Beyond Transactions: How Next-Gen Cards are Creating Value Around Payments

Contents

- Why Issuers Need to Differentiate

- Beyond Payments: Next-gen Cards Can Enable New Experiences

- The Path Forward

Why Issuers Need to Differentiate

The market competing on card rates and rewards may be oversaturated, but new fronts on which issuers can differentiate themselves have emerged – 74% of US customers want more personal experiences from their banks¹ and 35% are interested in using a single app for a consolidated banking and shopping experience2.

Fintechs have rapidly filled the gap between customer expectations and card offerings available today, creating bespoke products for niche customer segments and unlocking new revenue models in the process.

For example, small business and family expense management fintechs like Brex and Greenlight make money through monthly subscriptions, a percentage of the interchange fee on their credit cards, and (in the case of SMB-focused fintechs) interest on loans.

Similarly, subscription management has emerged as a new opportunity, with fintechs like Chargebee increasing payment volumes and interchange revenue through primacy of use.

Meanwhile, existing card programs are built for large and homogenous customer segments on legacy or hybrid platforms. They are also typically built around the physical plastic card, which can limit:

- Instant issuance and activation, seamless integration with mobile devices, and the ability to manage cards and transactions through smartphones

- Insight into transactions, spends, and customer behavior

These factors not only lend rigidity to the customer experience but also make it difficult to introduce innovative products and hyper-personalized offerings that are necessary to meet evolving customer demands and unlock new business potential.

Beyond Payments: Next-gen Cards Can Enable New Experiences

Digital issuance of credit cards has unlocked several new-age experiences for cardholders, the foremost being the ability to activate and use a card within minutes of application. But beyond immediate advantages like instant activation and replacement, next-gen processors help issuers enhance digital card experiences by baking in software capabilities that go beyond transactions.

Some of these capabilities are:

DIY controls: Give cardholders the ability to issue add-on digital cards (for family members or employees, for example) and set controls for transactions and spends

Intelligent insights: Harness customer, card and transaction data to deliver personalized insights and support for better card or financial management

Hyper-personalization: Deepen engagement with loyal customers through personalized rewards

Enhanced security: Build trust with granular and real-time security controls

Configurability: Build applications around payments that help niche customer segments save time and money

By leveraging these capabilities, issuers can create premium card experiences that rival leading digital-first players while opening new revenue streams through enhanced customer engagement and value-added services.

Expense Management

Digital issuance capabilities allow small business owners to issue add-on virtual business cards to employees. Issuers can also enable them to control spends, transaction types, and merchant categories. This results in an automated and proactive approach to expense management.

A Visa report shows that the current uptake of digitally issued virtual cards remains low, but there is a significant opportunity for issuers to cover the small business expense management market through card-based solutions. Moreover, 73% businesses that already use virtual cards are likely to take out another financial services product in 12 months, increasing the opportunity for issuers to cross-sell3.Similarly, digital issuance can be adapted for finance management for retail customers. For example, customers can create virtual cards for their children on the card app and set spend limits, blacklist merchants, or restrict spend categories.This would be a lucrative customer base for issuers – 46% of Gen Zs are financially dependent on their parents and 54% are interested in using digital cards to pay online. Issuers can establish a foothold in this segment early by engaging them younger, improving CLTV in the long run4.

Subscription Management

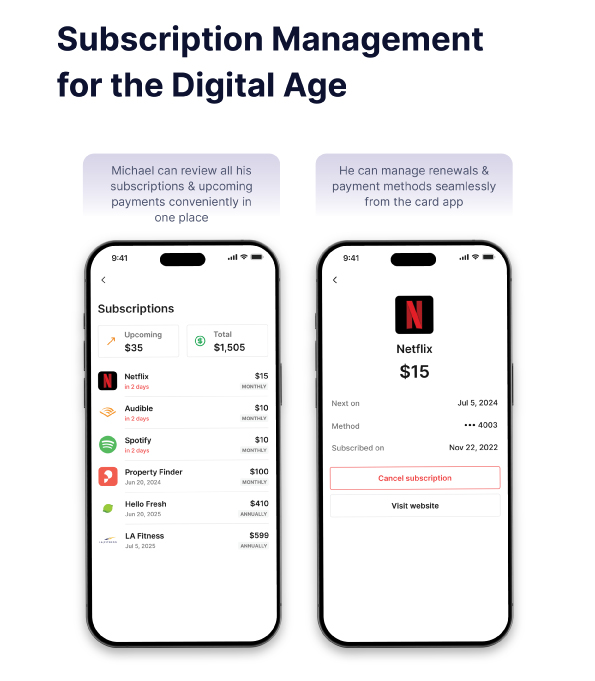

Issuers can enable programmable capabilities like cancelling, pausing, or resuming subscriptions on the cards used to pay for them. These capabilities allow them to drive customer loyalty, increase engagement, and reduce chargebacks.

Subscription Management

Forty-four percent of subscription-based businesses reported an increase in voluntary churn in 20235. Additionally, 73% of consumers are interested in a tool that would help them identify, track, cancel, or renew subscriptions6. This indicates a considerable opportunity for issuers to offer value-added subscription management services in their card apps.

Improved Customer Support

Issuers can build advanced customer support capabilities into their card program by leveraging real-time data processing, and conversational and generative AI. Cardholders can be empowered to manage their finances in a more streamlined manner through insights into card activity, and requesting automated action within the card app.

Such a customer support tool will be equipped to handle large call volumes and suited for the scale at which issuers operate. It could also help reduce costs by reducing dependence on live agents by 75%. Intelligent and automated support enabled by a next-gen processor could also improve resolution time and enhance customer satisfaction.

The Path Forward

The future of card issuing lies not in competing on traditional features, but in leveraging software capabilities to create truly differentiated value propositions. Success will come to issuers who can effectively combine these technological capabilities with deep understanding of customer needs to deliver innovative, segment-specific solutions.

As the industry continues to evolve, the winners will be those who view their cards not as simple payment tools, but as sophisticated software platforms capable of delivering unique, personalized financial experiences. The revolution in card issuing is just beginning, and the possibilities for innovation are boundless.

- References:

- EMarketer | Banking customers of all ages want more personalization | 2024

- PYMNTS Intelligence | Consumer Interest in an Everyday App | 2024

- Visa | Capitalizing on the potential in virtual cards | 2021

- PYMNTS | Digital Card Usage: A Path Forward | 2021

- Stripe | The state of subscription and billing management | 2023

- Mastercard | Mastercard Simplifies Subscription Management With Smart Subscriptions | 2024