Zeta Powers Sparrow’s Industry-leading Credit Card for the Underserved

We are incredibly excited to share the story of Sparrow – a credit card for underserved Americans, powered by Zeta Tachyon – our Next-Gen Processing Platform. In under 6 months, the Sparrow card has become a leading card in the US non-prime segment, thanks to its modern approach and amazing consumer experience.

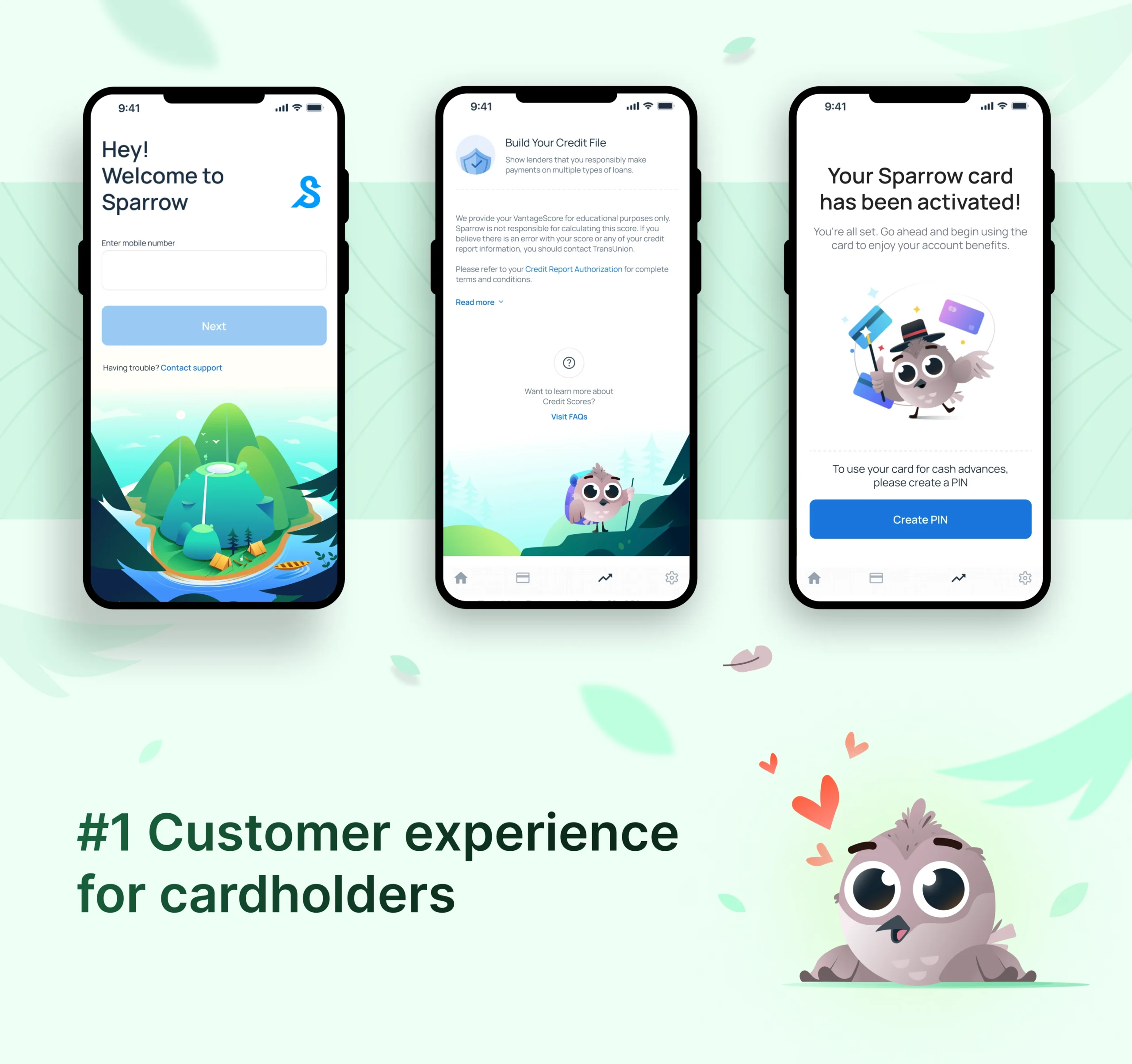

Highlights of the Sparrow credit card management app

- Sparrow was founded by industry veterans – Evan Feldman and Lisa Sturm – who have spent 30+ years building and managing large-scale credit card portfolios

- Sparrow’s credit card went live in October, leveraging Zeta for processing, mobile and web apps, servicing, and data platform

- Zeta has enabled Sparrow to deliver the Best Customer Experience, the Fastest Time-to-Market, and Unparalleled Program Management Capabilities

- Customers love everything about the card experience, especially the instant virtual card issuance (allowing the journey from application to first card purchase in minutes), fast and modern mobile app (with <100ms response time for any action), in-app card controls, and self-service capabilities, as well as best-in-class customer support

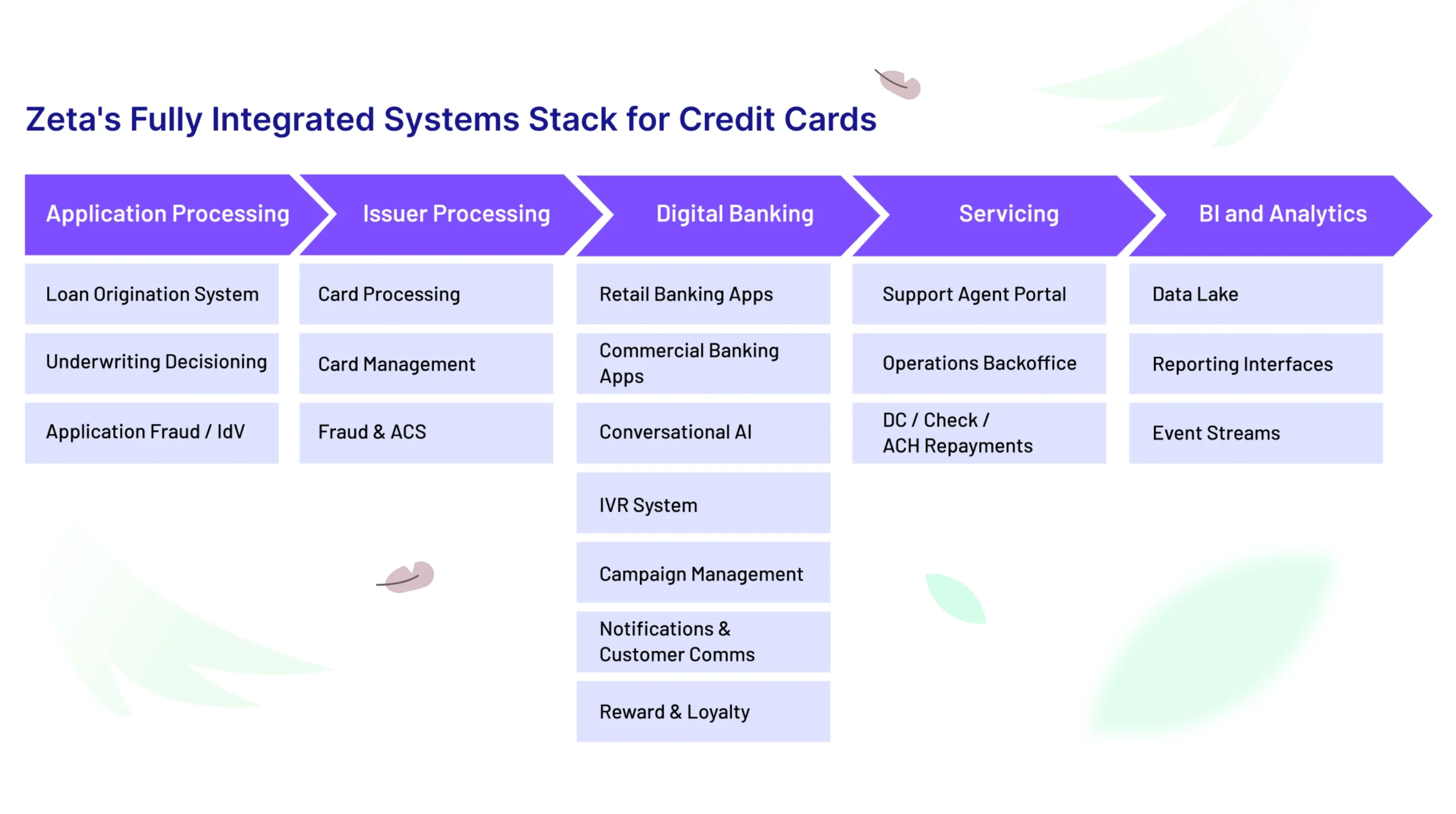

- Sparrow went from concept to launch with 14 systems and 8 services in 8 months due to Zeta’s fully integrated systems stack, comprehensive API and events catalog, and bespoke custom app development services

- Sparrow achieves high operational efficiencies by leveraging several other Zeta products, including our Saturn Servicing Suite for Customer Support and Operations, and Zeus Data Suite for BI and Analytics

Watch the highlights of the Sparrow card experience here:

Please read on for a detailed dive into each of the aspects outlined above.

#1 Customer experience for cardholders

Customers love the Sparrow card, as is evident from the number of 5-star reviews they have received in short order from launch. A few examples:

- The best card I have | ⭐⭐⭐⭐⭐

“…The app blows all others out of the water. Truly awesome!” - Great card, easy-to-use app | ⭐⭐⭐⭐⭐

“The virtual card is available right away on the app, which was super convenient. Overall the app is really easy to use, especially compared to some of my other cards.” - This is what every card should be | ⭐⭐⭐⭐⭐

“I was approved and had access to the card in my app immediately. And the app is so awesome. Looks super modern and has made managing my account so simple and quick. Way better than the apps for my other cards.” - Very happy with my decision | ⭐⭐⭐⭐⭐

“…I was approved and had a digital card in less than 5 minutes…No problems so far. Super cool app.” - Great card | ⭐⭐⭐⭐⭐

“…Made a payment and my available credit was returned immediately, no stupid holds like others. I hope they keep up the good work.” - Awesome card | ⭐⭐⭐⭐⭐

“Easy application process and great app that makes paying and staying on track super easy and fun!”

The Zeta Tachyon next-gen processing platform enabled several unique digital experiences and innovations that are each game-changing and, when bundled together, result in a card program that is far superior and arguably the #1 non-prime credit card experience in the market today. Some of these include:

- <100ms response time on every customer action: We are willing to bet that Sparrow’s digital mobile app is the fastest credit card mobile app in the entire industry. The app has a unique offline store updated in real time by Zeta Tachyon’s real-time events. This makes all customer information within the app available without a network call.

- Instant issuance: Zeta Tachyon and Sparrow deliver instant decisioning and provisioning within 3 seconds for 97% of Sparrow Card applicants. This is made possible by leveraging our rich cardholder creation APIs.

- Rich card controls: Sparrow cardholders can freeze cards, change PIN, and replace cards, all instantly leveraging just a sliver of Zeta Tachyon’s unique, granular, and real-time card management.

Here’s what Evan Feldman from Sparrow has to say about the customer experience:

“Sparrow has built the #1 credit card experience for the underserved in every respect, from a seamless application journey and instantaneous underwriting, a user-friendly mobile app, cutting-edge virtual card experience, a hassle-free repayment process, and an operations center that puts the customer first. This achievement has been made possible through the next-gen capabilities and integrated stack of Zeta.”

-Evan Feldman, Co-CEO of Sparrow

Fastest time-to-market

Sparrow went from concept to launch in under 8 months by leveraging Zeta’s comprehensive credit card stack. Here are some of the reasons why we were able to achieve this:

Fully integrated systems stack

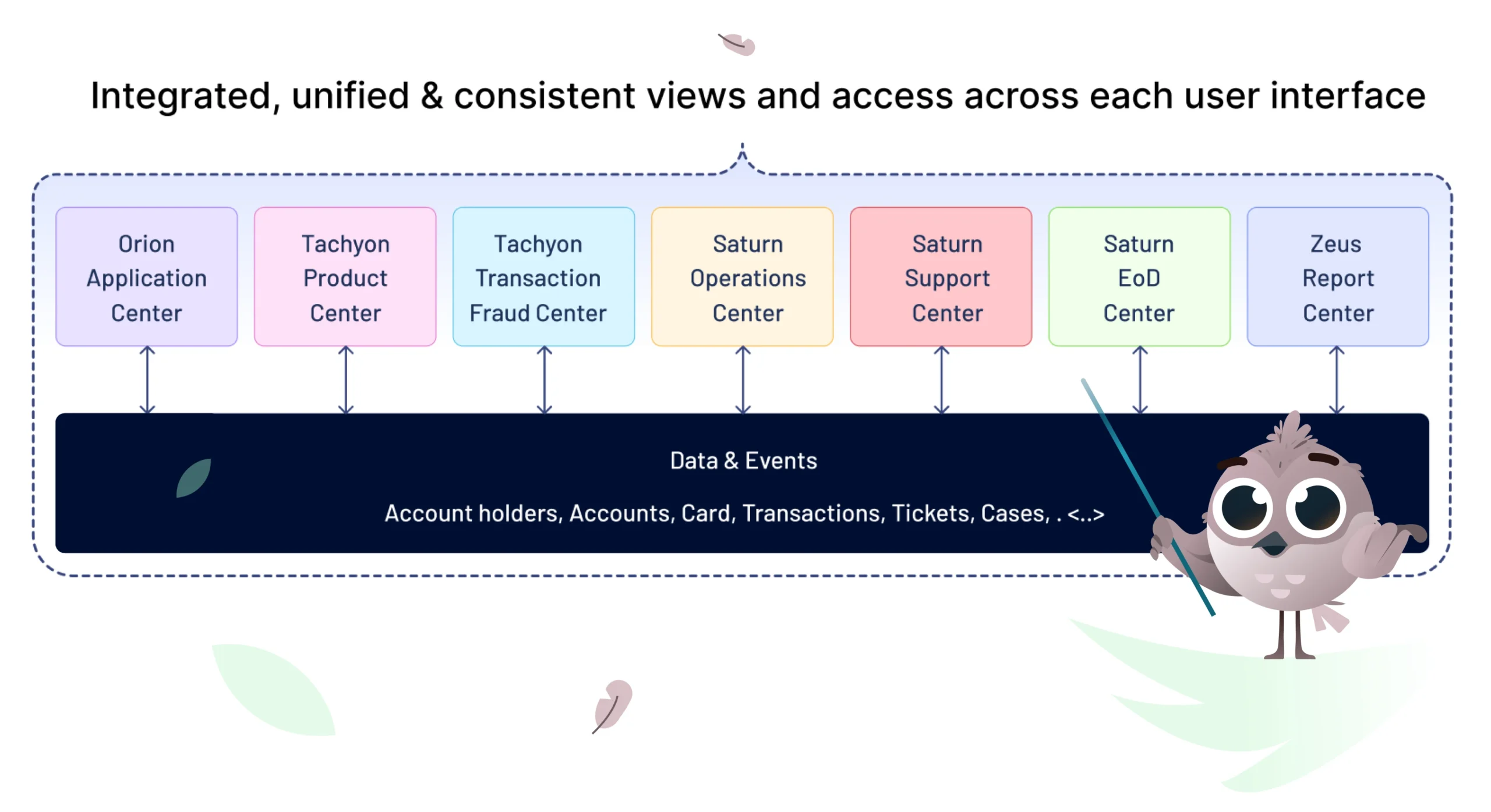

Apart from next-gen processing, Zeta optionally provides all other systems required to build and operate a credit card program pre-integrated with Zeta Tachyon (Image 1).

Image 1

10X the API and events breadth

Zeta Tachyon is the only next-gen card processing platform that has granular APIs and events. Every operation, every state change, every configuration, pretty much anything in the platform has associated APIs and events providing a far larger automation surface area than any other platform. This enables rapid application development in self-service mode.

Zeta Studios

Zeta provides optional high-end bespoke engineering services comprising developers, UX, design, and product managers who can build out your apps, integrations, and migrations. We set up a lean but highly efficient studio to wrap dozens of integrations and customizations of the Sparrow app experience at an accelerated pace. Zeta Studio teams benefit from pre-existing knowledge of the domain, the product, and our platform, resulting in 2x the development speeds you would get from internal teams or other outsourced vendors.

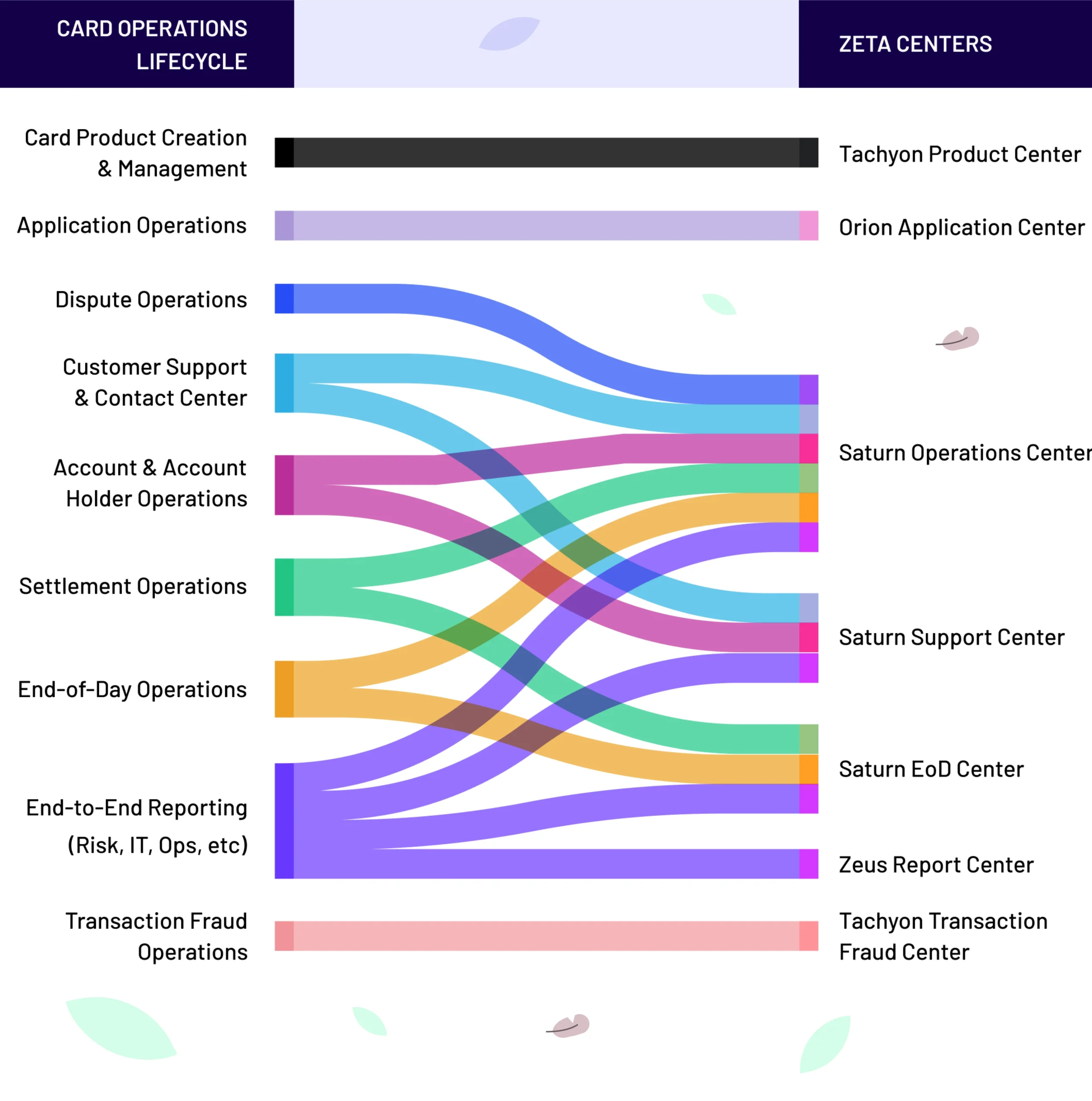

Unparalleled card program management capabilities

Over the past few years, Zeta’s product managers and customer success teams have spent countless hours engaging with nearly every key persona involved in managing a card program. This includes leaders of business or P&L, credit risk, portfolio/line management, servicing, operations, and compliance. We were reminded time and time again that the current set of admin interfaces, tooling, and systems used to manage card programs are woefully inadequate and antiquated. They provide neither the functionality nor the efficiency, and certainly not the granular visibility that card program managers need to successfully run a program at scale.

At Zeta, we have invested in building not just a truly next-gen card processing platform for cardholders but also web UIs and tools for each of the personas who manage the programs on a day-to-day basis. In terms of scope, Zeta’s platform provides toolchains and interfaces across the entire card operations lifecycle (Image 2).

Image 2

Sparrow was able to custom design and set up their entire card operations in a matter of months using the above products. Further, we estimate a 30% reduction in the number of agents required for card operations due to Zeta’s modern toolchains. Image 3 highlights how this is enabled through integrated interfaces across all card operations systems.

Image 3

On today’s processing platforms, dispute management is highly manual and disconnected from the rest of the card operations lifecycle. The Zeta Saturn Operations Center delivers one of the most efficient dispute management workflows with automated and manual Dispute decisioning, automated integration with Network Dispute systems (e.g., Mastercom, VRoll) and automated integration with Zeta Tachyon for posting or reversing provisional and final credits.

Upcoming features and customer experiences

This is just the beginning. Over the next few quarters, Sparrow will cement its position as the #1 credit card for the underserved by providing unique experiences to their growing customer base. A few Zeta capabilities that are under consideration for integration include:

- Conversational AI bots: In-app and on-call AI bots that deliver responses to any support questions, perform any actions, and provide human-like insights, leveraging the Zeta Merlin Conversational AI platform. Zeta Merlin leverages custom built orchestration flows, OpenAI and open source LLM models and rich, real-time, granular data provided by Zeta Tachyon.

- Family cards: A unique family add-on card and expense management experience with an extensive set of card controls. The Family Cards hub is enabled via Zeta Tachyon’s ability to apply dynamic real-time configurable policies to each unique transaction.

- Transaction enrichment: Zeta Tachyon’s AI-driven merchant information enrichment, including brand names, logos, hours of operation, and more.

Contact us to know how Zeta can power your card program!