Expert Insights on The 4 Stages of Card Program Maturity

I had the privilege of moderating a webinar with an all-star panel on the modernization of card programs a few days ago. We were discussing the release of a new report by Datos Insights on the four stages of card program maturity called Escaping the Legacy Card Tech Hamster Wheel. Joining me on the panel were:

- David Shipper: Strategic Advisor at Datos Insights focused on retail banking and payments. He is the author of the report, which is based on his interviews with payments executives at banks, as well as Datos Insights’ research and expertise in payments.

- Alan Ng: Managing Director of Payments Technology Consulting for Accenture. He brings over 20 years of consulting experience in payments technology and cash management modernization for global banks.

- Alex Johnson: Founder of the popular newsletter and podcast Fintech Takes, which is focused on the intersection of financial services, technology and public policy.

It was a great conversation and I’d urge you to watch the full webinar here. We covered a lot of topics through the 45-minute conversation, but I’d like to call out the following highlights in this blog.

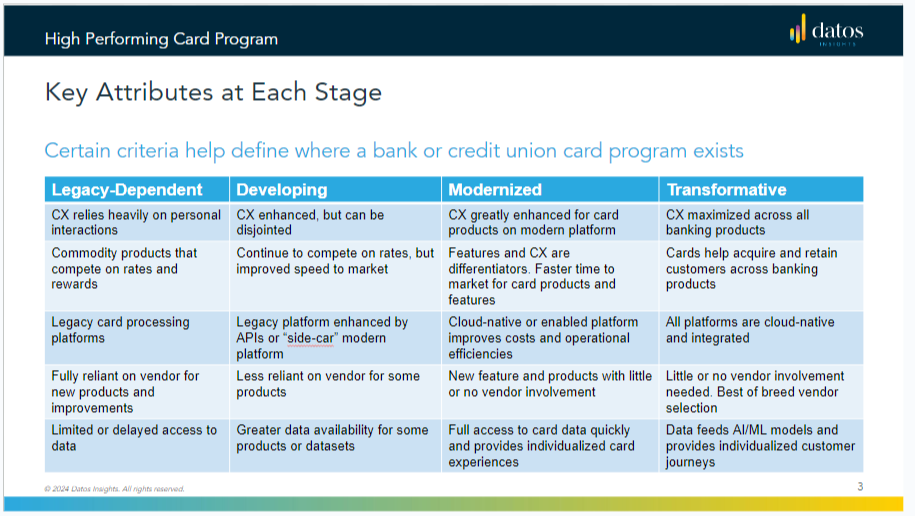

1. The 4 stages to card modernization

Issuers can unlock important benefits at every stage

David shared the key findings of his report around the 4 stages of card program modernization.

While he highlighted the benefits of the modernized and transformative stages of card maturity, David focused on the importance of issuers getting started on the journey to modernization, as every step unlocks significant benefits for the issuer. For example, testing with sidecar implementations as the first step can be complicated to manage operationally, but it is a step in the right direction and will deliver many benefits to the issuers and cardholders.

Another major finding that David highlighted was the limitation of modernizing a card platform and stopping there.

“We see that…a card program doesn’t operate in a silo. The card platform interacts with other platforms. So…a transformative card program is a really high bar that begins with (modernizing) the card platform but ends with everything else, like a modern core, or modern underwriting, or any platform that influences the card program being modernized.”

-David Shipper, Strategic Advisor, Retail Banking & Payments, Datos Insights

The report presents the benefits of such a transformative state in full detail.

Card executives take as much time deciding whether to modernize as actually doing it

When asked to share some practical guidance on what it would take for banks and credit unions to get moving on modernization, and perhaps advance from stages 2 to 3, or even to stage 4, Alan backed David on the importance of getting the processing of modernization started.

He explained that at Accenture they assume the fastest modernization project would take 2 years and this can go up to 3 years, depending on the size and complexity of the portfolio. He felt that these timelines – 2 to 3 years – are reasonable. What makes them artificially longer, is how long executives take to consider whether or not they should modernize.

2. Risks of the status quo

The biggest risk of status quo is the diversification of payment types

When asked for his perspective on the risks of staying with the status quo, Alan pointed towards the growing diversification of payment types.

“I would say the most important risk or opportunity on the horizon is the diversification of the payment methods. To me, that is the”killer” for legacy processors because they can’t handle anything other than cards. We’re seeing the emergence of new payment types – buy now pay later is just the beginning – in other geographies and sooner rather than later, they will arrive in the US.”

-Alan Ng, Managing Director, Payments & Technology Consulting, Accenture

The survey showed surprising insights on the sacrifices made by card executives

In sharing his observations from the interviews he did for the report, David shared some often heard frustrations of card executives with their legacy providers.

David also mentioned some factors that surprised him in the course of his interviews. One, is the number of migrations from one legacy platform to another legacy platform, with similar limitations. The other surprise was the sacrifices card executives have to make in working with a best-of-breed or vendor of their choice because they are not pre-integrated with the legacy platform.

3. What modern platforms can unlock

Fintechs are using modern issuance platforms to reimagine cards in 3 different ways

I asked Alex how the most innovative non-banks are disrupting payments, and how banks and credit unions should be thinking about these competitive threats.

He explained that fintechs are using modern card issuance to innovate in the following three ways:

- The card as a product: Innovations in how the card is expressed to the customer, from virtual cards with newer capabilities like subscriptions, to Visa’s new flexible credential that allows tying up debit and credit funding sources to the same card.

- The card as a business model: Fintechs are moving beyond debit cards with Durbin exempt interchange rates to charge cards and credit cards with modern platforms that can support both, debit and credit cards.

- The card as a data and engagement layer: Some of the most innovative digital-native issuance products do not have a card as the core product. For example, Ramp is a corporate expense management software and their card is just what the customers use to transact and transmit real-time data to the software.

Banks in the corporate card space are embracing more modern technology

Alex also used the example of banks in the B2B space to highlight how incumbents are using modern technology to become more competitive. For example, corporate card issuers are using modern issuance platforms to offer more APIs around their cards to allow other fintechs and ecosystem players to develop capabilities around them. This means that a fintech can develop their corporate expense management software around the issuer’s cards, instead of launching their own.

This is a smart competitive move by banks that ensures that their cards are available within modern fintech software that customers want to use.

He also referred to David’s report and called out how clearly it highlights the compounding benefit of being able to move fast, iterate on different parts of your platform, interact with other systems and other players, and enable the kind of decentralized innovation that banks and credit unions see in fintechs and big techs.

I couldn’t agree more. You can access the complete Datos Insights report here. And if you’d like to catch more of these brilliant insights, you can view the complete webinar here.