Rewriting India’s EMI Rulebook With Credit Line on UPI (CLOU)

Contents

- Transforming Loan Repayments: The Shift from EMIs to EPIs

- Cashflow-Based Financing for Cashflow-Dependent Borrowers

- The Road Ahead: Unlocking A New Era Of Credit In India

For millions of Indians, the traditional model of loan repayments is more of a burden than a benefit.

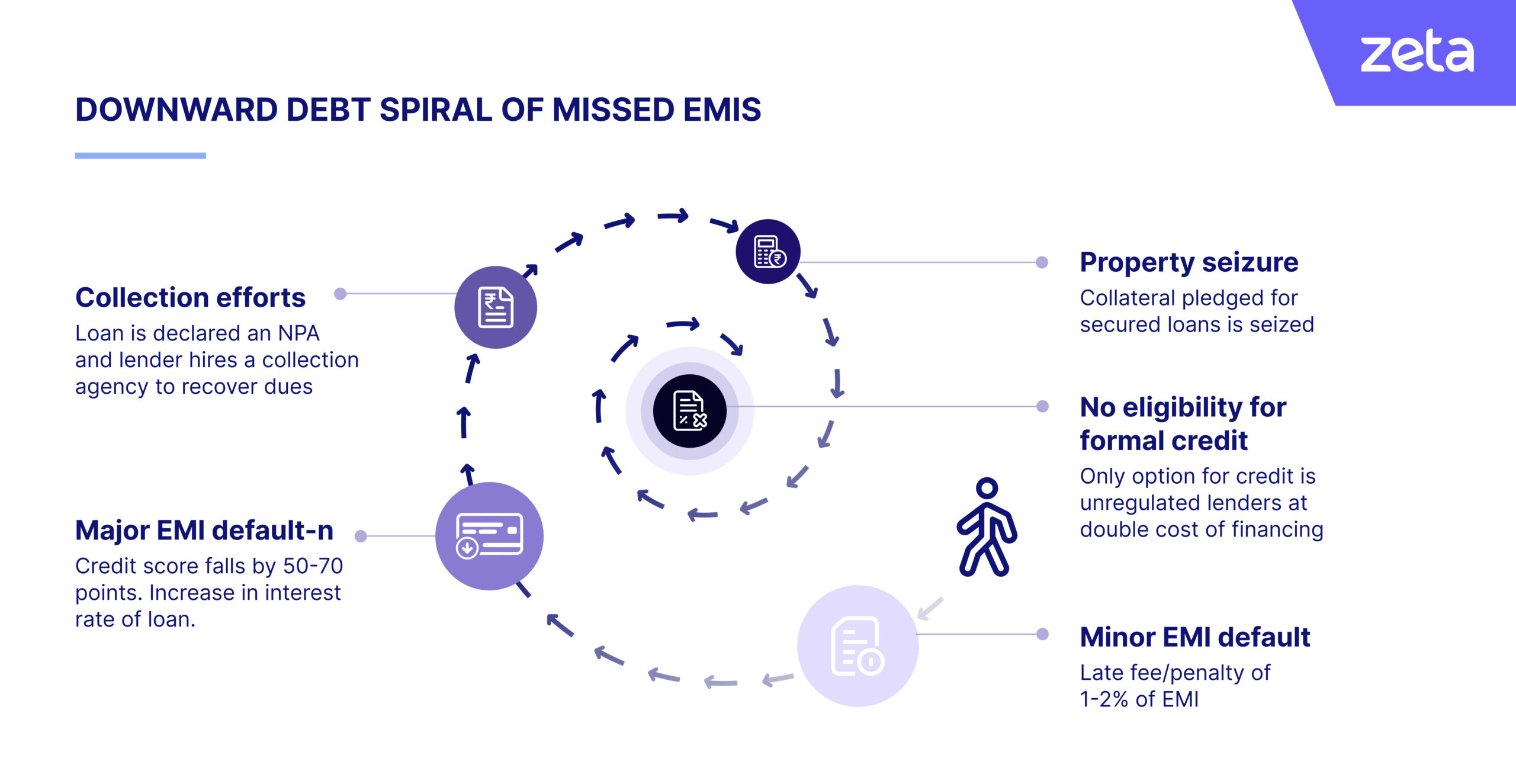

In a country where only 19% of the working-age population (aged 24 – 64) has regular employment1, traditional loan repayments can feel like a trap rather than a financial solution. The reality for most Indians – freelancers, gig workers, and small business owners – doesn’t align with the rigid structure of Equated Monthly Installments (EMIs). These individuals often face the stress of missed payments, leading to penalties, a significant drop in credit scores, and ultimately, more costly credit.

In fact, a missed EMI can cause a credit score to drop by as much as 70 points2, creating a vicious cycle where the inability to secure loans from regulated sources forces them into the unregulated market, where financing costs can more than double. Image 1 highlights the debt spiral created through missed EMIs.

Image 1

For banks, the challenge is equally daunting. EMIs are an important way of managing complex collection operations and the risk of lending. Existing systems, built for physical scale, struggle to accommodate the evolving needs of a digital-first economy. Increasing the frequency of repayments to fortnightly, weekly, or daily would drive up the complexity and overheads of collections. Similarly, moving away from equated installments would throw amortization schedules, fee calculations, and ledger balances into chaos. With the rapid digitization of credit through UPI, however, there’s an imminent need for such a shift.

Enter Credit Line On UPI (CLOU)—a solution poised to bridge this gap. CLOU’s digital-first repayment model promises to reduce the overheads and complexities of offline collections. We believe this opens up the possibility of moving away from equated monthly installments to more frequent, smaller repayments that would suit more borrowers. Slightly farther on the innovation horizon, we believe CLOU can also enable true cashflow-based financing for Indians, allowing them variable repayments based on variable cashflows. We explore both possibilities in this blog.

Transforming Loan Repayments: The Shift from EMIs to EPIs

CLOU can unlock a paradigm shift in credit repayments, a move away from the traditional EMI model to a more flexible and adaptive Equated Periodic Installments (EPIs) that better match the income cycles of borrowers.

Consider the status of the gig workers in India. Research shows that 59% of India’s gig workers are paid weekly, while the rest receive daily wages, with a median income of Rs. 200,000 ($2400) per year3. The higher end of the gig economy in India has a lot more borrowing power, with tech talent getting paid $5 per hour for basic work and up to $400 per hour for specialized work by senior AI engineers4.

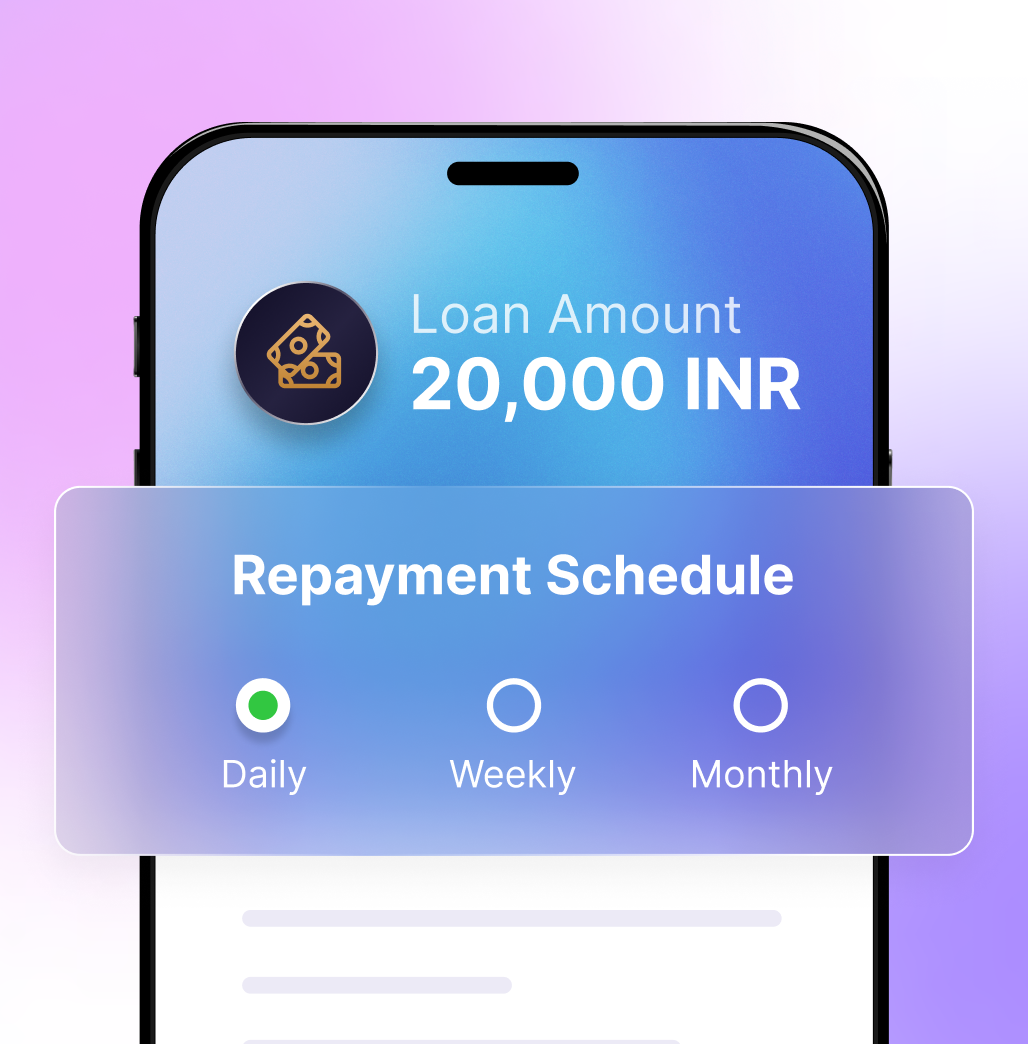

With EPIs, borrowers could have the flexibility to make repayments on a schedule of their choice – weekly, bi-weekly, or even daily – depending on what best suits their financial situation. This flexibility reduces the stress associated with meeting rigid repayment schedules and helps borrowers avoid defaults.

For banks, this can open up new customer segments without a significant increase in collection risk or overheads. CLOU allows borrowers to make repayments seamlessly through their existing UPI apps, with each repayment automatically allocated to their credit lines. From a systems readiness perspective, banks need to ensure:

- Product configuration systems that support the design of shorter and custom repayment periodicities, such as daily, weekly, and bullet payoff after x days of purchase

- Robust integration with third-party application providers (TPAPs) on UPI to define branded user experiences allowing users to control their repayment frequencies and modes, make repayments, as well as receive automated repayment reminders

- Repayment apportionment rules where multiple loans are linked to a single credit line

We cover these system requirements in more detail in our white paper Chak De India: Democratizing Credit With Credit Line On UPI.

Cashflow-Based Financing for Cashflow-Dependent Borrowers

CLOU unlocks new opportunities for cashflow-based or revenue-based financing, particularly for underserved segments.

UPI transaction history provides rich insights into various granular aspects of a user’s cashflow such as transaction velocity, merchant categories, ticket size, and payment timeliness. For small merchants, UPI transaction history can provide a deeper view of their turnover, seasonality of business, and cashflow patterns. With India’s digital public infrastructure, banks can also easily access other data points to give them a cohesive picture of the borrower’s monthly and annual revenue flows.

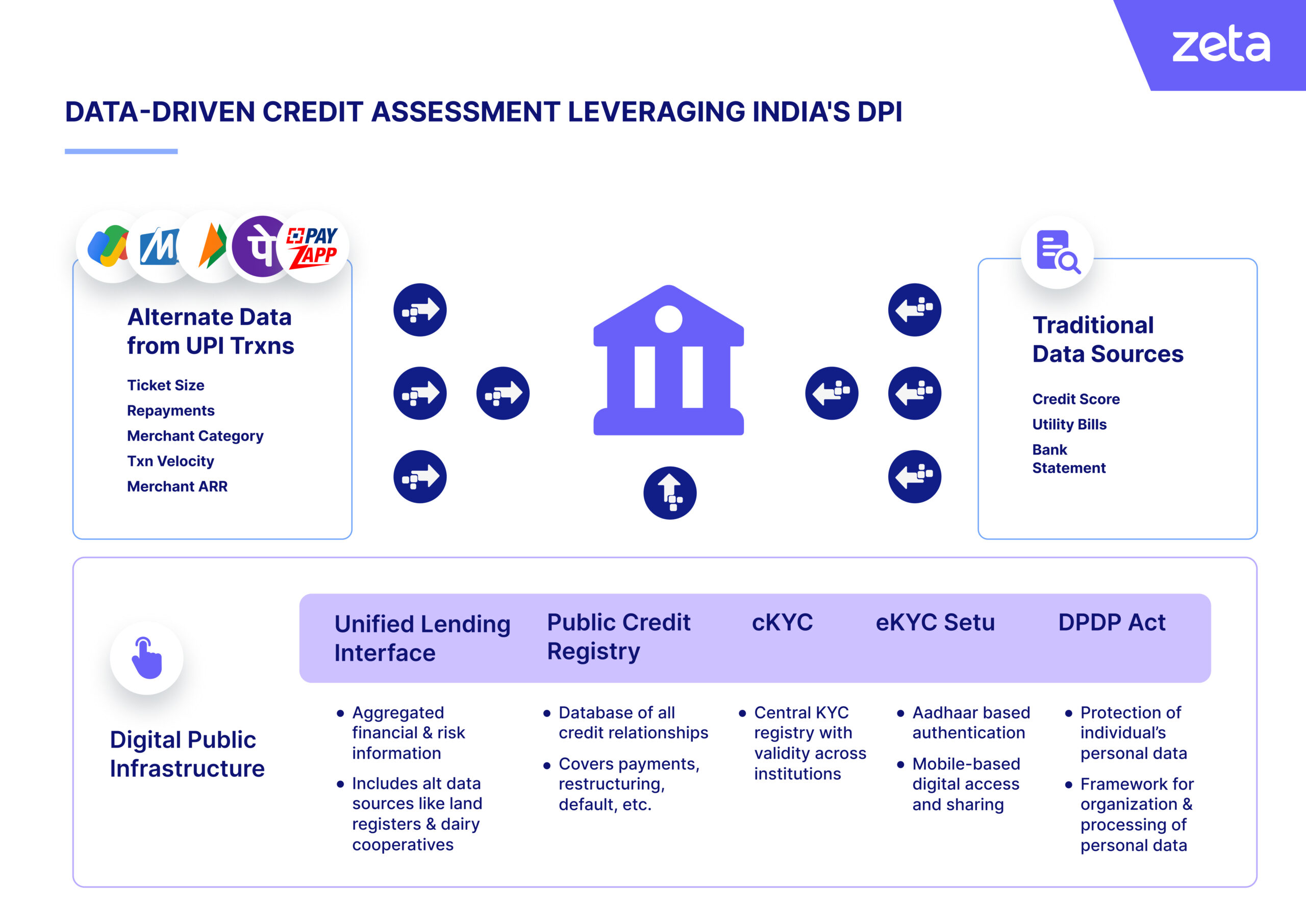

Image 2 shows how banks can leverage India’s Digital Public Infrastructure (DPI) to execute data-driven credit assessment:

Image 2

Banks can leverage these attributes to assess the creditworthiness of the customer as well as their repayment ability on a regular basis.

Cashflow-financing repayments are set as a fixed percentage of recurring revenue flows (between 1 and 10%), not as a fixed amount. A great example of how this can play out is iSPIRT’s much-publicized use case for OCEN, Rajni. 5

As per the use case, Rajni is a street vendor who takes a loan from her local moneylender in the morning to buy supplies, converts the principal amount into sales at a small profit, and repays the loan at the day’s end. The interest rates on the loans Rajni avails daily can go up to an exorbitant 150-300% annually. To serve Rajni via the traditional setup, banks would have to send a loan officer to Rajni to offer her a loan, but the cost for that (~Rs. 1500) would make the outreach unviable for the intraday loan amount she needs (~Rs. 500).

With CLOU, banks can use the UPI transaction data to know Rajni’s daily, weekly, and monthly turnover. Based on this information, they can calculate her annual recurring revenue (ARR) and issue her a revolving credit line to the tune of 1x-2x of that via UPI. Rajni, therefore, can pay a far lower interest rate than she used to pay the local moneylenders, and she can make repayments seamlessly on a daily basis via UPI.

There are millions of merchants like Rajni in the country, and the opportunity for banks to serve them credit products without investing money in extending or collecting the loans manually cannot be overestimated.

Of course, enabling this, at the volume and velocity expected with CLOU, requires ground-up system changes, especially the ability to dynamically amend amortization schedules, fee calculations, and ledger balance updates for millions of cashflow-based credit lines.

Our white paper Chak De India: Democratizing Credit With Credit Line On UPI offers a detailed roll-out plan for CLOU based offerings that covers system and product readiness for such forward looking scenarios.

The Road Ahead: Unlocking A New Era Of Credit In India

CLOU is more than just a technological innovation; it represents a new era of credit distribution in India. By 2030, CLOU is projected to exceed USD 1 trillion in transaction volumes, driven largely by the inclusion of customers who have historically been excluded from formal credit systems due to the rigidity of traditional EMI structures. This increased credit penetration is expected to significantly boost India’s GDP, paving the way for a more inclusive and customer-centric lending environment.

The future of credit in India is here, and with CLOU, it’s brighter than ever. We’re continuing to explore deeper opportunities with CLOU and would love to hear from you if you’re looking to launch differentiated, forward-looking digital credit products in India.

References:

- Drishti IAS, India Employment Report 2024 | March 2024

- Bajaj Finserv | Missed your EMI payment? Know the consequences | October 2023

- LEAD, Gig Economy – The Indian Picture So Far | December 2023

- Times of India, Tech gig economy grows, India to have 23.5 million workers by 2030 | June 2024

- iSpirit.in, The Rajni Use Case | First created in 2017