Demystifying Next-Gen Compliance for Modern Banks

- Adapting to regulatory change: How next-gen compliance helps

- Next-gen compliance in action

- Adopting next-gen compliance

We’re seeing a year with intensifying supervisory scrutiny on banks in the US, as regulators look for ways to protect consumers in this fast-changing economy and payment landscape. Compliance professionals have a huge load on their shoulders as they deal with an unprecedented rate of change to existing regulations or completely new regulations with many unknowns and higher complexity.

This is especially challenging when their institutions use legacy technology. Solutions are more complex when built on legacy platforms, and we’re all too familiar with the constraints on modifying these systems to adapt to new regulations.

Next-gen compliance represents a shift from a reactive to a proactive approach in managing regulatory requirements. It is a technology-led approach that allows for real-time updates, extensive automation, and significantly fewer manual processes. I introduce Next-Gen Compliance and its advantages briefly in this blog, but you can also watch my webinar on this topic where I demo how easy it is to make the Reg Z Credit Card Penalty Fee update using next-gen compliance.

Adapting to regulatory changes: How next-gen compliance helps

Image 1

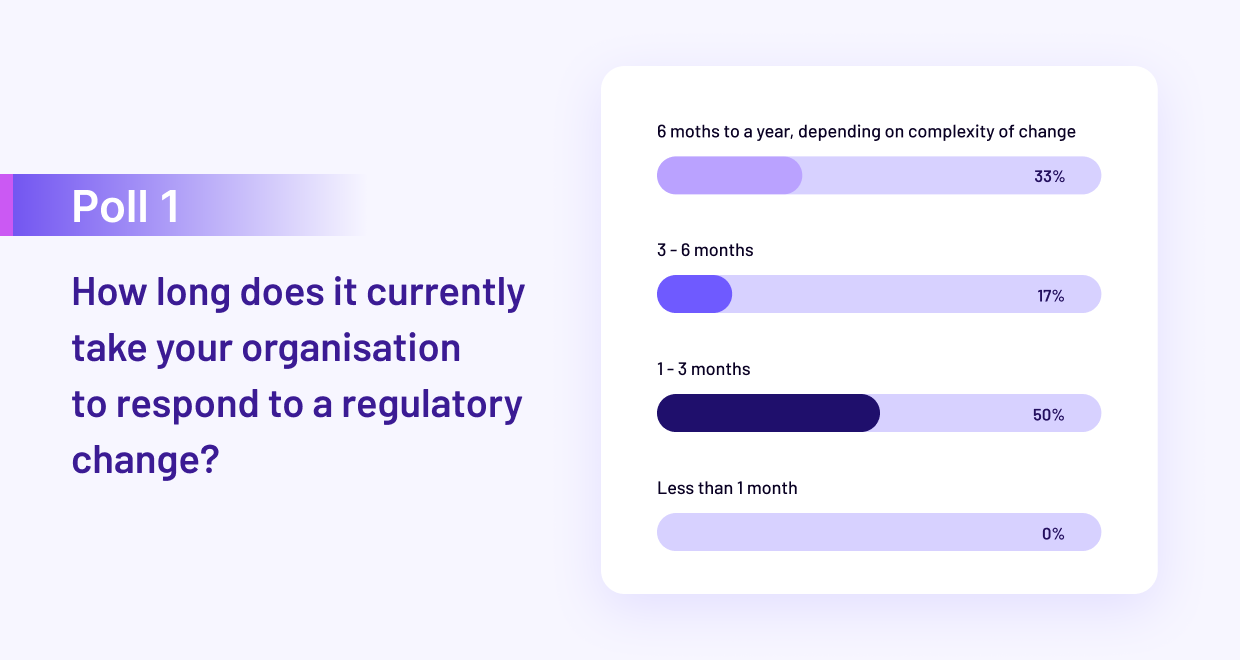

Our webinar on next-gen compliance was attended by compliance leaders and executives from across financial institutions in the US. In response to a live poll during the webinar, the audience unanimously responded that updating systems to meet a regulatory change requirement is a project spanning several months on legacy systems. Something as straightforward as altering a late fee can become a quarter-year project.

Compliance teams need to determine which programs would be impacted, delve into hard-coded systems to identify necessary changes, assess dependencies across multiple systems, and manage extensive documentation and client communications. This process is not only time-consuming but also diverts resources from other productive activities.

Image 2

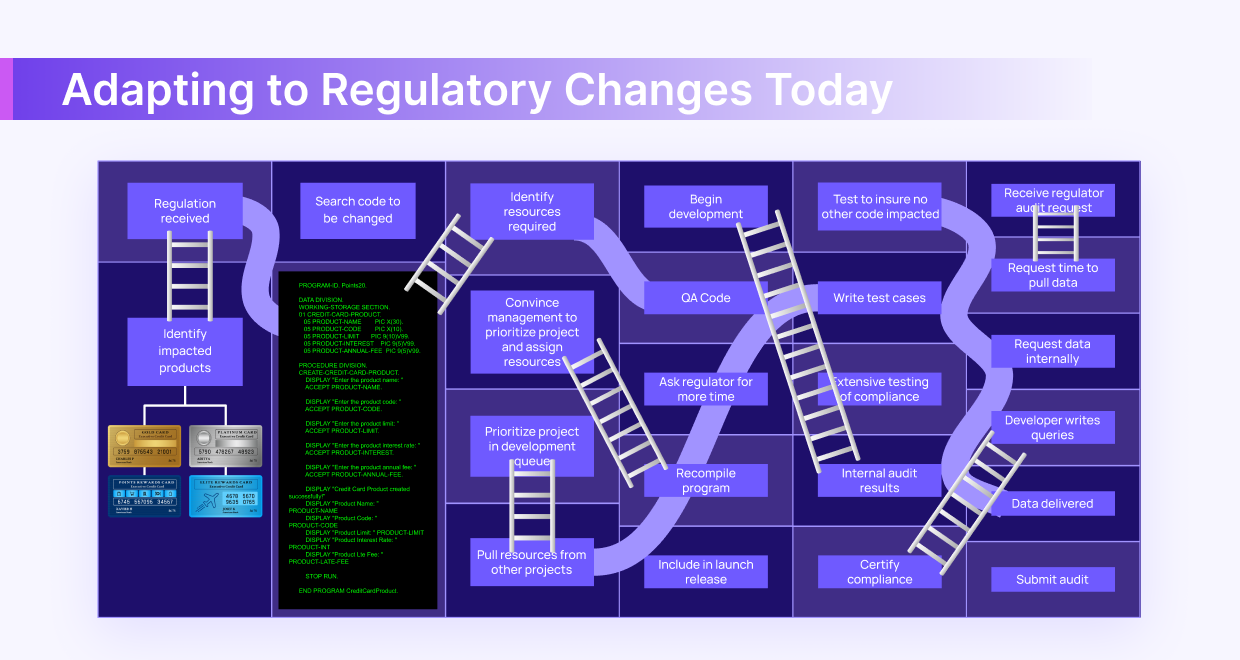

Despite all the advancements in technology today, the challenges for compliance professionals remain the same: legacy systems are rigid and slow to update. Institutions often attempt to implement agile methodologies to speed up processes, but the basic approach to compliance adaptation remains reactive, resource-intensive, and prone to errors.

The concept of next-gen compliance involves next-gen technology systems that are built from the ground-up to be agile, scalable, and compliant. What this means, for example, is that product attributes will not be hard coded, but will be presented as variables that can be configured or updated independently to respond to regulatory changes. You can also imagine compliance policies, like delinquency policy or fee policy, created as independent entities that are applied to several products at once.

Image 3

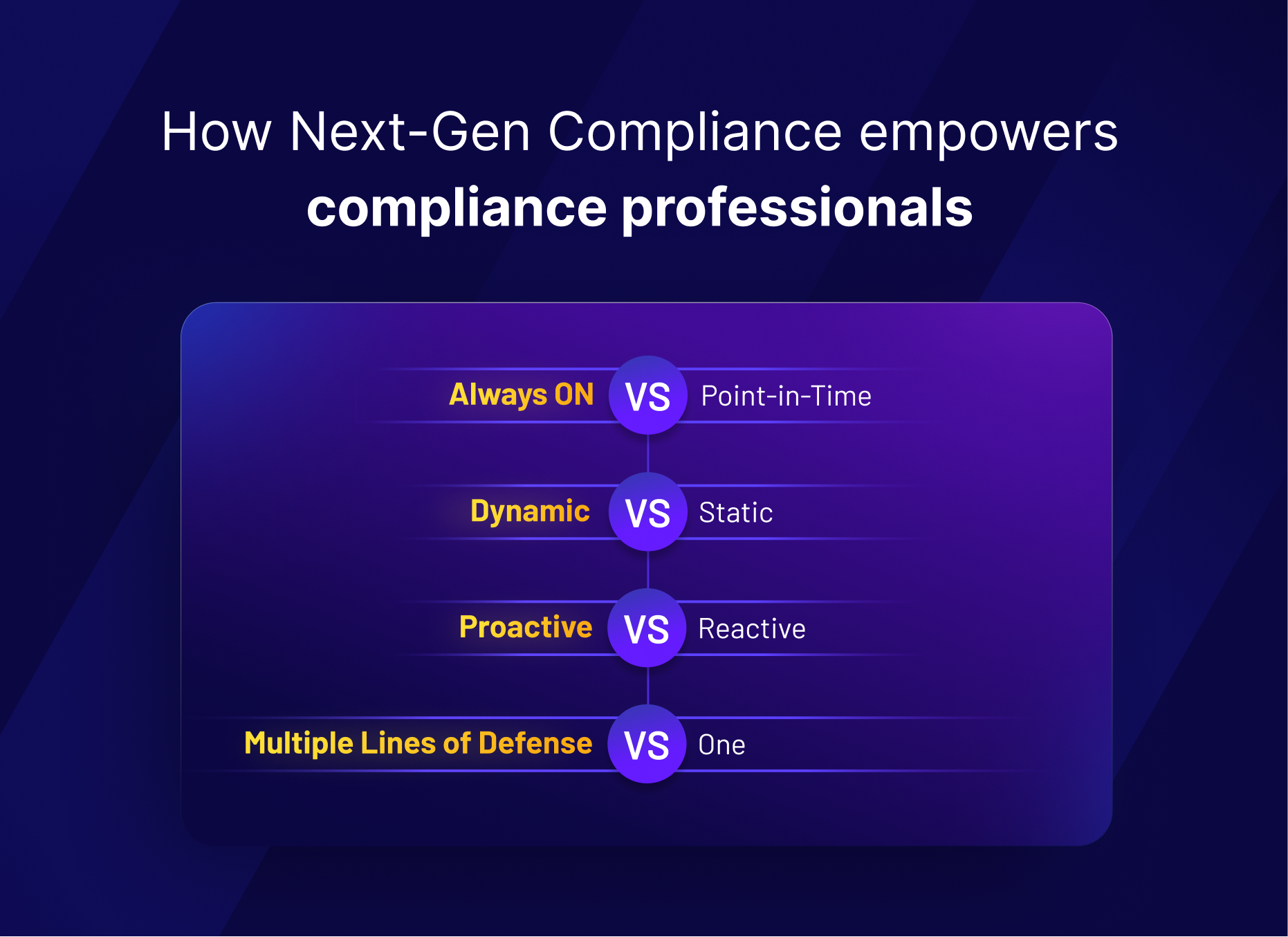

As a result of being baked into next-gen technology systems, next-gen compliance addresses some of the most persistent challenges faced by compliance professionals:

- An always-on posture versus spot checks being made only during audits or regulatory changes

- Proactive compliance with horizon scanning and regulatory change management that allows for planning and responding before time

- Dynamic compliance control by adopting next-gen approaches like configurability versus hard-coded policy data

- Multiple lines of defense through the use of maker/checker, controller, and auditor workflows built into the system and process

Next-gen compliance in action

The easiest way to truly understand the impact of next-gen compliance is to see it in action. Our webinar includes a 9-minute demo of how financial institutions can make the Reg Z Credit Card Penalty Fee update using Zeta’s next-gen platform. The demo highlights:

- The configurable fee policy framework that separates the business logic of the fee (when, how, and to whom it is applied) from its variables (how much, how many times, and so on)

- The process involved in updating the late fee policy

- The maker-checker controls involved in the fee policy update

- The quality assurance array and test cases used to validate that the fee update has been applied correctly

Image 4

Access the demo as part of the webinar here.

The total time taken for the late fee update in a next-gen compliance setup, including configuration change and the QA validation in pre-production was 4 hours. This process would typically take six figures and 4-6 months with a small team on legacy platforms. The same would be true for accessing data in legacy systems to meet exam requests to determine compliance gaps on accounts with rates, charges, over-charging, and so on.

Adopting next-gen compliance

The transition to next-gen compliance offers a host of advantages. It enhances the ability of financial institutions to adapt quickly to regulatory changes and significantly reduces the operational costs associated with legacy systems. Most importantly, it frees up compliance professionals to focus on strategic risk management rather than getting bogged down in the minutiae of regulatory adherence.

I cover these and other advantages of adopting next-gen compliance in my webinar, along with a comprehensive 360° framework that helps ensure coverage across regulatory aspects, business policies, digital compliance, and customer data.

We’re also talking to several financial institutions to discuss how they’re planning to modernize their compliance approaches. Do reach out to me if you’d like to know more or if you’d like to discuss how Zeta can assist you in implementing next-gen compliance in your organization.