Next-Gen Card Support is Intelligent, Personalized and Conversational

Contents

- Beyond Scripted Chats: Attributes of a Next-Gen Card Support Agent

- Under the Hood: Capabilities that Power Elena

- Banking-Grade Security for Validated Accuracy

- The Path Ahead

The Consumer Financial Protection Bureau’s research reveals a growing frustration with financial customer support:

“I am being sent in an endless loop with no way out… I am going to get a late fee and be reported late on my bureau.”

“This chatbot seemed to only pull in the same answers from the FAQ page, none of which were helpful to my situation.”

“Their chatbot just sits on the typing screen and you cannot enter any information.”

These chatbot failures exemplify a broader crisis in customer service—where automation comes in the way of effectiveness. While 68%1 of customers report negative experiences with chatbots, financial institutions continue investing in these systems, projecting $8 billion2 in annual savings and 110.9 million3 users by 2026.

The problem isn’t limited to chatbots. Live phone conversations, still the most preferred4 method of contacting companies for support, suffers from long wait times and high costs. This industry-wide misalignment between service delivery and customer expectations demands more than incremental improvements.

A fundamental reimagining of customer support is needed—one where Generative and Conversational AI enhance rather than inadequately replace human capabilities.

Beyond Scripted Chats: Attributes of a Next-Gen Card Support Agent

The frustrations reported by consumers to the CFPB can be alleviated by an AI assistant that is equipped to mimic human intelligence, memory, and language. Let’s look closely at what this means:

Natural language: Should host a natural language interface that can enable intelligent and unscripted conversations

Automation at scale: Should be able to resolve routine queries automatically and at scale

Intent awareness: Should be able to pick up signals of intent expressed in everyday language

Personalization: Should be able to personalize conversations through cardholders’ historical and real-time data

Intelligent insights and action: Should be able to derive insights and perform tasks based on existing customer data, bank’s SOPs, policies, product information and other information from its knowledge base

Contextual escalation: Should be able to seamlessly hand over complex queries to a human agent, with the context preserved

Banking-grade guardrails and security: Should not hallucinate, make unauthorized decisions, or breach compliance guidelines

Deep integrations: Should integrate deeply with issuers’ core systems for access to workflows, authentication, and authorization

Zeta has brought these capabilities to life with Elena, our new AI card support platform that delivers faster resolutions while preserving conversation context. Let’s examine the technical foundation that makes this possible.

You can also read about Elena’s capabilities and impact in our solution paper here: Elena: Advanced Conversational AI for Card with Intelligent Insights & Actions.

Under the Hood: Capabilities that Power Elena

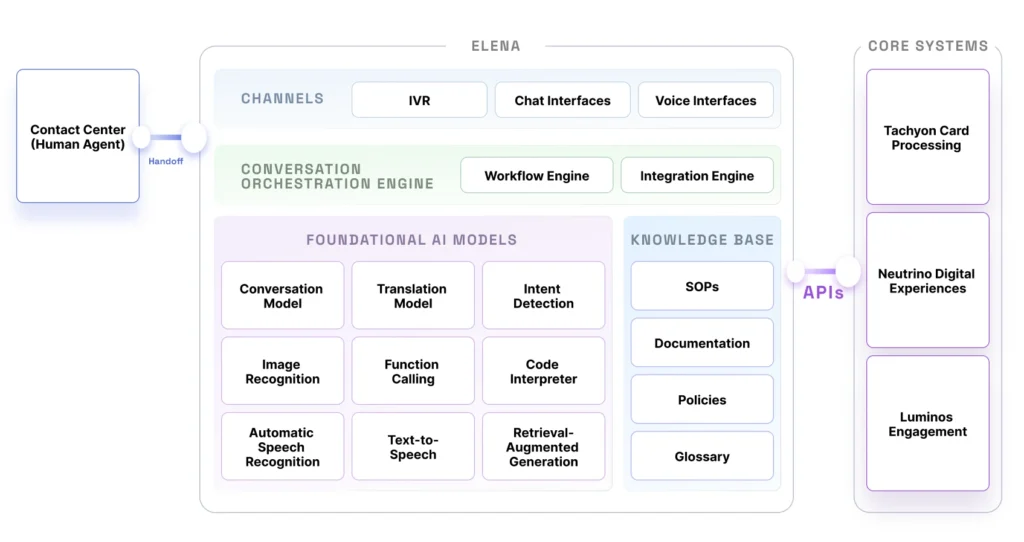

Elena leverages advanced AI models to help it execute requests and enable natural conversations, deep integrations with issuer knowledgebases and core processing systems, and a thorough hallucination prevention framework for accuracy.

Image 1: Elena‘s 3-layer architecture

1. A central orchestration engine manages all conversations across voice and chat channels. It receives customer requests and triggers foundational models for intent detection, code generation, and more.

2. Advanced AI models help the assistant understand and execute requests:

- Retrieval Augmentation Generation (RAG) combines information in databases with generative Large Language Models

- Intent Detection identifies user intention and the desired outcome from queries

- Code Generation helps visualize data for the consumer

- Image Recognition

- Advanced Speech Recognition (ASR) for accurate voice command interpretation

- Contextual Dialogue Generation facilitates a natural flow of conversations

- Natural Text-to-Speech (TTS) delivers clear vocal responses

3. An integration layer enables personalization and context awareness by tapping into systems and repositories like:

- Zeta’s card processing core Tachyon for real-time data, event streams, and orchestrated workflows

- Card issuers’ document repositories containing policies, knowledgebase, and standard operating procedures

4. An underlying next-generation processing platform with modern architecture accesses and acts on data instantly to deliver intelligent, personalized support for AI to leverage:

- Comprehensive API catalog supports every create, read, update operation that an AI assistant can execute

- Real-time events stream allows the AI to adapt its decisions and actions

- Hyper-personalization and configurability of the AI’s conversational flows enable unique and context-aware responses to customer needs

Banking-Grade Security for Validated Accuracy

Elena is fortified with banking-grade guardrails to ensure that every interaction meets strict standards for safety, accuracy, and compliance:

Intelligence Trained on Issuer Knowledge

Elena‘s knowledge foundation is based exclusively on issuer-approved sources like detailed knowledge repositories, standardized operating procedures, approved workflow documents, and compliance guidelines.

Multi-layer Hallucination Prevention

- Intent-focused action generator validates user intent before directing conversations through pre-approved flows to avoid the risk of hallucinations

- Enterprise-grade Large Language Model verified for accuracy incorporated into the assistant’s response generation system

- Robust prompt engineering and real-time validation against approved functions ensure every response stays accurate and within defined boundaries

- Rigorous input management employs sophisticated anti-jailbreak protections to validate every input, safeguarding against system manipulation attempts

Quality Assurance

Elena maintains high-quality performance through continuous response monitoring and systematic scenario testing. Careful evaluation of edge cases and immediate corrective action capabilities ensure consistent accuracy.

Regulatory Compliance

The platform adheres to PCI-DSS specifications for secure card data handling, implementing end-to-end encryption and controlled access protocols. Elena operates on SOC 2 Type II certified infrastructure with regular security audits and robust data privacy measures, ensuring card issuers can deploy the solution with complete confidence in its regulatory compliance.

The Customer Experience Payoff

Built on advanced AI models and deep processing integration, Elena delivers a transformative customer support and service experience that addresses the key limitations of conventional chatbots while setting new standards for customer service.

Intelligent Conversational Interface

Elena leverages sophisticated language models to enable natural, unscripted interactions across voice and chat channels. Unlike rigid menu-based systems, customers can express their needs in plain language – from checking balances to disputing charges – without navigating complex IVR trees or predefined workflows. The assistant’s advanced speech recognition and natural text-to-speech capabilities ensure fluid communication regardless of channel choice.

Instant Insights and Actions

Through direct integration with the underlying card processing system, Elena provides instant access to transaction data and account insights. Customers can ask questions like “How much did I spend on dining last month?” or “Show me all my recurring subscriptions” and receive immediate, personalized responses. Its ability to execute real-time actions enables everything from instant payment processing to dispute management.

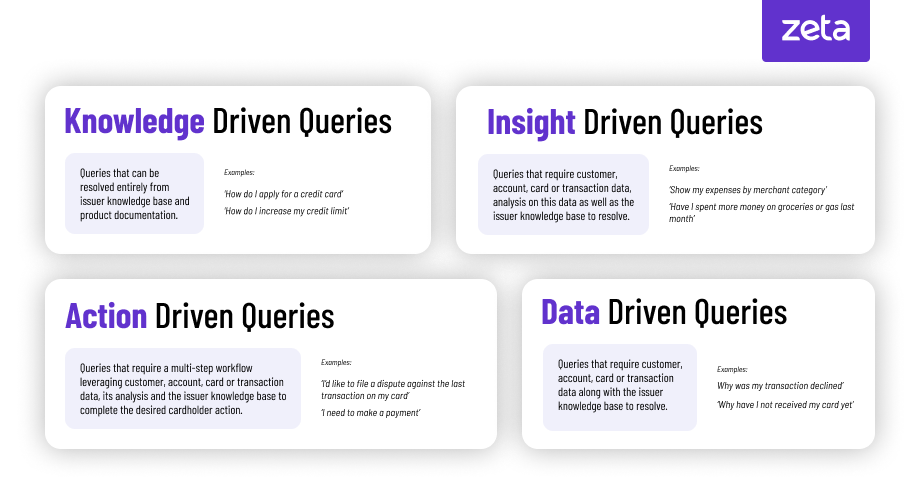

Elena’s ability to understand intent and resolve customer queries can be classified as follows:

Image 2: Classification of queries handled by Elena

Context-Aware Conversations

A key differentiator is Elena‘s ability to maintain conversation context throughout the interaction. It preserves and builds upon earlier exchanges, allowing customers to modify requests mid-conversation without repetition or restarts. For instance, a user can start by checking their balance, decide to make a payment of $100, then adjust it to $150 within the same natural flow – just as they would with a human agent.

Intelligent Escalation Protocol

When situations exceed AI capabilities, Elena ensures seamless transition to human agents. Its sophisticated contextual handoff preserves the entire conversation history and relevant account information, enabling agents to continue service without requiring customers to restate their needs. This integration of AI efficiency with human expertise creates a truly unified support experience where nothing gets lost in translation.

The Path Ahead

As digital payment volumes surge and customer expectations evolve, the need for truly conversational AI support is no longer optional – it’s imperative for staying competitive.

Tomorrow’s customers won’t tolerate robotic scripts or fragmented support experiences. They expect fluid, intelligent conversations that solve problems instantly. For issuers ready to embrace this transformation, advanced Conversational AI offers a clear path forward – one where technology enhances rather than hinders the customer experience.

For issuers looking to modernize their customer experience, the future of conversational support isn’t just a vision – it’s ready to deploy today.

Want to explore how Elena can revolutionize your customer experience?

Download our comprehensive whitepaper, Elena: Advanced AI Card Support with Intelligent Insights & Actions, or connect with our team at sales@zeta to begin your journey toward intelligent card support.

References:

-

- Verint | The State of Digital Customer Experience Report | 2024

- CFPB | Chatbots in Consumer Finance | June 2023

- CFPB | Chatbots in Consumer Finance | June 2023

- McKinsey | Where is Customer Care in 2024? | March 2024