Virtual Installment Cards: Improving BNPL Outcomes for Banks and Customers

Contents

- Surging Consumer Demand for Flexible Payments is Fueling BNPL Growth

- Why BNPL is Gaining Preference

- Key Advantages Banks Can Leverage to Compete with BNPL Providers

- The Shortcomings of Current Credit Products Offered by Banks

- Virtual Installment Cards (VIC): A Game Changer for Banks

- How Does the Virtual Installment Card Work?

- Virtual Installment Cards vs. Other Credit Products: A Side-by-Side Comparison

- Virtual Installment Card: Moving the Needle for Banks

- Virtual Installment Cards Drive Profitability with Key Segments

Surging Consumer Demand for Flexible Payments is Fueling BNPL Growth

As consumer demand for flexible payment options at checkout continues to surge, banks stand to gain significantly from the BNPL market but may need to take creative approaches to compete.

In the U.S., the Gross Merchandise Volume (GMV) for BNPL purchases alone is expected to reach $171.6 billion by 2029 (CAGR of ~6%) driven primarily by increased purchase frequency and Average Order Value (AOV) – research reveals that BNPL has an 85% higher AOV compared to other payment methods1.

A recent report by Adobe Analytics reveals that consumers spent about $731 Billion online between January and September 2024, with ~$57.6 Billion coming through BNPL purchases – an increase of 10.3% from the same period in 20232. It is evident that BNPL is emerging as a preferred payment method as customers look for convenient – readily available – and flexible options.

Why BNPL is Gaining Preference

BNPL has gained share so quickly because it offers two unique attributes: it avoids revolving debt and it doesn’t require preplanning to acquire credit. For many credit-card-averse customers, BNPL offers a way to ensure a purchase is paid off within a certain time frame with installments, creating certainty and confidence in the purchase. Customers also don’t have to plan ahead to apply for a card. With simple applications at the point-of-sale, customers can be spontaneous. BNPL providers like Affirm, Afterpay, and Klarna have built a significant head-start with their network of partner merchants.

However, banks hold several key advantages that can help them capture the BNPL space effectively.

Key Advantages Banks Can Leverage to Compete with BNPL Providers

Banks are better positioned to offer BNPL services to customers because:

- Strong credit risk management: Banks have a wealth of data on consumers’ creditworthiness, enabling them to assess and manage risk far more effectively than BNPL providers. This allows them to offer more reliable products and minimize default risks.

- Regulatory advantage: Operating within an established regulatory framework gives banks a leg up. As regulators around the world begin to impose stricter regulations on BNPL providers, banks are already well-equipped to handle compliance, reducing friction in their operations.

- Lower cost of capital: With access to low-cost capital through deposits, banks can offer better interest rates and lower fees, making their products more attractive to consumers and merchants alike.

- Consumer trust: Research indicates that consumers trust BNPL offerings from banks more than those from pure-play providers3. This trust seems to stem from the bank’s established reputation for managing credit responsibly and operating within a regulatory framework, making customers more comfortable using bank-based BNPL services.

Even with these inherent advantages, banks must do more to capture this market.

The Shortcomings of Current Credit Products Offered by Banks

Banks have attempted to compete with BNPL by offering installment repayment options on credit cards but have fallen short primarily because, in contrast to BNPL, existing products only allow customers to convert their purchases into installments after the purchase is made. This creates no incentive to make a purchase in the first place and little incentive to choose a specific credit card over another since there is no certainty that an installment offer will be available.

Traditional installment loans are often hard to apply for, delaying access to quick financing. Overall, current credit products lack the convenience and certainty that BNPL provides, making them less attractive for online purchases.

Virtual Installment Cards (VIC): A Game Changer for Banks

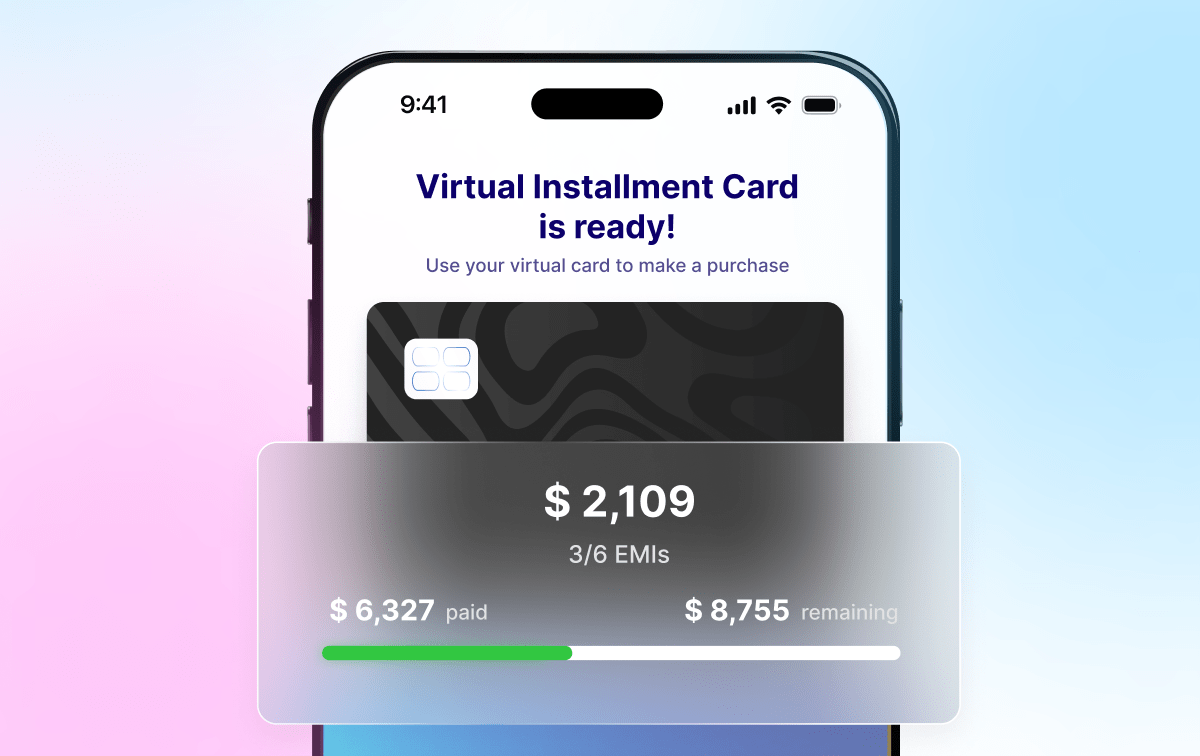

Virtual Installment Cards (VIC) are temporary digital cards, issued instantaneously, that access a consumer’s existing credit card limit to make installment purchases.

The Virtual Installment Card (VIC) is just one of many innovative use cases powered by Gen 3 card technology, made possible by next-gen platforms. In our latest eBook, The Future of Cards is Now, we delve deeper into the defining attributes of Gen 3 cards, including VIC and other transformative experiences that issuers can offer. Discover how these innovations are reshaping the future of card experiences – download the eBook to explore more.

How Does the Virtual Installment Card Work?

The animation below shows how a customer, Bob, creates and uses a Virtual Installment Card:

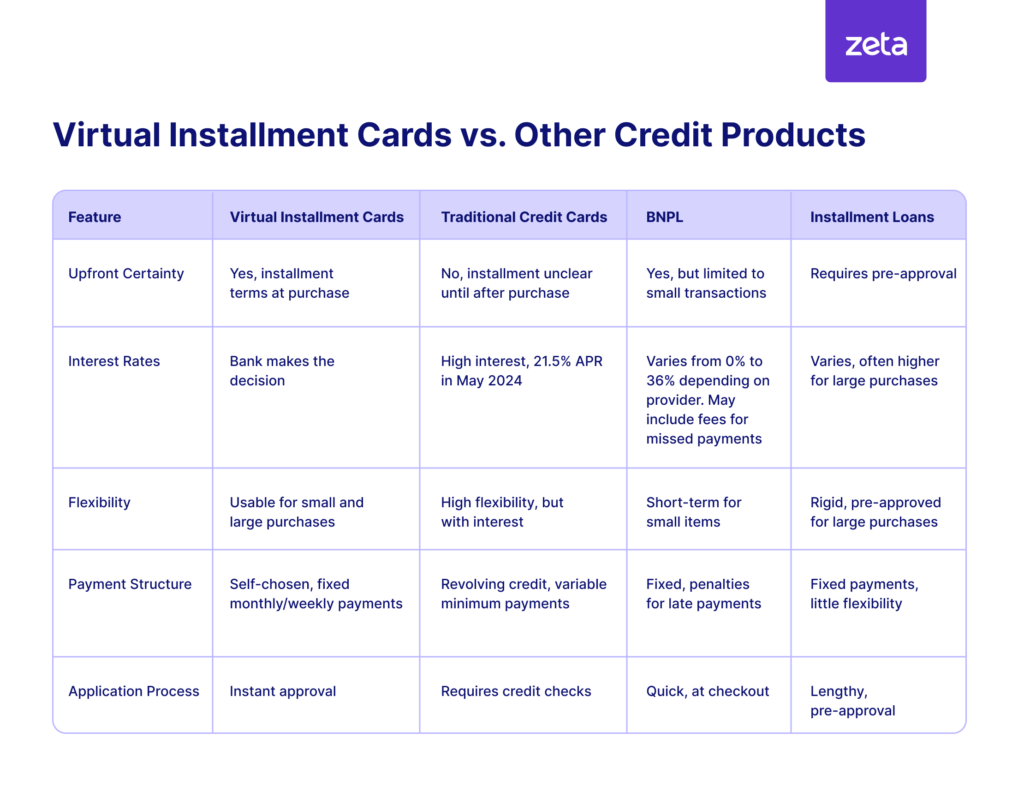

Virtual Installment Cards vs. Other Credit Products: A Side-by-Side Comparison

The following image illustrates how the Virtual Installment Card stacks up against other credit products.

Image 1

As shown in the table, the Virtual Installment Card stands out by offering consumers upfront certainty at checkout, instant approval, and flexible payment structures for both small and large purchases. It is important to note that the repayment structure plays a crucial role in the customer’s choice of payment method. According to a Federal Reserve survey, 87% Americans chose BNPL because it allowed them to spread out the repayments4, which is another way of making high-cost purchases more manageable.

Importantly, the VIC also allows banks to compete with BNPL players by offering flexibility in pricing with interest rates, fees, and other charges.

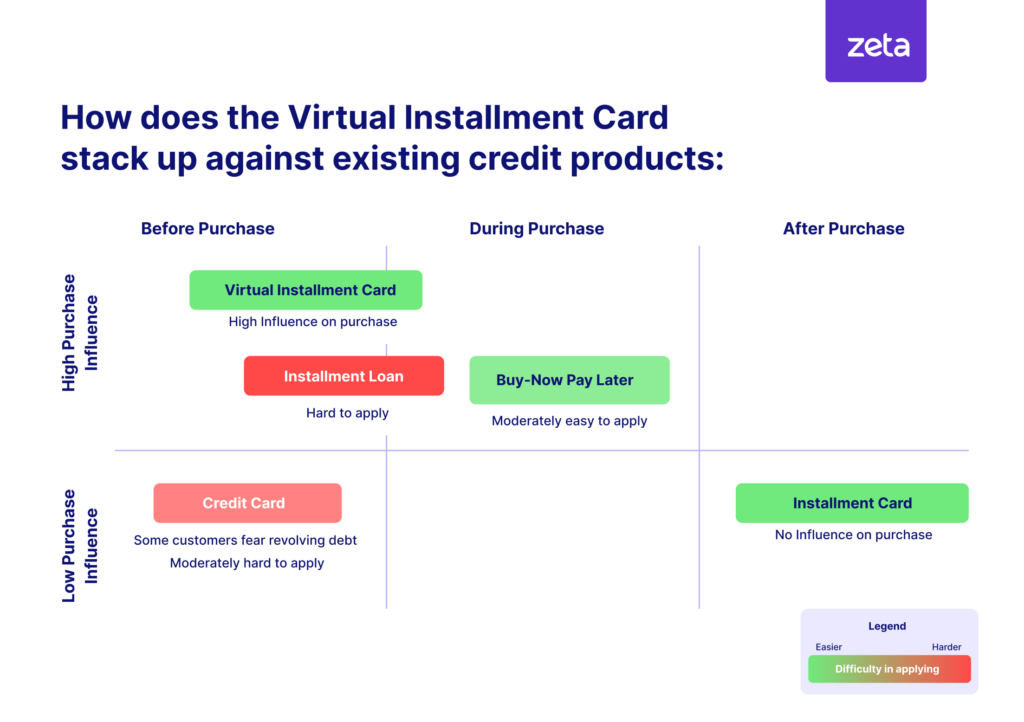

In summary, the Virtual Installment Card combines flexibility, convenience, and a quick application process. This drives strong pre-purchase influence and encourages higher usage compared to other credit instruments, as illustrated in image 2.

Image 2

Virtual Installment Card: Moving the Needle for Banks

By offering tailored offers and installment certainty at check-out, Virtual Installment Cards have a direct impact on the purchase decision, encouraging customers to make transactions. This purchase influence eventually leads to increased interest revenue as the customer makes the purchase.

Additionally, the flexibility of structured payment plans allows consumers to manage their finances more effectively. With clear, predictable payments, the risk of default decreases, as customers are less likely to face unexpected financial strain. And finally, installment purchases create a lock-in effect, earning customer loyalty. As customers commit to longer payment terms, their ongoing engagement with the card reduces the likelihood of churn, which in turn ensures they continue using the card for future purchases.

Virtual Installment Cards Drive Profitability with Key Segments

Virtual Installment Cards offer a way to improve profitability in one of the most challenging segments: transactors, who rarely or never carry a balance. Prompting this segment to put large purchases, vacation expenses or merchant-specific spend on a specific card and then carry a balance that yields interest charges could be a game changer for a very sought-after but profit-challenged segment.

Additionally, Virtual Installment Cards can appeal to debit-committed spenders who are creditworthy and financially responsible, but averse to carrying revolving balances.

Virtual Installment Cards combine the ease of BNPL services with the structured repayment options of traditional installment loans while offering the same control and customization as modern credit cards. Consumers benefit from certainty and flexibility at the point of sale, while issuers retain control over risk and transaction type.

If you’re interested in how innovations like the Virtual Installment Card are driving the future of card programs, our eBook, The Future of Cards is Now, offers deeper insights. Explore how Gen 3 card platforms are empowering issuers to tap into untapped segments, create new revenue models, and redefine the cardholder experience.

References:

- Capital One Shopping | Buy Now Pay Later Statistics | 2024

- Reuters | Who are buy now, pay later borrowers, and what are they buying? | 2024

- S&P Global, Consumer Checkup: Banks have the edge in buy now pay later | March 2024

- Federal Reserve | Report on the Economic Well-Being of U.S. Households in 2023 – May 2024 | 2024