Strategies to Navigate Card Program Modernization

Contents

- The 4 Stages of Card Program Maturity

- The Stage 3 Challenge for Issuers

- The Crawl-Walk-Run Strategy

- Conclusion

For card program executives using legacy platforms, waiting months, even years, for basic digital features, let alone truly innovative experiences, is a harsh reality. It’s no surprise that these executives already feel the urgency to modernize.

Despite this, however, the decision to modernize their card platforms is a hard one. It involves a multi-year disruption to established systems and operational flows. Also, there is immense pressure to show modernization results in a few quarters or risk losing vital stakeholder confidence1.

David Shipper, Strategic Advisor on Retail Banking and Payments at Datos Insights, spoke extensively to senior card program executives at US banks and realized that they are looking for ways to take smaller steps towards modernization. In his latest report for Datos Insights’ titled Escaping the Legacy Card Tech Hamster Wheel, David frames card program modernization in 4 stages and presents progressive strategies to advance from one stage to another. This blog captures his insights on navigating card modernization and presents the Crawl-Walk-Run modernization strategy that we help financial institutions adopt.

The 4 Stages of Card Program Maturity

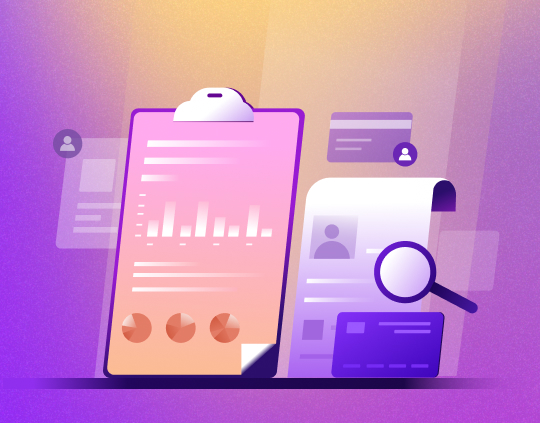

David led Datos Insights’ research into the technological state of card programs across the US. Based on his findings, the report frames the card programs as having 4 stages of technological maturity – legacy dependent, developing, modernized, and transformative. The framework also highlights the benefits unlocked at each stage and the steps necessary to navigate from one state to the next (Image 1).

Image 1

The Stage 3 Challenge for Issuers

The Datos Insights report finds that the majority of issuers are stuck at Stage 2, which is defined as being legacy dependent with a layer of APIs built over, or a side-car implementation of a modern platform running select new programs. While this approach is often a necessary starting point to modernization, staying in Stage 2 can expose issuers to compliance and regulatory risk—not only from rapidly changing regulatory postures but also from meeting existing compliance, control, and audit requirements.

For example, in several conversations, card program executives have highlighted that it takes weeks to update the rates in their system every time the Fed changes interest rates, costing them millions a year because they have to open a ticket with their legacy platform. Legacy systems are so complex and entangled with each other that it’s difficult to gain efficiencies from simply changing a single system, adding API layers, or updating user interfaces. This complexity also delays the launch of new products, innovation, and the ability to react to regulatory changes.

Most issuers struggle to go from Stage 2 to Stage 3 because it requires them to move the entire portfolio of card programs and customers to a modern issuer processing platform. This goes beyond system upgrades and requires a complete overhaul of the card program operating model across origination, processing, collections and more. A shift to Stage 3 thus represents a significant commitment to the modernization of the card program and requires executive-level support.

The Crawl-Walk-Run Strategy

Undertaking modernization is daunting; however, the next generation of technology enables several low-risk approaches to help banks take the important first step. As Accenture highlights in their 2023 Top 10 Banking Trends report: “The likely disruption caused by a multi-year transformation was always a good excuse for sticking with your mainframe. However, today’s cloud-native platforms not only dramatically reduce the timeline; they also allow migration and the launch of new products to be done progressively, which reduces the risk. The ROI has improved dramatically.3”

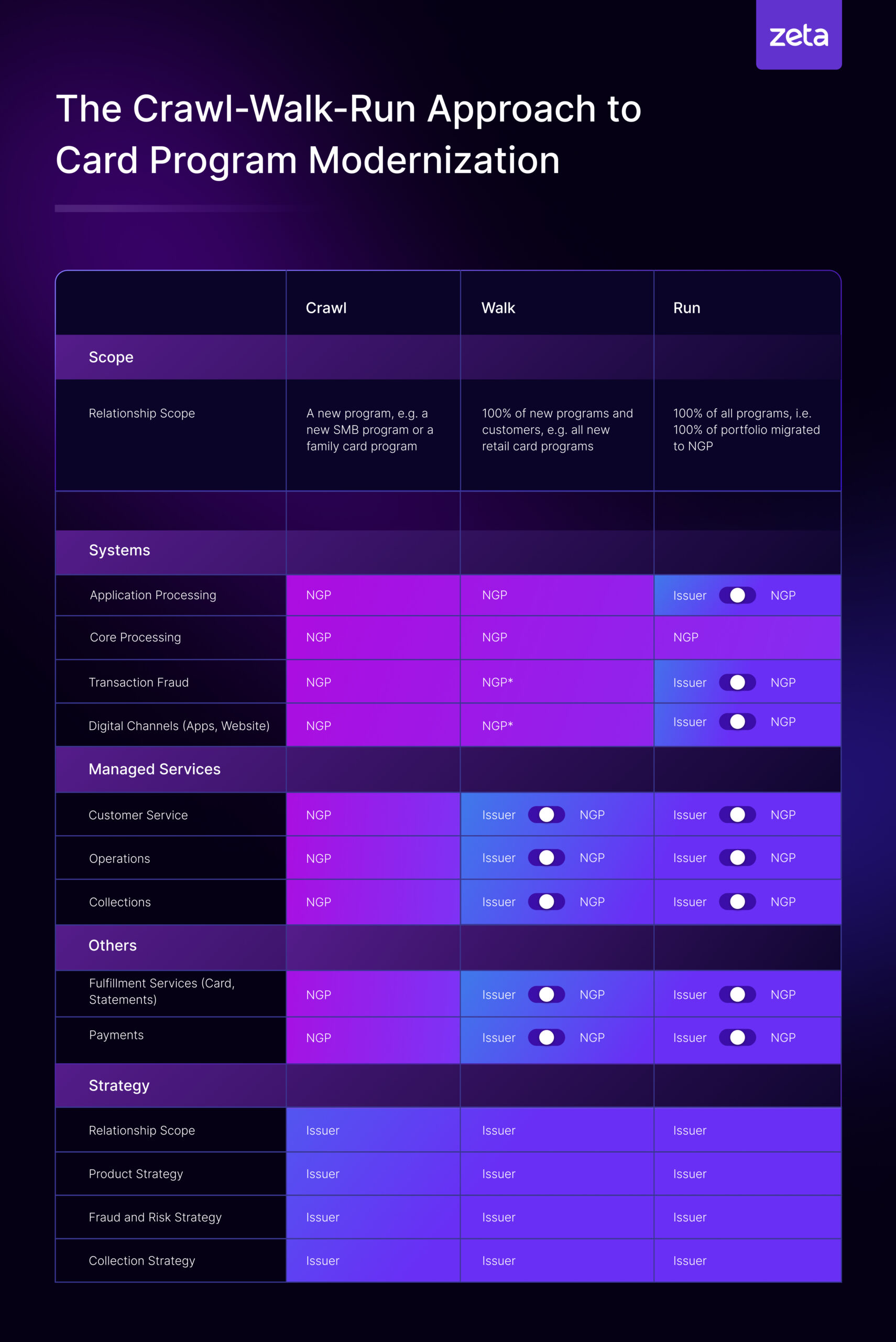

Through our discussions with several leading US issuers, the Crawl-Walk-Run strategy has emerged as a practical modernization approach. This phased transformation minimizes risk for banks by starting small with a single program, allowing them to identify and address challenges before wider implementation. Additionally, this approach is cost-effective; outsourcing in the initial phase limits upfront investment, and the bank gradually builds internal capabilities, reducing reliance on external partners over time.

Image 2

Image 2 illustrates the progressive shift of modernization in scope, growing from one side car program, to all new programs and finally to the entire portfolio. Importantly, it also highlights a progressive approach towards modernizing the operations, servicing and surround systems related to the card program. While this approach proposes outsourcing most non-strategic functions to the next-gen processing (NGP) partner initially, issuers should focus on a time-bound move towards in-sourcing modernized functions back based on their specific strategy.

Crawl: Issuers should start small with one sidecar program, preferably focused on a specific customer segment, like a small business card or a family card, on a modern issuer processing platform.

- Guidance:

- Outsource most aspects to limit pressure on existing processes and systems

- Manage only core functions in-house, such as business strategy and compliance

- Account for merging data from two sources for business and regulatory reporting

- Benefits:

- Limited risk

- Offers a window to evaluate benefits

Walk: Once validated, issuers should move all new programs to the modern platform in a time-bound manner.

- Guidance:

- Start insourcing strategic functions based on your strategy (e.g., applications, customer support)

- Partner continues to support, but issuer teams begin to take control

- Use this time to train teams, upgrade skills, and build comfort with the change

- Benefit

- Benefits of modernization unlocked for more programs

- Controlled organizational pivot to modernization

Run: Finally, issuers can unplug the legacy processing platform and migrate the entire card platform over to the modern platform.

- Guidance

- The modern platform becomes the default platform

- Planned sunset of old legacy systems

- Move all new and existing programs to the modern platform

- Issuer teams are fully in the driving seat

Conclusion

The early stages of modernization may require additional outlays for extra personnel to manage two parallel systems or the effort needed to merge data from two processing systems for business and regulatory reporting. However, in the long run, these investments pay off through better operational savings, lower infrastructure costs, and enhanced growth.

Alan Ng, Managing Director of Payments Technology Consulting for Accenture, described card modernization as a 2-3 year process, depending on the size and complexity of the card programs. He also noted, however, that this timeline is often artificially extended by the time executives take to deliberate on modernization. Given the growing risks of the status quo, how do you take this initial step into modernization and overcome these challenges? As we continue to engage with card programs across the US, we welcome your thoughts and comments on this topic.

References:

- Geoffrey Moore, Crossing the Banking Tech Chasm | October 2023

- McKinsey, On the cusp of the next payments era: Future opportunities for banks | September 2023

- Accenture, Top 10 Banking Trends for 2023 | February 2023