8 Attributes of High-Performing Card Programs

Contents

- Technology Attributes Driving Innovation and Agility in Card Programs

- Card Program Readiness for an AI-Powered World

- Conclusion

The bar for what makes a credit card feature or experience innovative – or even competitive – keeps shifting. Issuers have been investing in developing modern capabilities within their card programs for a decade. However, most card-related digital experiences have already become commoditized. JD Powers’ 2024 survey of bank and credit card mobile and online app users reveals that “the gap in overall customer satisfaction between top- and bottom-ranked bank and credit card apps and websites has narrowed considerably.” And, “with limited differentiation between brands, it’s become challenging to distinguish and drive meaningful digital customer relationships.” 1

For example, customers consider digitalized experiences of services like bill payments, fund transfers, and POS payments to be table stakes today. They seek greater security, more transparency and control, and effective personalization in how they spend, repay, and are rewarded.

Delivering these is difficult to impossible on legacy card platforms. The challenge is not so much the ability to develop these features or experiences on legacy card platforms. It’s the speed at which issuers can bring new features to market and how much control they have over the final product. Global analyst firm Datos Insights calls this ‘a state of learned helplessness’ in their latest report titled Escaping the Legacy Card Tech Hamster Wheel.

On the other hand, early adopters of modern technology and digital-first competitors are bringing new experiences to the market at a rapid pace, creating a widening competitive gap. In May 2023, JPMC announced that they were delivering 15 feature releases every week on the Chase.com ecosystem, and had brought down their new product launch timelines from 18 months to between 3 and 6 months.2

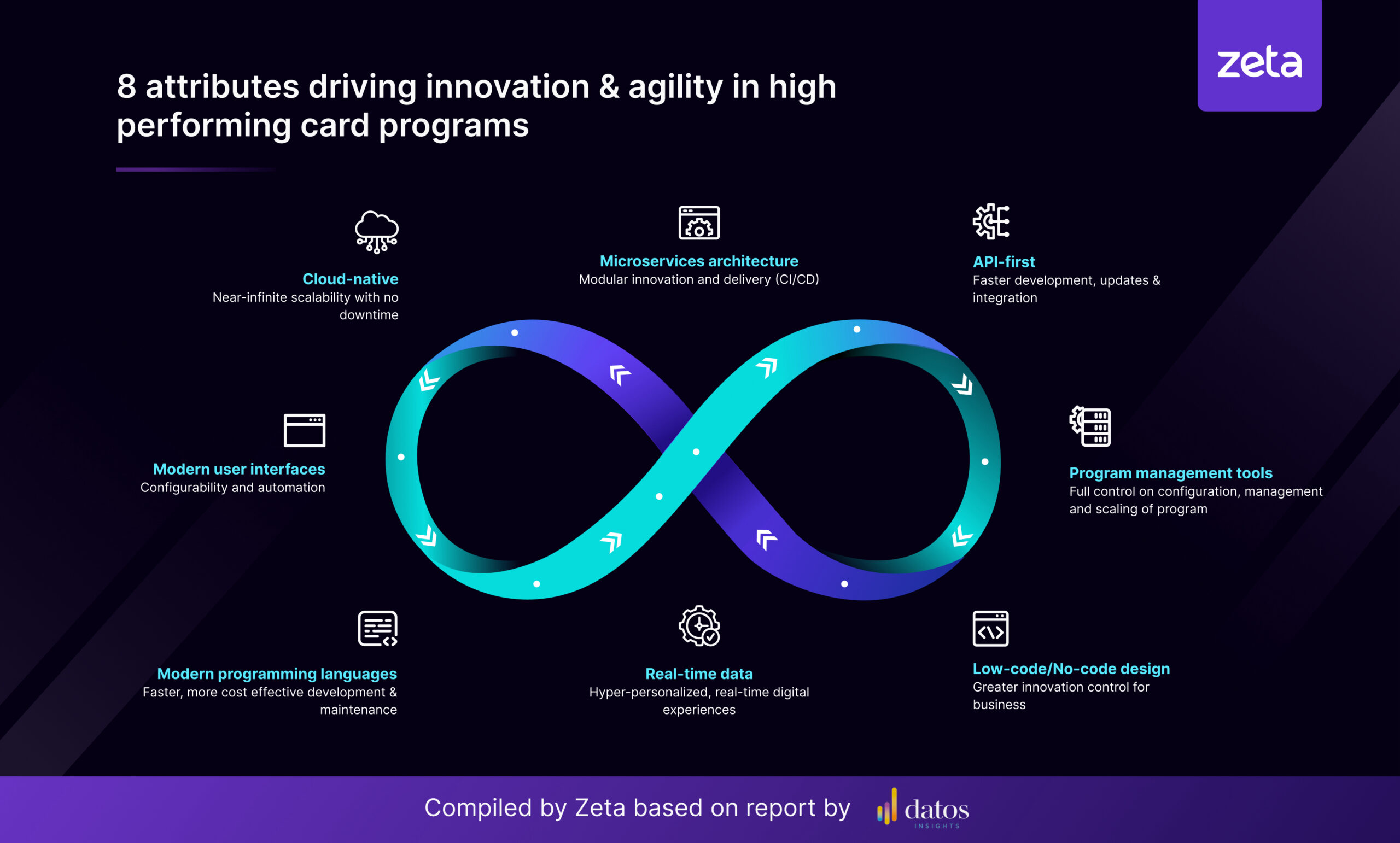

The Datos Insight report delves into this competitive gap and identifies 8 defining capabilities of high-performing card programs. In this blog, I illustrate how these capabilities come together to enable innovation and agility for these issuers.

Technology Attributes Driving Innovation and Agility in Card Programs

Legacy processing systems were built in a pre-cloud, pre-mobile world. They function in silos, making it difficult to connect them seamlessly with other systems. Additionally, these systems are often inflexible, struggling to adapt to changing needs or scale efficiently as demand grows.

High-performing card programs have adopted next-generation technology that is built with these limitations in mind. It’s inherently connected, allowing for easy integration and data sharing. It’s highly scalable, allowing it to adapt easily to increased user volume or new features. Next-gen processing platforms are also modular in composition, enabling faster customization by combining pre-built modules, or updates and modifications to individual components without impacting the entire system.

Image 1 illustrates the 8 key attributes of next-gen processing platforms driving innovation and agility in high-performing card programs.

Image 1

Let’s look at how each of these attributes enable high performing card programs to move faster and compete better:

- Cloud-native infrastructure enables near-infinite scalability with little to no downtime

- Microservices-driven architecture enables modular innovation and delivery without impact to the larger system

- API-first headless architecture with extensible object models enables faster creation of applications with ease of integrations and updates

- Modern user interfaces enable easy configurability and automation, especially in compliance workflows, as well as offer unified interfaces for operations and support

- Program management tools enable the ability to configure, manage and scale card programs with no dependence on vendor teams

- Modern programming languages allow significantly faster, more cost effective development and maintenance of software

- Real-time data and analytics improve decision-making, allow embedding contextual nudges in customer journeys, and build segmented offerings

- Low-code/No-code design gives business personas like business analysts, product managers greater innovation control and speed in product creation by using config-as-code semantics

Card Program Readiness for an AI-Powered World

Artificial intelligence (AI) is rapidly transforming the competitive landscape of banking and payment experiences. According to research by the American Banker, around 37% of US banks are already in the process of implementing at least one generative AI use case. This movement is strongest among larger institutions, with 55% of global and national banks with over $100 billion in assets having initiated at least small-scale implementations. Credit unions are not far behind, with 50% having at least one use case in production. 3

A key requirement of AI adoption and scaling is a modern platform that enables the real-time flow of data and action across systems. By enabling this, the 8 presented attributes of next-gen processing platforms also give card programs an advantage in adopting AI capabilities. As explained in the Datos Insights report, “AI and machine learning enhance all aspects of card processing and servicing by integrating and analyzing data from diverse systems.”

Over the next decade, issuers that are able to adopt and scale AI effectively will see a compounding effect on their capabilities and returns. Already, McKinsey’s 2023 survey 4 has identified ‘AI high performer’ organizations where at least 20% of earnings before interest and tax (EBIT) was attributable to AI.

Conclusion

According to the latest Datos Insights report, “Financial institutions without a clear roadmap for moving away from legacy technology are destined to fall behind their peers at an accelerating pace.” Dive into their report to explore the four stages of card program maturity, providing a practical framework for banks and credit unions to elevate their portfolios.

And Contact Us to know how Zeta can help you advance to next-gen card programs.

References:

- J.D Power, Bank and Credit Card Apps and Websites Struggle to Find Ways to Stand Out as User Experience Becomes Increasingly Homogenized | May 2024

- J.P Morgan Chase, Investor Day Transcript | May 2023

- American Banker, Preparing for banking’s AI revolution | March 2024

- McKinsey, The State of AI in 2023: Generative AI’s Breakout Year | August 2023