Zeta’s Next-Gen Credit Processing is Natively Multi-Network

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 was enacted by Congress as a response to the “Great Recession” of 2007-2009. The purpose of the Act was to provide greater oversight and tighter controls and regulation of the financial services industry with the goal of preventing a future financial crisis in the U.S.1

Section 1075 of the Act, also known as the Durbin amendment, is best known for introducing a cap on interchange fees (or the fees that card issuers charge merchants) for issuers with more than $10 billion in assets. This section also mandated for “issuers to make available at least two independent debit networks on the cards they issue so that merchants have a choice of debit networks when processing debit transactions”2

The goal of this amendment was to introduce competition and choice by providing3

- at least two unaffiliated payment card networks to process electronic debit transactions, preventing network exclusivity, and

- preventing card issuers from inhibiting merchants from directing the routing of an electronic debit transaction

Now, in 2022, newly proposed legislation by Senator Durbin, U.S. Senate Bill S.4674 – the Credit Card Competition Act of 2022, aims to provide for similar dual routing provisions for credit card networks4

Zeta’s goal and commitment as a technology service provider is to support card issuers by offering a next-gen platform that allows them to rapidly comply with applicable current and proposed laws and regulations.

While Zeta is not offering any specific comment on the proposed legislation, through this blog post we want to highlight how our credit processing platform, Zeta Tachyon, is natively multi-network and would allow issuers to rapidly achieve compliance to a multi-network scenario if called upon to do so.

Fundamentals of credit card network routing (i.e. the status quo)

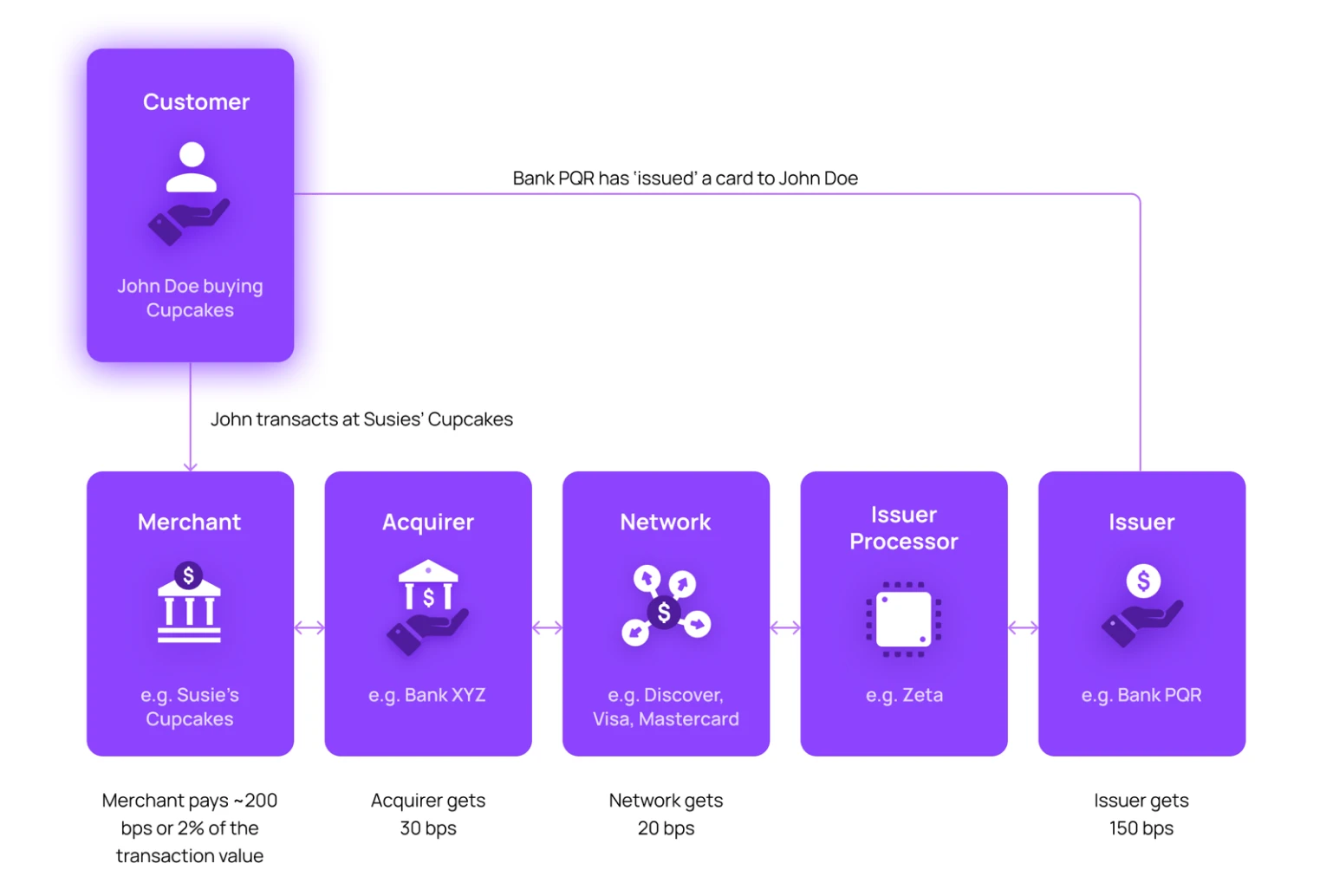

Let’s first understand how a typical credit card transaction works in the US today.

A Customer, say John Doe, who has been issued a credit card by Bank PQR transacts at a Merchant called Susie’s Cupcakes. The merchant’s Acquirer or Bank XYZ routes the transaction via a Network, say Mastercard, to an Issuer Processor, say Zeta, which processes and authorizes the transaction on behalf of the Issuer, or Bank PQR

In this scenario, the Merchant incurs a cost of 200 basis points or bps of the transaction value which is distributed amongst the Acquirer, Network, and the Issuer as highlighted in the example above – the numbers provided are representative but can differ significantly on a case-by-case. The payment of these fees is the source of much debate and legislation globally5

As you can see in this case, the transaction must take a single path. This is because as of today the specific BIN6 or Bank Identification Number assigned to the Issuer is (typically) tied very closely to a specific Network; this BIN is embossed on the Customer’s credit card and is typically the first four to six numbers printed on the front of the card.

Multi-network routing

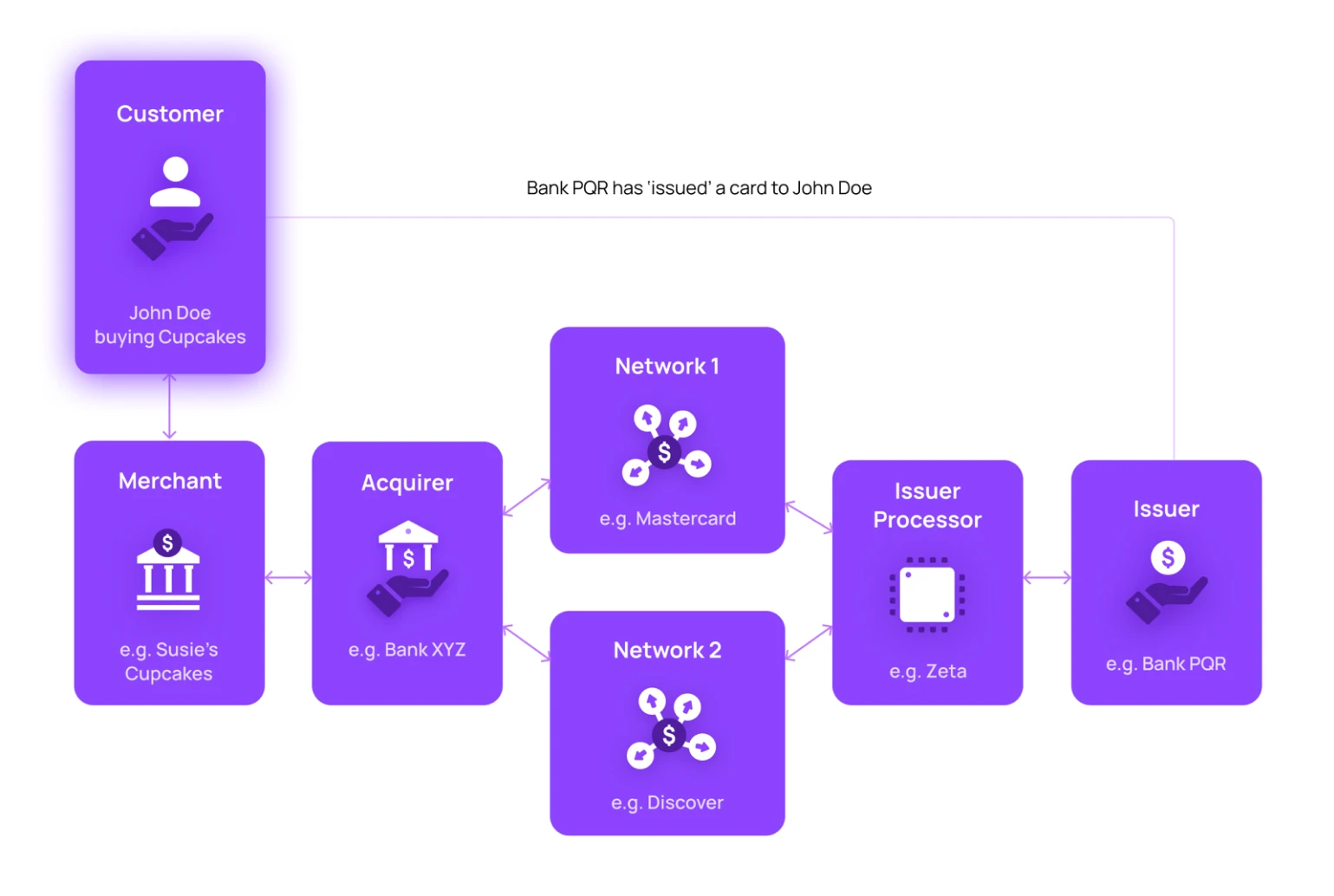

A multi-network credit network routing scenario as proposed with the new legislation (akin to the 2010 debit card routing regulation) would require that a transaction that would previously take the single network route to be optionally routed via a different network – at the discretion of the merchant or the customer at the point of payment.

Let’s see what that would look like in the scenario where there are 2 networks.

In this case:

- The Issuer would need to contract with two different networks

- The Issuer would ‘announce’ their BIN on both the networks

- The transaction could reach the Issuer Processor on either network

- The Issuer Processor would authorize the transaction

- The Issuer Processor would also need to provide a settlement mechanism to their Issuer to settle with both networks, i.e. Network 1 and Network 2

Application Identifiers (AID)

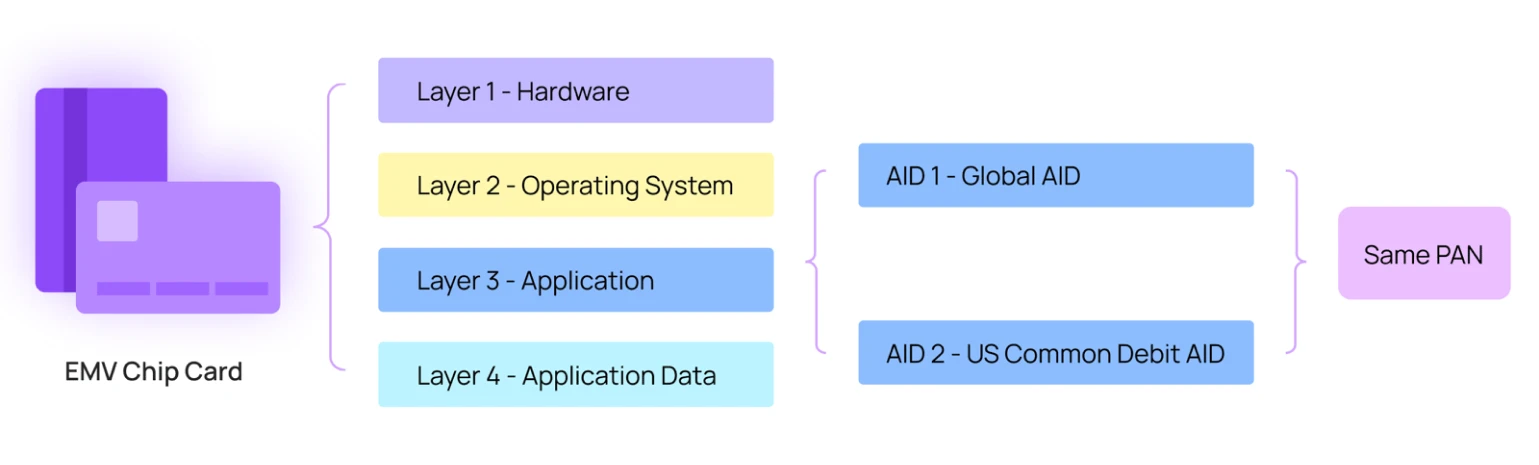

To achieve the dual routing scenario described above, we also need to understand the usage of EMV7 Application Identifiers (AIDs).

A single card can be personalized with multiple AIDs pointing to the same card number or PAN8 which is embossed on the physical plastic card. Each application can have its own set of parameters such as keys, cardholder verification methods etc.

In the context of debit cards and the Durbin Amendment 2010, all debit cards issued in the U.S must have at least 2 AIDs: one “global” AID which is mostly used for international usage and another “US Common Debit ” AID for usage within the US.

If the merchant decides to route via the “Global AID”, then only one routing option will be available, that is to route via the card brand’s payment network (Visa, MasterCard, Discover etc..)

If the merchant decides to route via the “US Common Debit” AID then two options will be provided – one to route via the global AID (Visa, MasterCard) and the other via the US debit network. By selecting the US common debit AID, merchants can make intelligent and cost effective routing decisions.

Application Identifiers (AID)

Should this proposed legislation make it into law, there would be many significant implications to consider. We attempt to provide a very initial set of those below. Note that these are based on our interpretation of available material at this stage and will continue to evolve as more information becomes available.

- Multiple Network support: Supporting two different payment networks on a single card will require BIN certification to be performed twice and cards to be configured uniquely for each network that may participate in the transaction.

- Multiple AID support: As of today, all credit cards issued in the US region are single AID cards, and would need to be programmed for multiple AIDs (see the prior section).

- Multiple Card Personalization Validation (CPV) support: Supporting two different payment networks on a single card will require CPV certifications to be performed twice and multiple card personalization profiles to be stored for each network.

- Multiple authorization processing rule support: Each network processes a transaction uniquely with a very specific set of rules and configurations – a multiple-network routing scenario would require the Issuer Processor to be able to configure the card with rules for multiple networks.

- Support for special processing rules across multiple networks: Some networks, namely Mastercard and Visa, perform additional processing checks such as fraud monitoring and risk assessment. Issuers will need to work with their Issuer Processors to devise a work-around if such capabilities are not available with the second routing channel.

- Support for settlements across multiple networks: Most Issuer Processors today support settlements across a single network only, this would need to be extended to multiple networks.

As is evident from the bullets above, supporting multiple networks is not-trivial and requires Issuers to carefully think through implementation strategies.

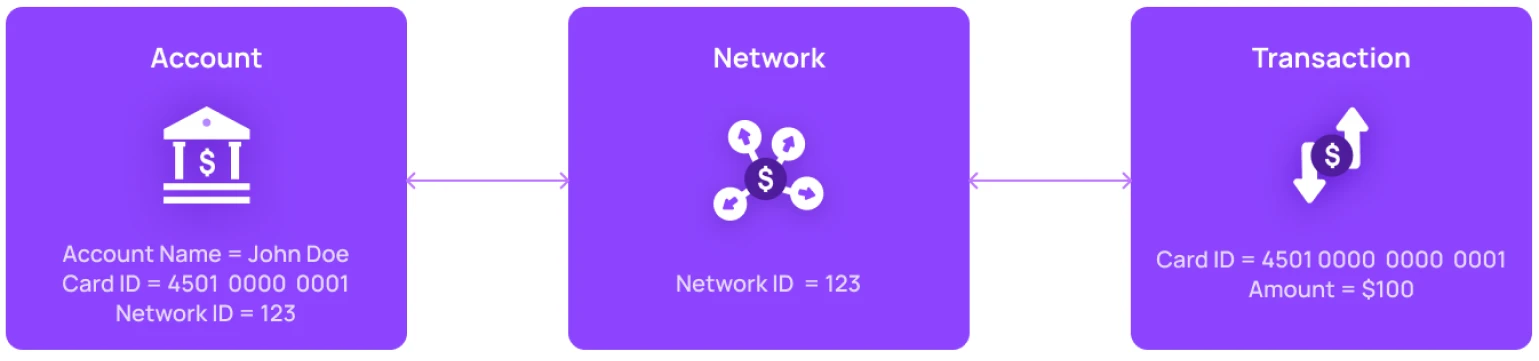

Let’s dive deeper by first highlighting how a typical legacy Issuer Processor maps the various entities that participate in a credit transaction today.

On a typical legacy platform:

- An ‘Account’ and ‘Card’ are the same

- A ‘Transaction’ is hard-linked to a ‘Card’ which is hard-linked to the ‘Network’

- Hence the Issuer Processor expects that the transaction will only come through the specific Network hard-linked for that specific Card

As you can probably surmise from the example above, most legacy Issuer Processors today have almost non-existent capability to deal with multiple-network routing given these hard linkages and non-flexible entity models.

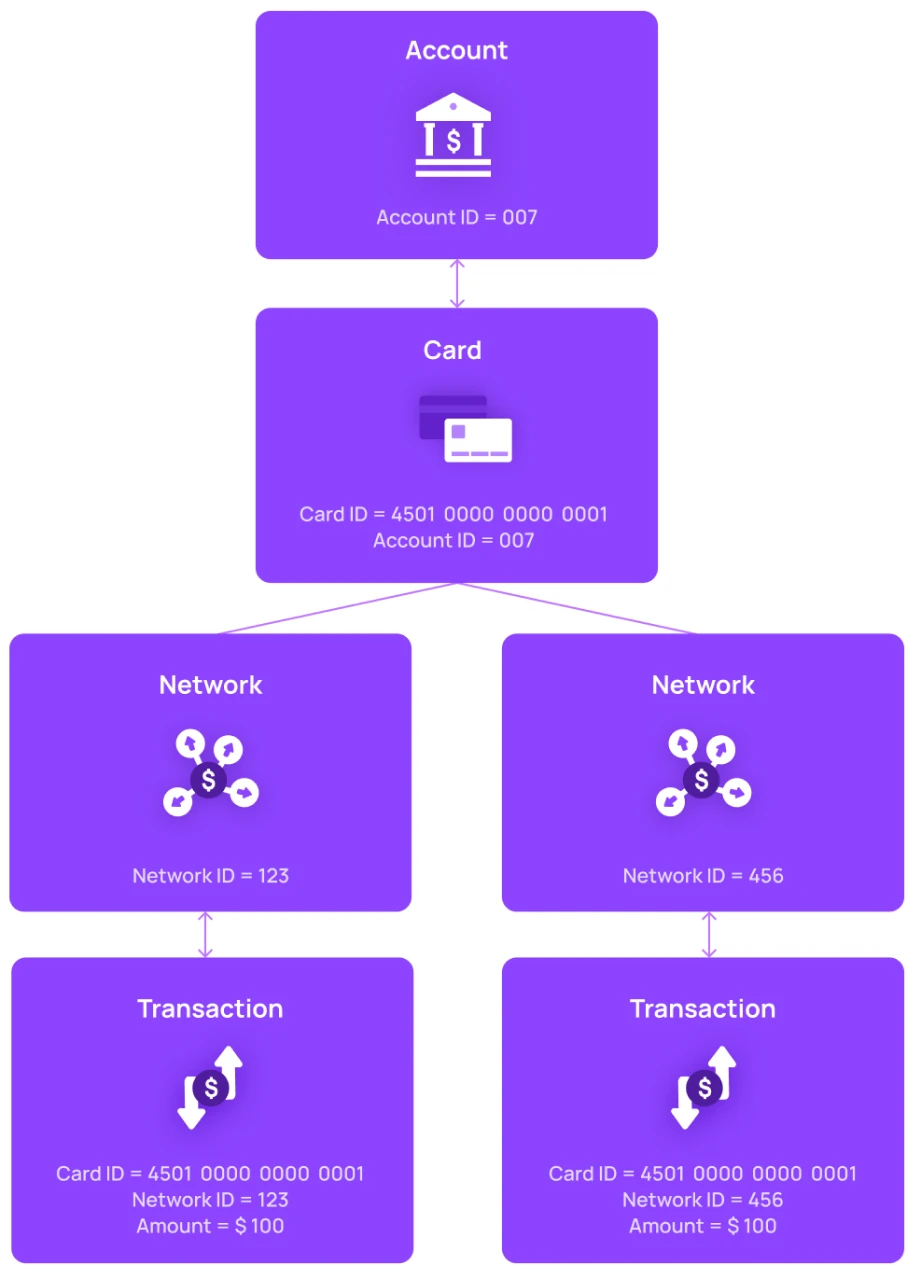

Zeta Tachyon’s normalized entity model

Zeta Tachyon is the industry’s only processing platform which ships with a highly flexible and normalized data model for cards, networks, BINs, payment instruments, accounts, account holders, and other significant entities. It allows issuers to gain unparalleled flexibility in designing for today and tomorrow’s use cases – by allowing them to model one-to-many and many-to-many relationships between these entities that were previously never possible.

Let’s explore this by first understanding how Zeta’s next-gen processing stack treats these various entities. Please note that the representation below has been simplified to exemplify the dual-network routing use case – the platform is in fact capable of many additional use cases given the possible entity linkages (which will be the topic of a future post).

As such,

- The system provides for a clean separation between the entities representing an Account, a Card, and a Network

- Most importantly, a Card is not hard-linked to a Network

- Each transaction can have a unique and separate Card ID and a unique and separate Network ID

- Therefore, for any Card on the Zeta processing platform the transaction may be routed via any supported or advertized Network

Also, as was outlined earlier in the section on the implications of dual-network routing, any multiple-network support will need to provide for the ability for the Issuer Processor to store multiple sets of configurations (such as the AIDs that were highlighted above) for each network and invoke those in the context of the transaction which is offered – this is achieved seamlessly with Zeta Tachyon.

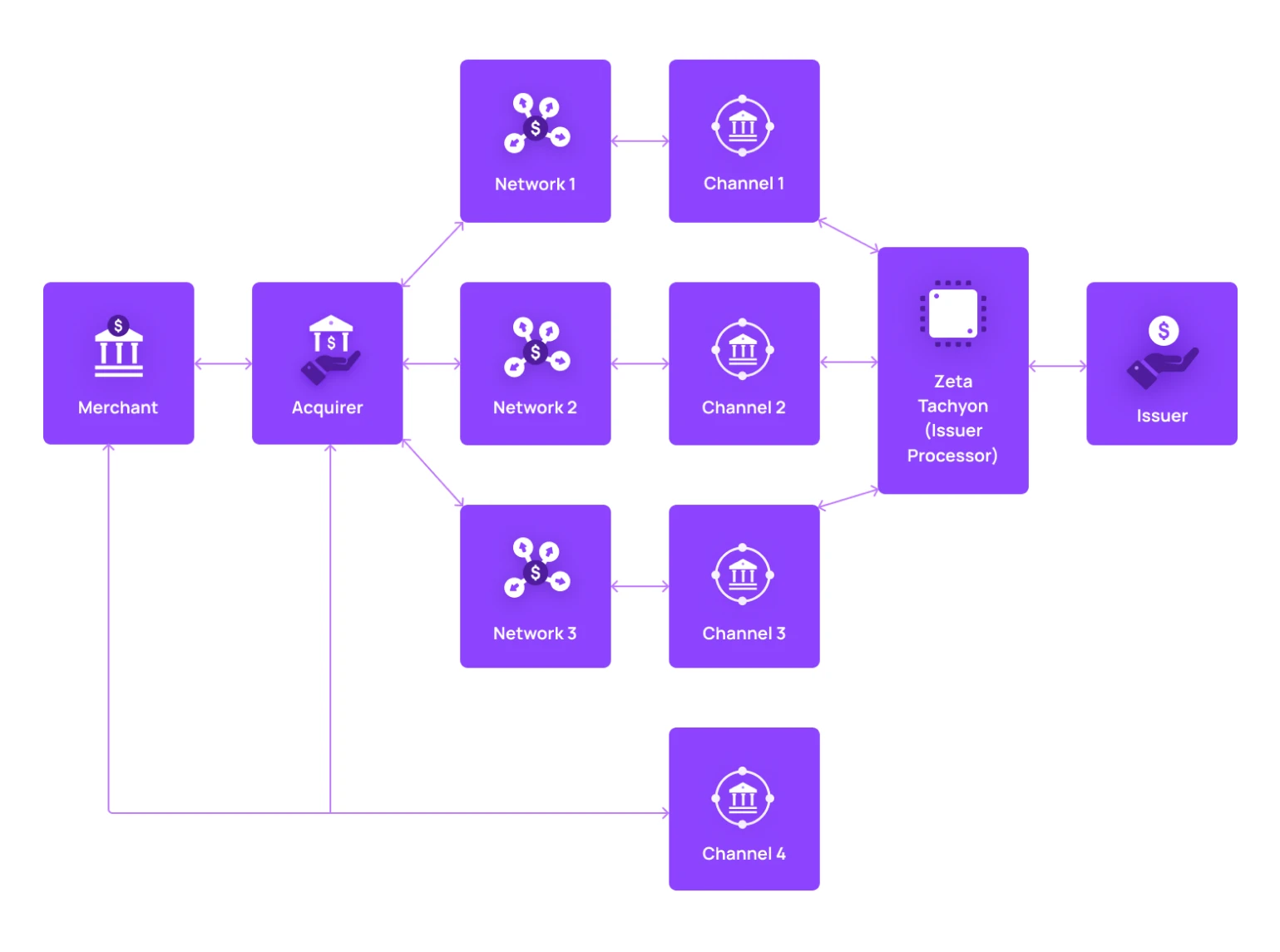

But that is not the full extent of the functionality offered, the subsequent diagram outlines additional capabilities available to Issuers with Zeta’s stack in the context of multiple networks – which go far and beyond support for just dual-networks.

Multi-Network

A single card can work on as many open loop networks as you want as an Issuer- two is just the starting point

Closed-Loop Networks

Zeta offers the ability to build closed-loop networks that allow Issuers to build direct connectivity with merchants thereby allowing them to achieve a number of benefits

- A Merchant can directly send a transaction to the Issuer bypassing any network entirely; this is achieved by introducing the concept of channels which are agnostic to networks

- Can ink custom settlement deals with merchants with specific business rules, e.g. settlement durations

- Can setup custom rewards including those funded wholly or in part by the Merchant

- Can build custom BNPL deals with specific merchants

- Can lower network costs for the merchant

Conclusion

In summary, Zeta Tachyon provides the industry’s first and truly multi-network credit processing stack that is ready to support any existing and future use-case that may be required due to new laws and regulations.

Furthermore, it allows for modeling practically any use-case given its flexible entity model and to achieve various open and closed loop processing scenarios that were previously not possible.

Footnotes

- https://www.investopedia.com/terms/d/dodd-frank-financial-regulatory-reform-bill.asp

- https://www.justice.gov/opa/pr/justice-department-supports-federal-reserve-board-sproposed-rule-debit-card-interchange-fees

- https://www.jdsupra.com/legalnews/federal-reserve-proposes-changes-to-5661516/

- https://www.paymentsdive.com/news/Durbin-Congress-credit-card-routing-legislation-Visa-Mastercard/628314/

- https://en.wikipedia.org/wiki/Interchange_fee

- https://www.investopedia.com/terms/b/bank-identification-number.asp

- https://en.wikipedia.org/wiki/EMV

- https://www.investopedia.com/terms/p/primary-account-number-pan.asp