Transform Cardholder Experiences

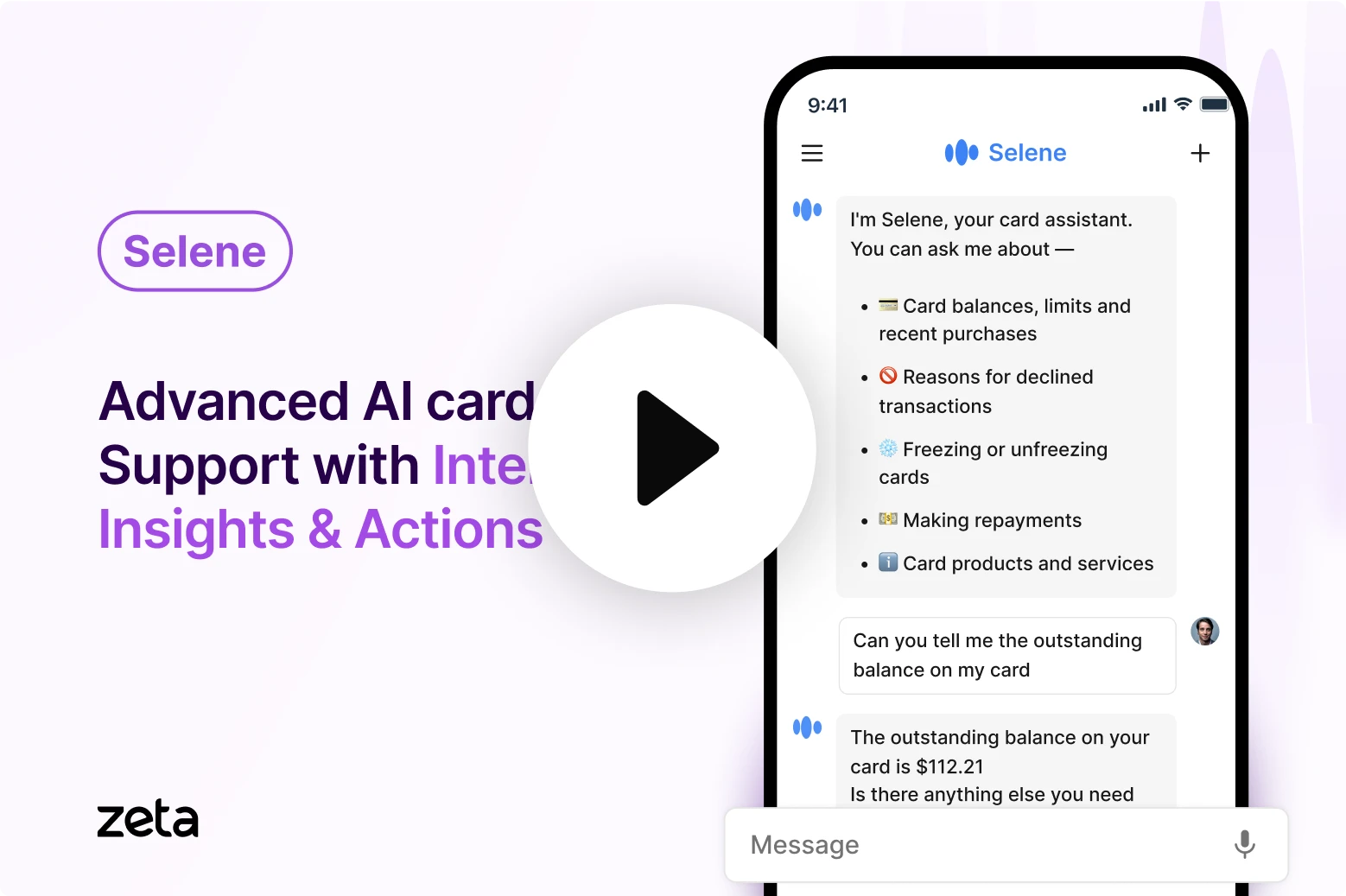

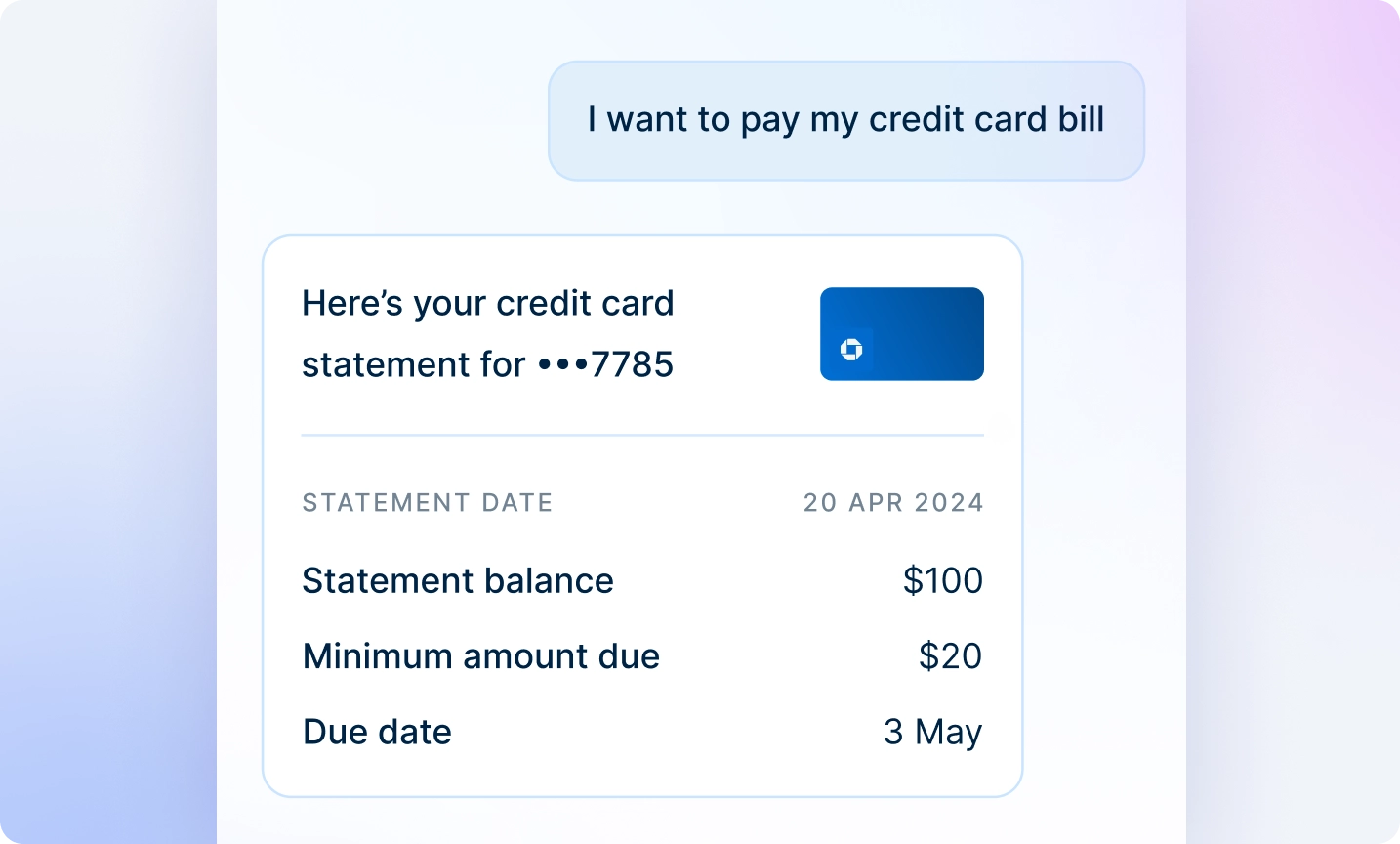

Experience card support that understands context, responds intelligently, and takes action instantly. See how Selene combines human-like understanding with banking-grade security to deliver support across the card lifecycle.

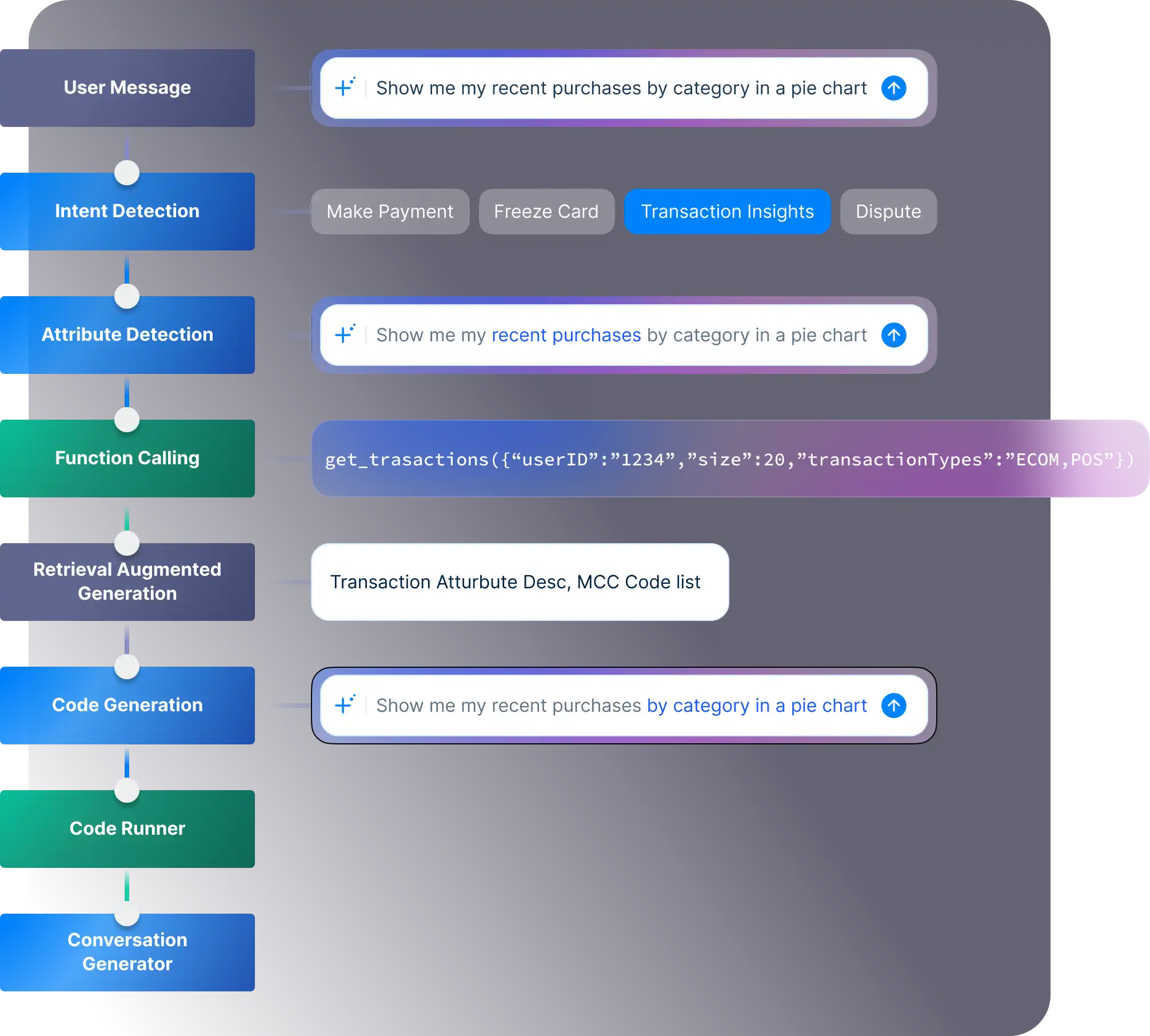

How Selene Conversational AI Suite Works

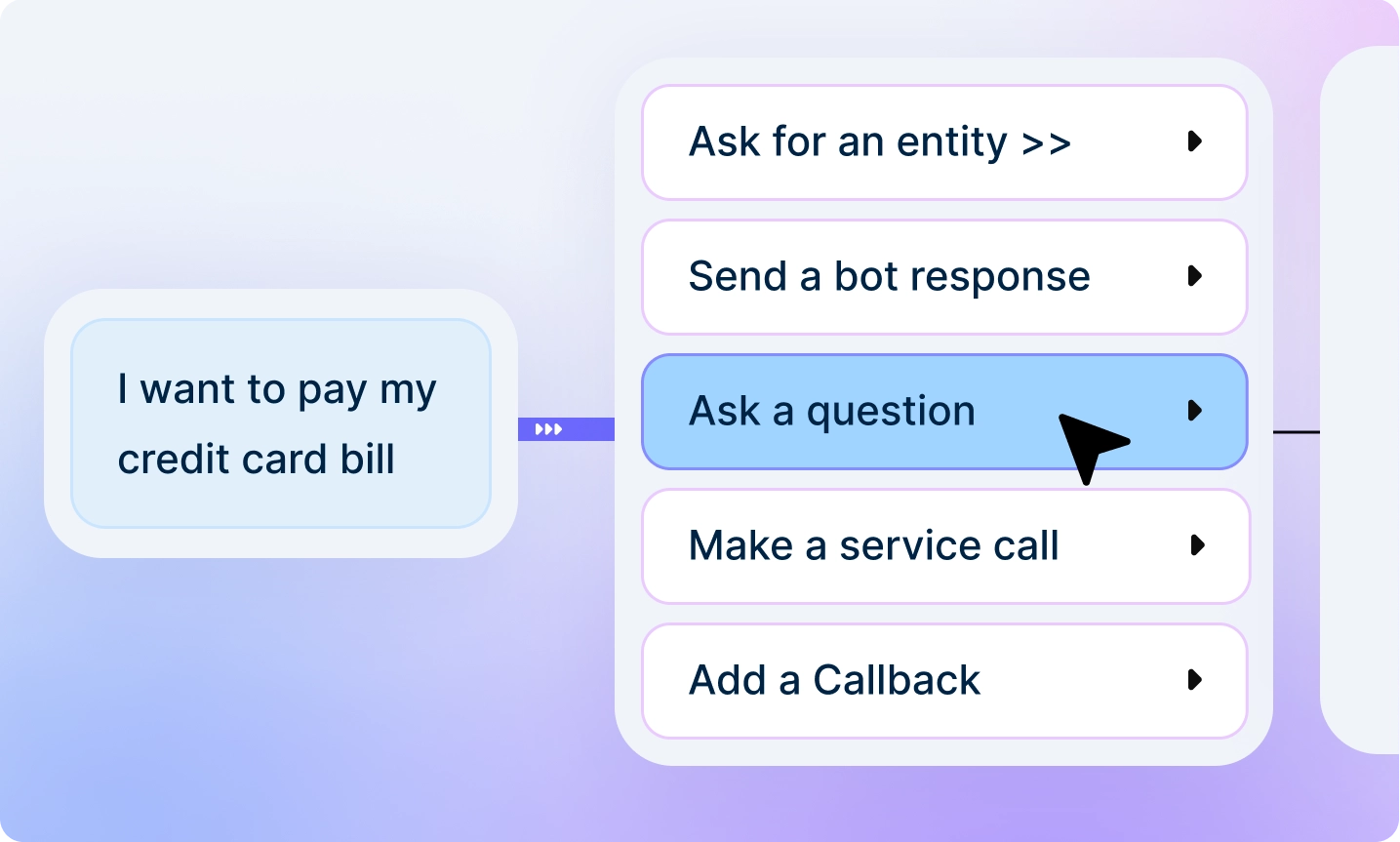

Selene is Zeta’s natural language AI platform for retail customers. All conversations, across voice and chat channels, are managed by a conversation orchestration engine. Foundation models for Intent Detection, Code Generation, Image Recognition, etc., allow Selene to understand and execute the request being made, while it accesses all Zeta platforms with a toolkit to make API calls, run code, convert text to speech, and more.

Selene Conversational AI Suite Capabilities

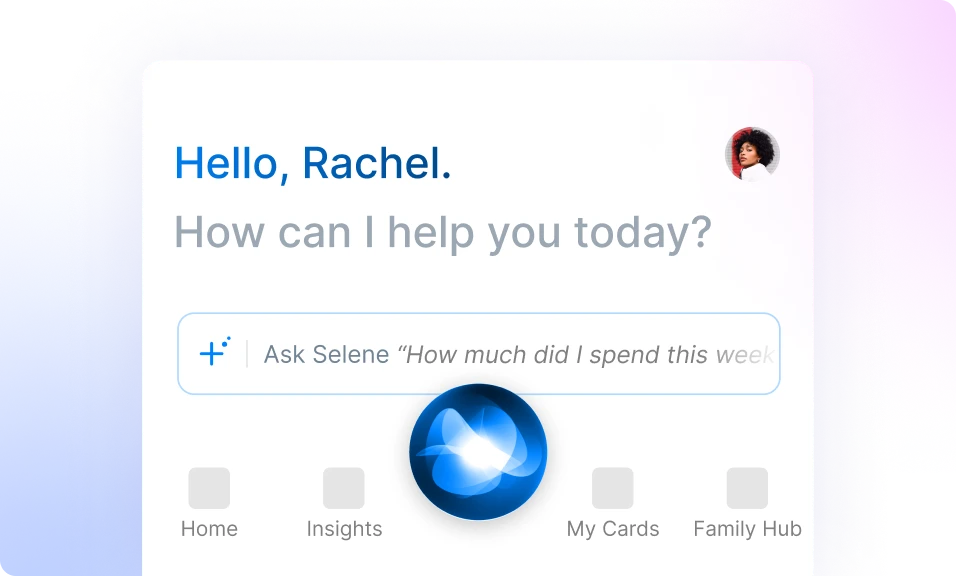

Omnichannel

Make your voice and chat channels easy to use with Selene's natural language conversation skills that are constantly upgraded to leverage the latest Generative AI capabilities.

Intent Recognition

Significantly reduce fallback rates with Selene’s ability to recognize and act on financial services intents across retail banking products.

Embeddable

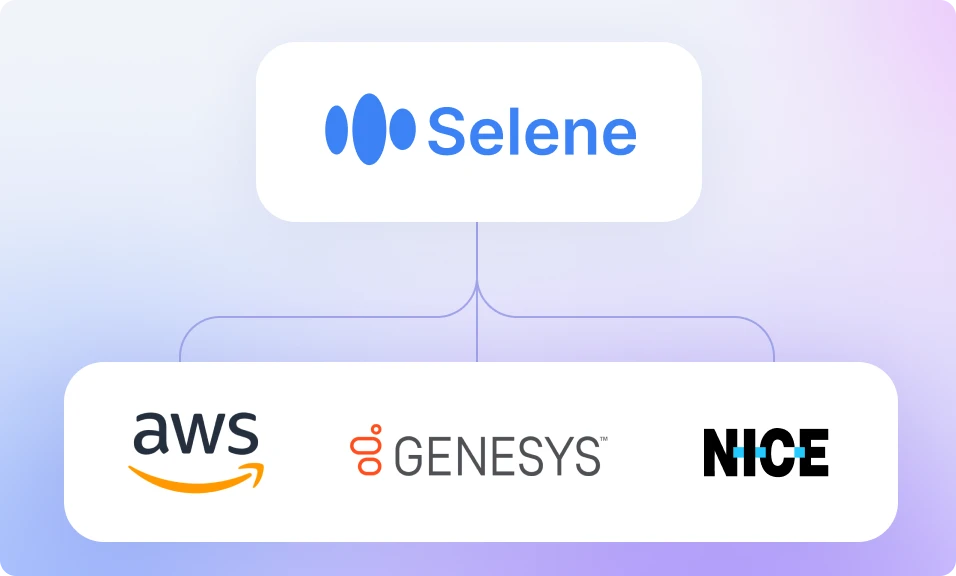

Seamlessly embed Selene into your existing mobile app and Contact Center platform like AWS Connect, Genesys, or NICE.

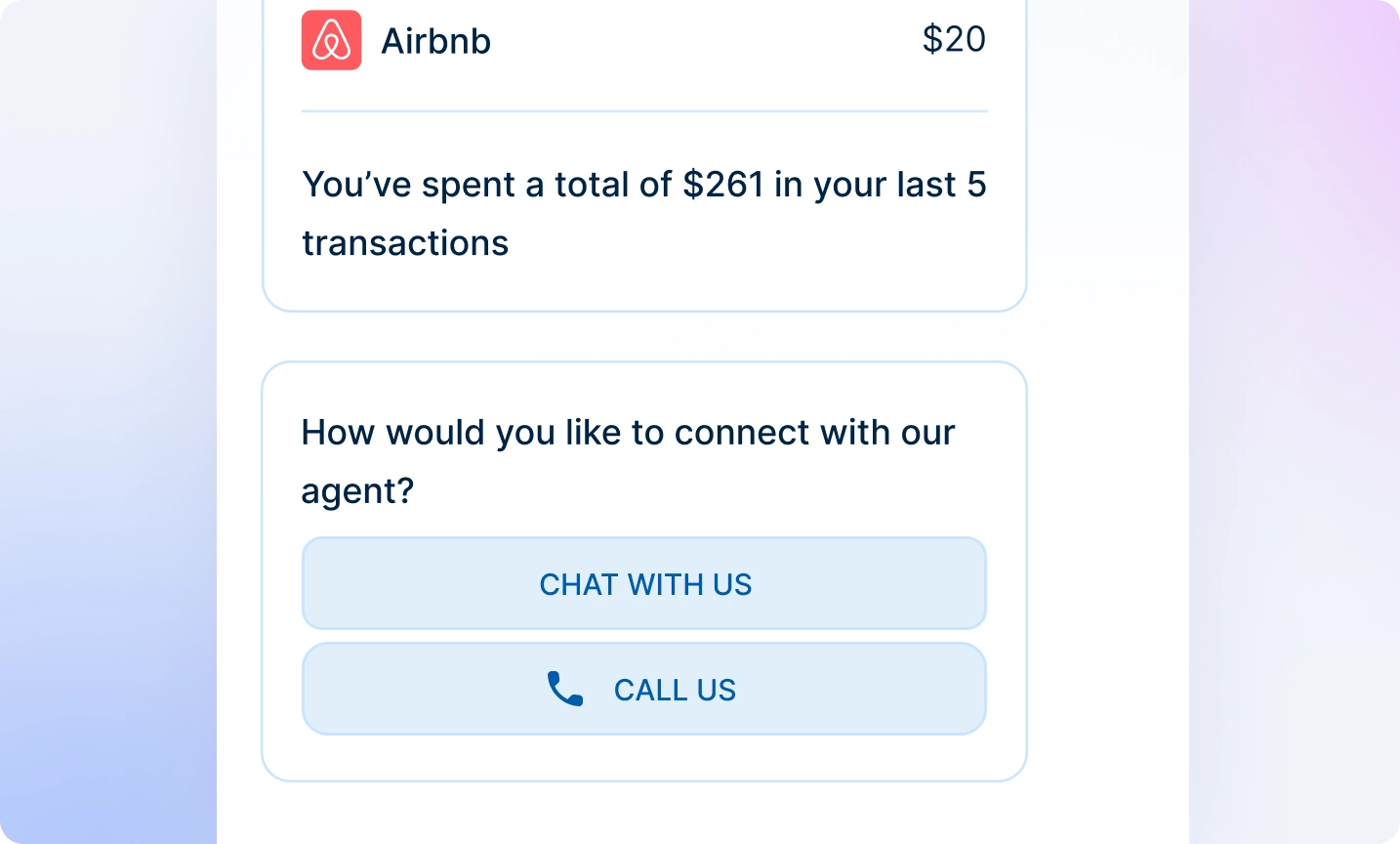

Contextual Hand-off

Reduce repetition during escalations and session hand-offs. Selene supports hand-off to a live agent over voice or chat with the full context of the session.

Knowledge Augmentation

Train Selene's intent flows and responses based on organizational guidelines with documentation, standard operating procedures, and knowledge bases.

Monitoring and Analytics

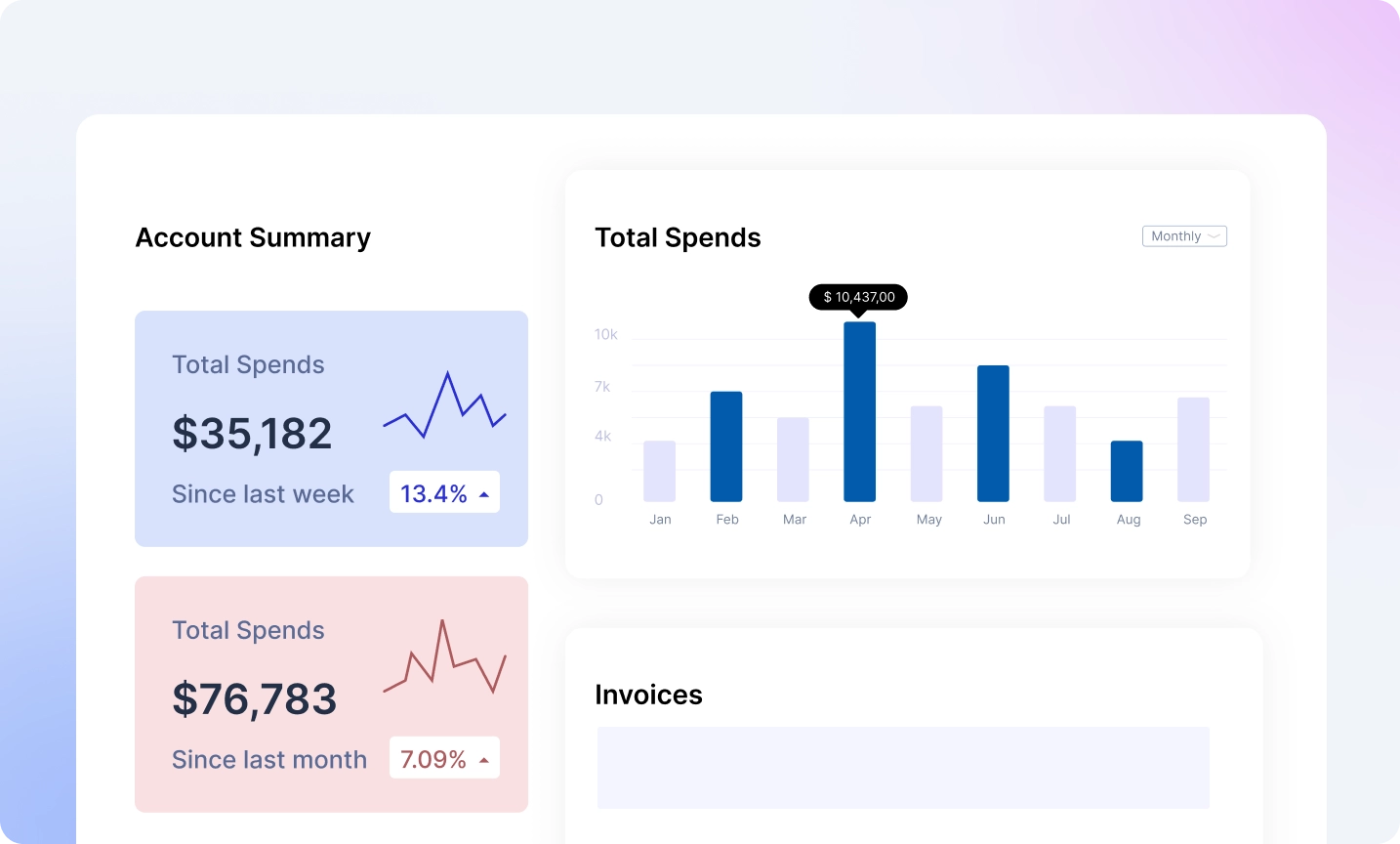

Manage Selene with a high degree of transparency and control with detailed raw performance data on its customer interactions.