases operational efficiency by simplifying navigation and reducing the need for specialized training. Customizable interfaces allow financial institutions to tailor the user experience to the specific needs of different roles, enhancing productivity and user satisfaction. The shift towards web-based interfaces also allows for real-time configuration changes, further improving the platform’s responsiveness and usability.

6. Modern Programming Languages

- The reports agree on the importance of using modern programming languages, such as Java, Python, and JSON, in next-gen processing platforms. Both Celent and Datos Insights contrast these languages with older ones like COBOL, which are still in use in many legacy systems.

- Business Impact: Modern programming languages are better suited to modern development practices and are easier to maintain, reducing the technical debt associated with legacy systems. The use of these languages enables financial institutions to implement CI/CD pipelines, ensuring that platforms can continuously evolve and meet the demands of a rapidly changing technological landscape.

7. Broad Card Program Controls

- Datos Insights and Celent, along with implications from When The Levee Breaks, emphasize that next-gen processing platforms provide more control over card programs, allowing issuers to manage and grow their programs with greater autonomy. This includes the ability to make in-house changes, reducing reliance on external vendors for modifications and updates.

- Business Impact: Broad card program controls empower financial institutions to innovate rapidly, developing and launching new card products and features with minimal dependency on external providers. This flexibility enhances efficiency, reduces time-to-market, and enables a more agile response to regulatory or market-driven changes.

Conclusion

Together, these reports articulate a compelling vision of next-gen processing platforms. Businesses can unlock new levels of efficiency, agility, and customer satisfaction by harnessing real-time capabilities, enhancing security, and focusing on customer-centric innovations. These advanced platforms are not just technological upgrades; they are strategic enablers that drive business growth, foster innovation, and ensure sustained competitive advantage in an ever-evolving market.