- AI in Banking

- 6 min

Next-Gen Card Support is Intelligent, Personalized and Conversational

Selene transforms customer support with intelligent, conversational AI that instantly resolves queries, maintains context, and seamlessly escalates complex issues—all with banking-grade security and compliance.

-

-

Salil Ravindran

Product Marketing at Zeta

-

- Cards & Payments

- 4 min

Beyond Transactions: How Next-Gen Cards are Creating Value Around Payments

Discover how next-gen processors can enable personalized experiences, advanced expense management, and innovative financial services for businesses and consumers.

-

- Compliance

- 5 min

What’s in Store for Banking Regulation under Trump 2.0?

Explore the potential banking regulatory landscape under a second Trump administration, including proposed legislation on credit card competition, interest rates, and data privacy, and the CFPB's pending rules and expected transitions.

-

-

Karla Booe

Chief Compliance Officer, Zeta

-

- Cards & Payments

- 6 min

Giving Small Business Credit Cards an Expense Management Upgrade

Next-gen card technology can help issuers offer SMBs more than just payments with intelligent expense management that combines automation and control.

-

-

Salil Ravindran

Product Marketing at Zeta

-

- Cards & Payments

- 6 min

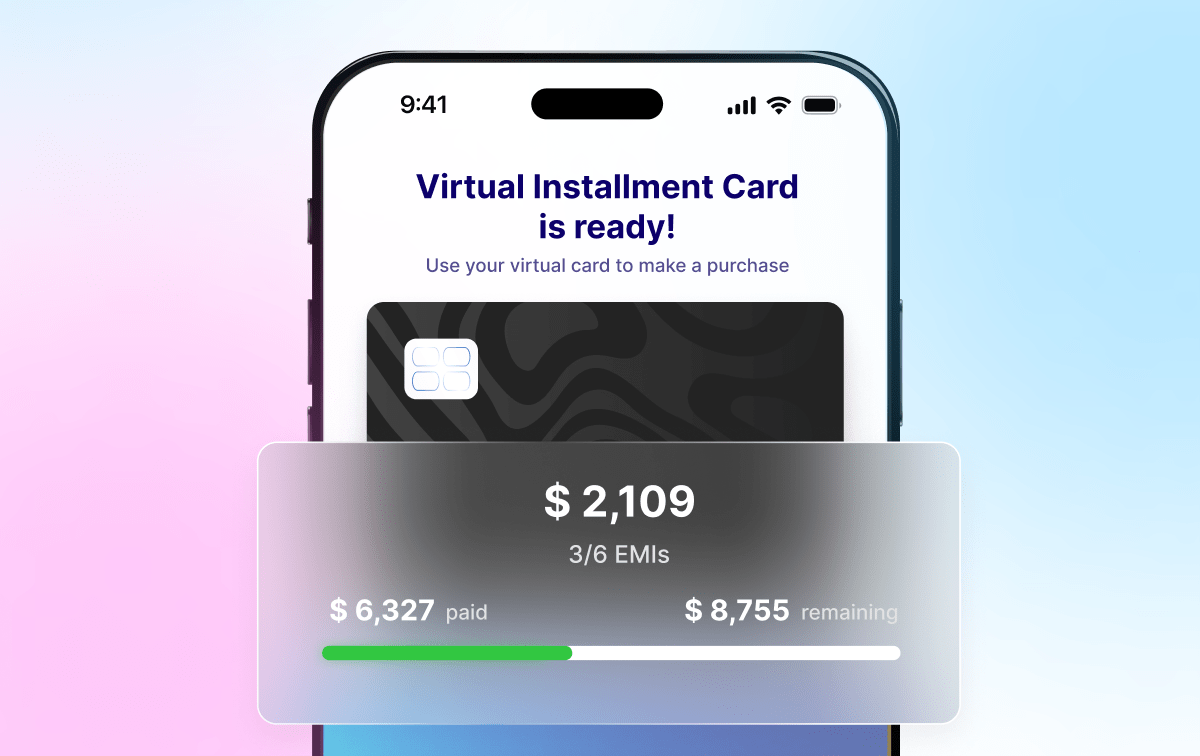

Virtual Installment Cards: Improving BNPL Outcomes for Banks and Customers

Virtual Installment Cards are game-changers. They empower banks to compete with BNPL by offering flexible, structured payments that drive purchase decisions and enhance customer loyalty.

-

-

Chris Harris

Head of US Marketing for Zeta

-

- Cards & Payments

- 4 min

Breaking the Status Quo with Transformative Card Experiences

Next-gen card platforms are empowering issuers to offer innovative experiences like family hubs & virtual installment cards that drive customer loyalty, enhance security, and boost card utilization.

-

-

Gary Singh

President, North America

-

- News & Updates

- 2 min

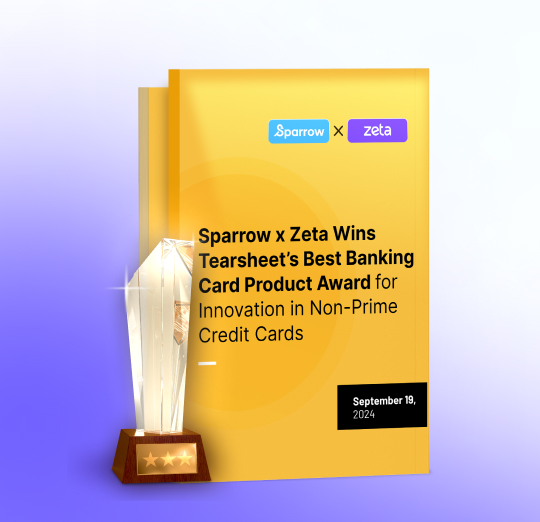

Sparrow x Zeta Wins Tearsheet’s Best Banking Card Product Award

Sparrow card, powered by Zeta, has won Tearsheet’s Best Banking Card Product award for empowering underserved Americans with modern, customer-first experiences.

-

- Technology

- 5 min

Understanding the Role of Dynamic CVV in Digital Fraud Prevention

Enabling dynamic CVV in cards can help issuers build stronger customer trust and reduce the financial impact of fraud on businesses and consumers.

-

-

Bharathi Shekar

Director, Product

-

- Perspectives

- 5 min

Why Financial Institutions Fail to Modernize and How to Fix It

In a recent conversation with innovation expert Geoffrey Moore, we explored the challenges banks face in modernization. Moore’s 4 Zones of Transformation framework—Performance, Productivity, Incubation, and Transformation—offers a clear roadmap for financial institutions. By understanding these zones, banks can better manage tech debt, foster innovation, and drive long-term success.

-

-

Gary Singh

President, North America

-

- Credit Line on UPI

- 6 min

Credit Line on UPI: Why Proactive Planning is Key to Success

Credit Line on UPI (CLOU) is revolutionizing digital lending in India, presenting banks with a $1 trillion opportunity by 2030. To succeed, banks must plan ahead—evaluating market trends, regulatory shifts, and technology readiness to unlock new revenue and reshape traditional lending products.

-

-

Salil Ravindran

Product Marketing at Zeta