Category: Credit Line on UPI

-

- Credit Line on UPI

- 6 min

Credit Line on UPI: Why Proactive Planning is Key to Success

Credit Line on UPI (CLOU) is revolutionizing digital lending in India, presenting banks with a $1 trillion opportunity by 2030. To succeed, banks must plan ahead—evaluating market trends, regulatory shifts, and technology readiness to unlock new revenue and reshape traditional lending products.

-

-

Salil Ravindran

Product Marketing at Zeta

-

- Credit Line on UPI

- 6 min

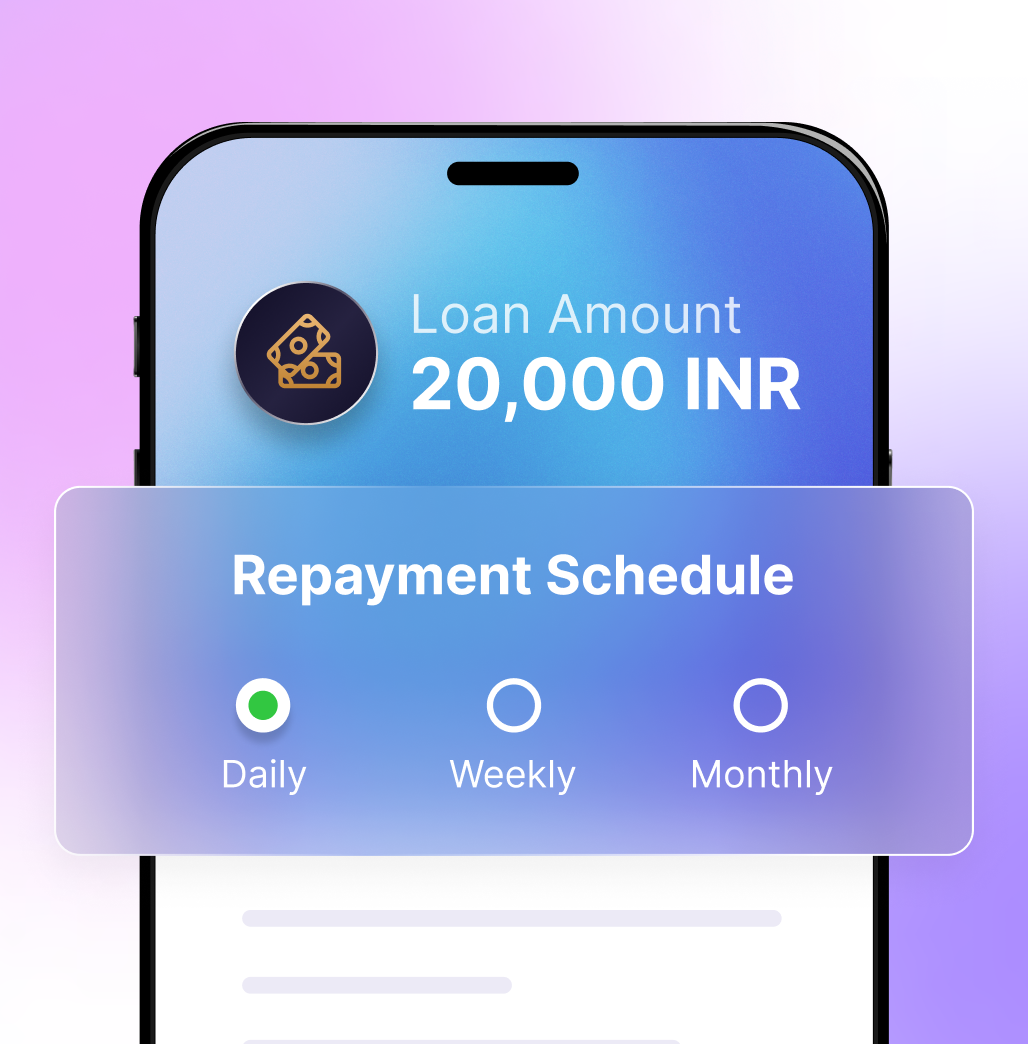

Rewriting India’s EMI Rulebook With Credit Line on UPI (CLOU)

Discover how Credit Line on UPI can revolutionizing India’s loan repayment system, shifting from traditional EMIs to more adaptable EPIs, and enabling cashflow-based financing for cashflow-dependent borrowers.

-

-

Deepak Kumar

Head of Product Management at Zeta India

-

- Credit Line on UPI

- 4 min

A Definitive Blueprint for Digital Credit: The $1T Opportunity With Credit Line On UPI

As we witness the birth of digital credit in its truest form with credit line on UPI, banks need guidance on effectively planning, launching, and scaling products on CLOU.

-

-

Sivaram Kowta

President, Banking, Zeta India

-

- Credit Line on UPI

- 4 min

6 Reasons Why Credit Line on UPI Will Transform Retail Lending in India

Credit Line on UPI empowers banks to transform India’s credit landscape by bridging accessibility gaps and unlocking a $1 trillion opportunity through a digital-first approach.

-

-

Sivaram Kowta

President, Banking, Zeta India