Zeta Tachyon Omnistack Architecture

- Aries: Customer Lifecycle Management module for retail or commercial customers, including application processing, onboarding, and profile management.

- Aura:Account Lifecycle Management module for any asset or liability product, spanning account processing, statementing, billing, fees, charges, interest computation, ledger posting, and more.

- Athena:Universal Switch and Transaction Lifecycle Management module covering authorization, clearance, settlements, disputes, and fraud management across card networks (such as Visa, Mastercard, Amex), and payment networks (like RTP, ACH, and Zelle).

- Acropolis: Lifecycle management of any payment instrument including physical and virtual cards, tokens, and QR codes with controls for BIN provisioning, BIN splitting, instrument renewal, expiry, PIN management, and more.

- Ruby: Revolving Credit Cards, Commercial Credit Cards, Small Business Credit Cards, Secured Credit Cards, Co-brands and Private Label Cards

- Diamond: Debit card transaction processing and management

- Pearl: Prepaid Cards including GPR, Gift Card, Benefits, and Commercial Cards

- Sapphire: Retail and Commercial Checking and Savings Accounts

- Emerald: Unsecured installment-based loans such as Personal Loans, BNPL, or POS Loans

- Tropaz: Term Deposits processing and management

- APIs: Granular APIs for every operation

- Admin Interfaces: Modern, unified interface to manage product and system configurations

Tachyon Omnistack Architecture

- Aries: Customer Lifecycle Management module for retail or commercial customers, including application processing, onboarding, and profile management.

- Aura:Account Lifecycle Management module for any asset or liability product, spanning account processing, statementing, billing, fees, charges, interest computation, ledger posting, and more.

- Athena:Universal Switch and Transaction Lifecycle Management module covering authorization, clearance, settlements, disputes, and fraud management across card networks (such as Visa, Mastercard, Amex), and payment networks (like RTP, ACH, and Zelle).

- Acropolis: Lifecycle management of any payment instrument including physical and virtual cards, tokens, and QR codes with controls for BIN provisioning, BIN splitting, instrument renewal, expiry, PIN management, and more.

- Ruby: Revolving Credit Cards, Commercial Credit Cards, Small Business Credit Cards, Secured Credit Cards, Co-brands and Private Label Cards

- Diamond: Debit card transaction processing and management

- Pearl: Prepaid Cards including GPR, Gift Card, Benefits, and Commercial Cards

- Sapphire: Retail and Commercial Checking and Savings Accounts

- Emerald: Unsecured installment-based loans such as Personal Loans, BNPL, or POS Loans

- Tropaz: Term Deposits processing and management

- APIs: Granular APIs for every operation

- Admin Interfaces: Modern, unified interface to manage product and system configurations

Tachyon Architecture Benefits and Impact

- Launch multiple products on a single platform

- Reuse integrations for collections, origination, fraud, or fulfillment across multiple products

- Deliver unified web and mobile apps across products with universal transaction APIs

- Design creative product bundles with features from different product families

- Get unified analytics for your customers across their multiple relationshps with you for better cross-sell and up-sell

- Leverage cross-product data decision engines to drive decisions based on total customer relationship value

CASE STUDY

Learn how next-gen processing platforms help issuers launch differentiated card programs

Read Now Data Model Extensibility

Zeta Tachyon allows data models associated with objects like customers, accounts, cards, or transactions to be enriched with custom fields, attributes, or even rich media from internal or external systems enabling:

- Transaction enrichment

- L2/L3 transaction data

- Tracking and reporting additional regulatory and compliance fields

- Ingesting application information and alternative data to decisioning platforms

- Hyper-personalization in authorization rules, notifications, rewards, digital experiences, reports, and more

How Data Model Extensibility Works in Zeta Tachyon

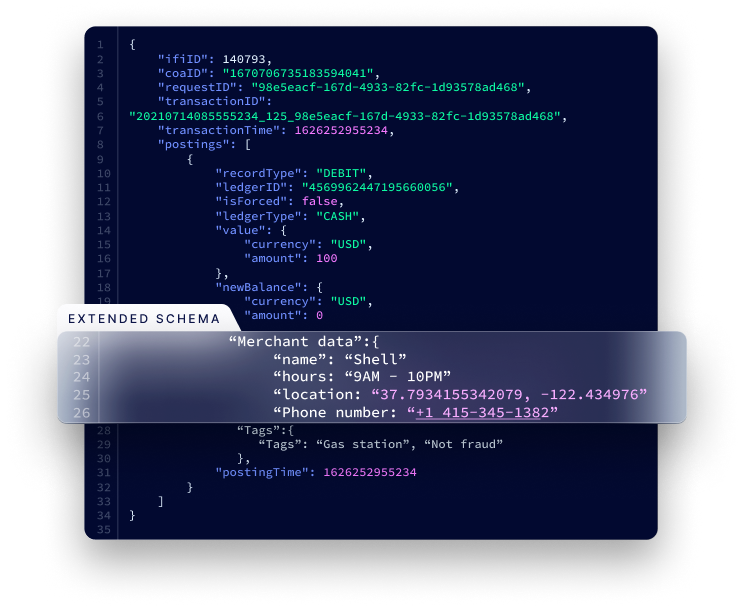

- Zeta Tachyon uses extensible JSON Schemas as the internal representation for every object. Each schema comes with predefined attributes.

- Financial institutions can easily extend the schema of any object to add additional objects, arrays, or attributes.

- Data for these additional custom attributes are provisioned across Zeta Tachyon modules as well as external systems through API calls or batch files.