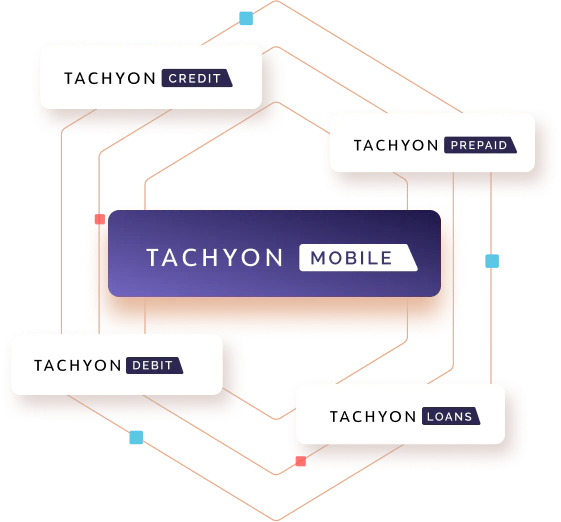

Zeta Tachyon Mobile works as a mobile banking app for credit card, debit card, prepaid and retail loan customers and operates seamlessly with all products in the Zeta Tachyon Suite

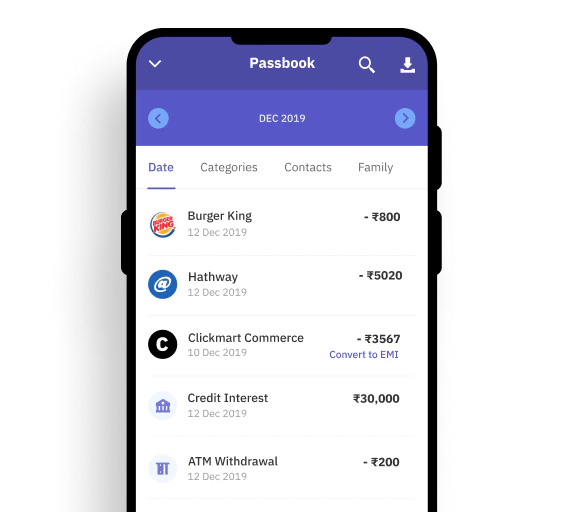

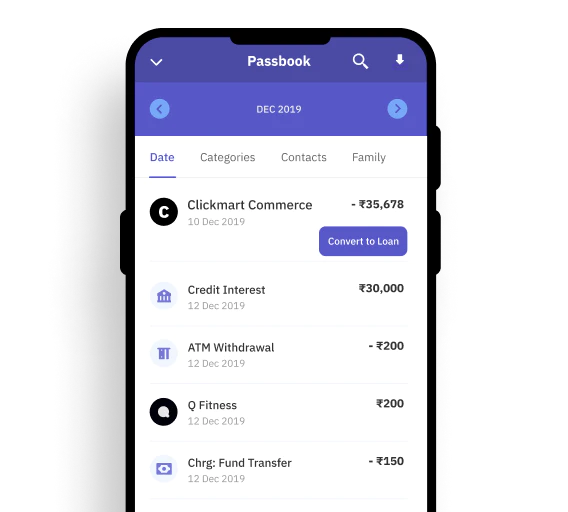

Recognizable merchant names

Zeta Tachyon Mobile translates merchant IDs (MIDs) into friendly merchant names that your customers can easily recognise. Delight your customers while reducing fraud costs by eliminating unrecognised transaction related disputes

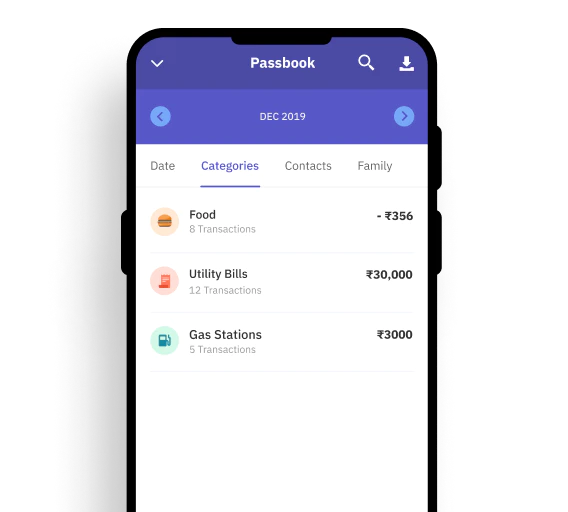

Spend categories

View transactions categorised into food, transport and other automated or manual classifications

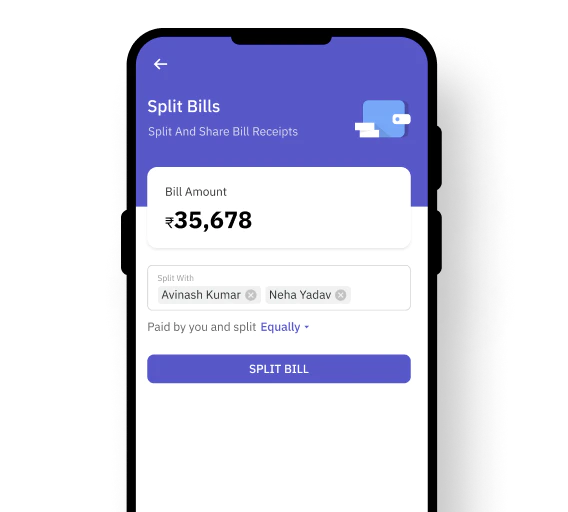

Split bills

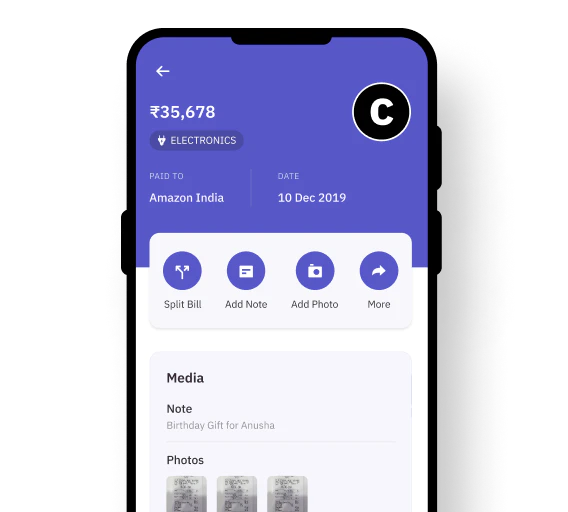

Add notes and media

Upload/add receipts

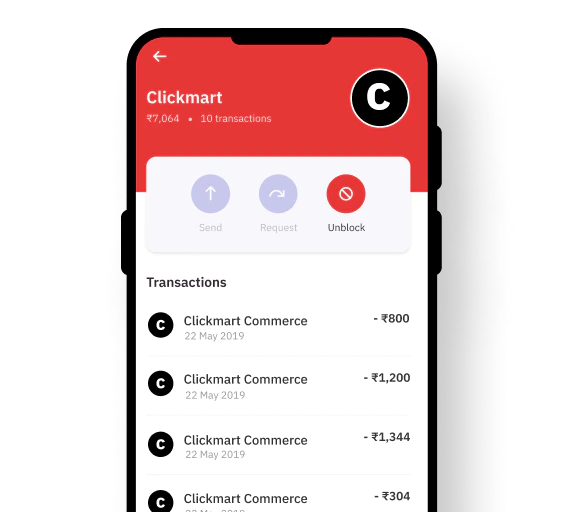

Block merchants

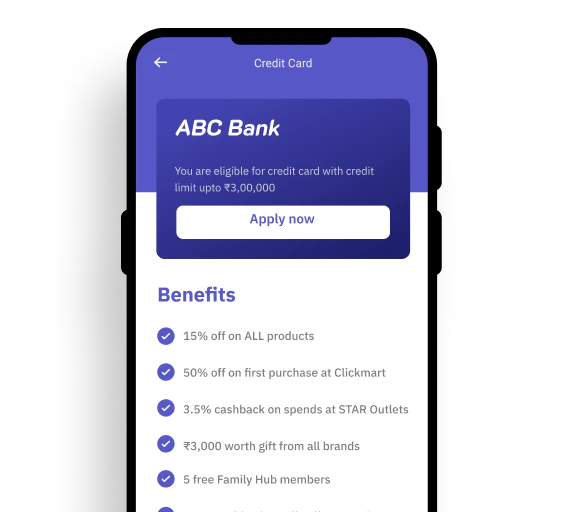

Convert high value transactions into Pay Later fixed monthly instalments at POS or post purchase

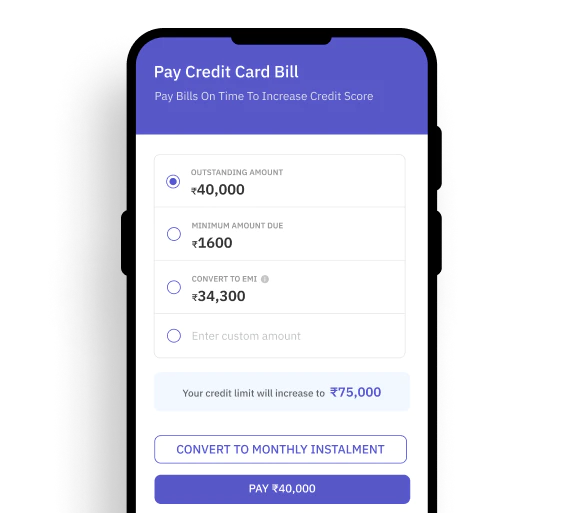

Convert outstanding credit card balances into monthly instalments

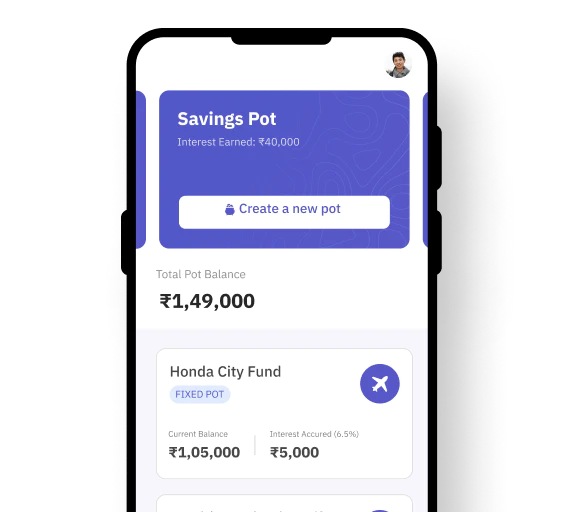

Create goal based, fixed, recurring and flexible term deposits

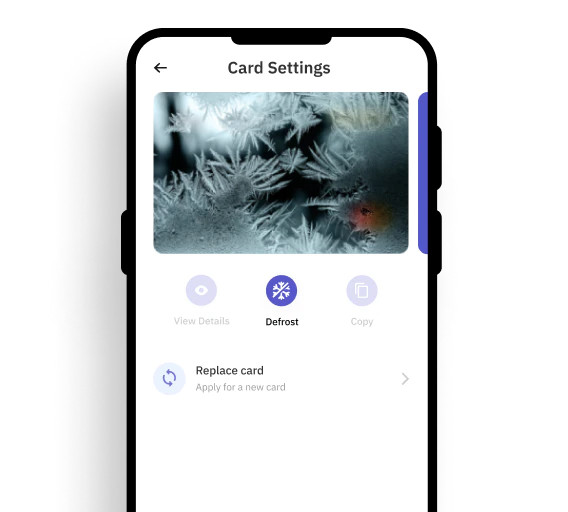

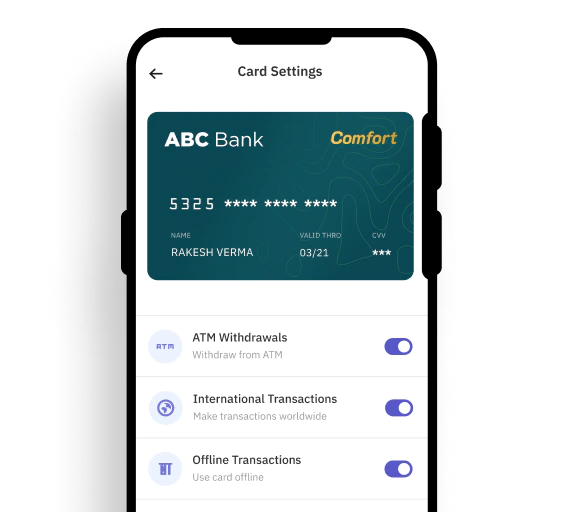

Instant block and unblock

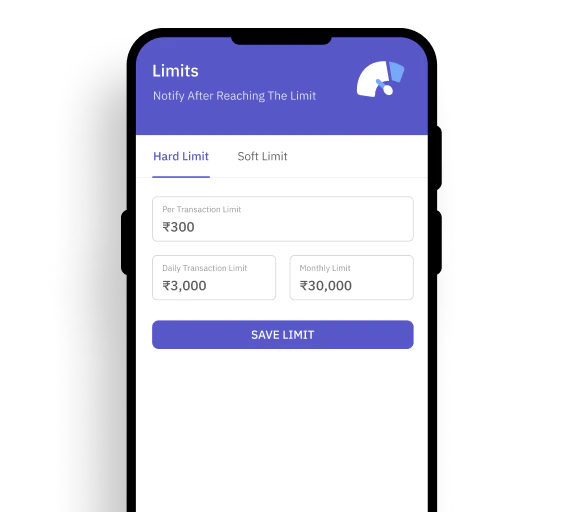

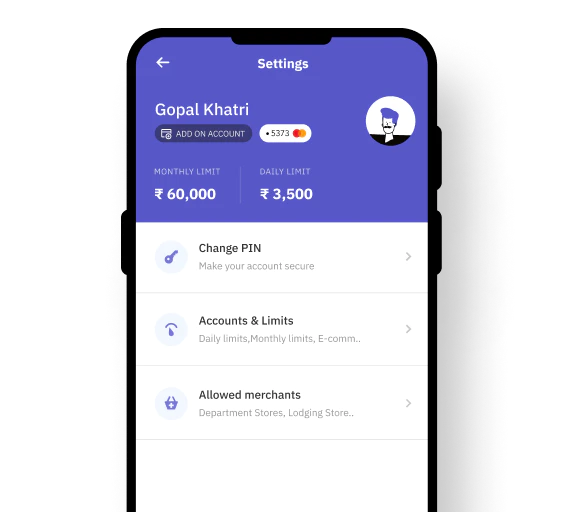

Set hard and soft transaction limits

Enable/disable ATM, tap and pay, international, online transactions

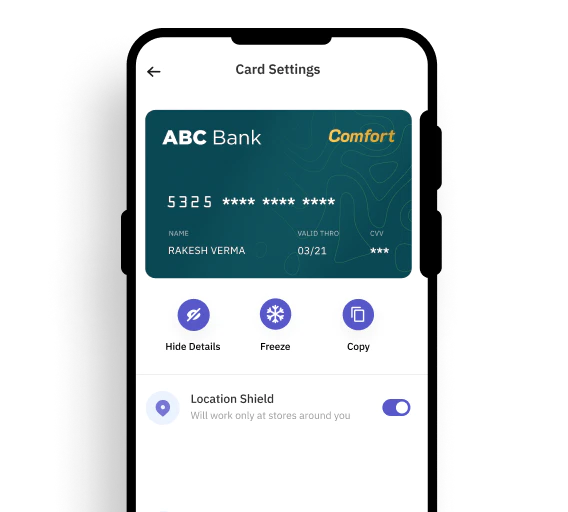

Location Shield - Prevent usage of card outside of the location of the user, preventing online and offline fraud from other cities/countries

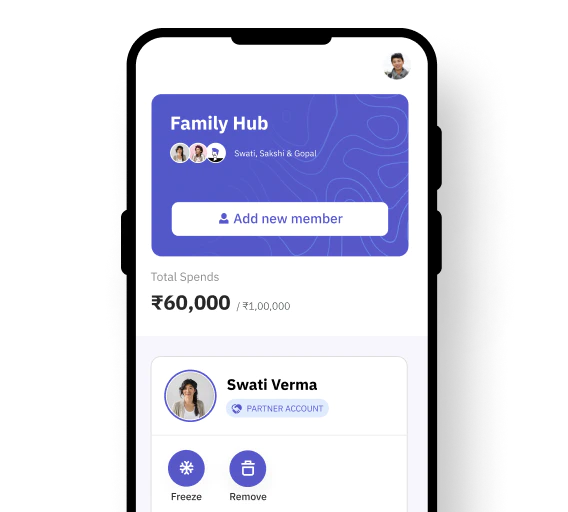

Create virtual cards, physical cards and mobile wallets for family members

Create a pocket money card for your child and set transaction limits, whitelist/blacklist merchants and categories, set time-based restrictions and more

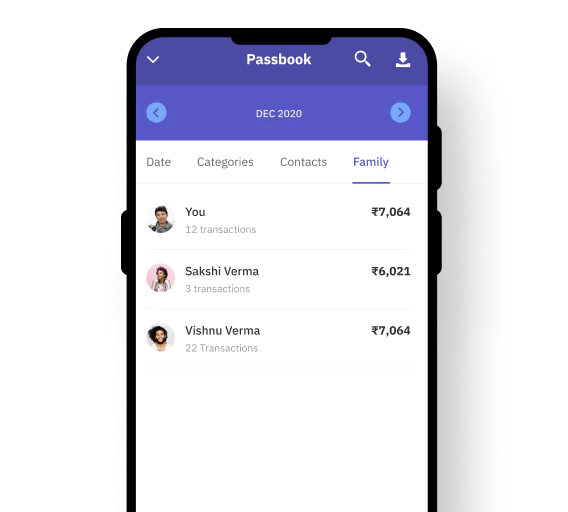

View family spend statements

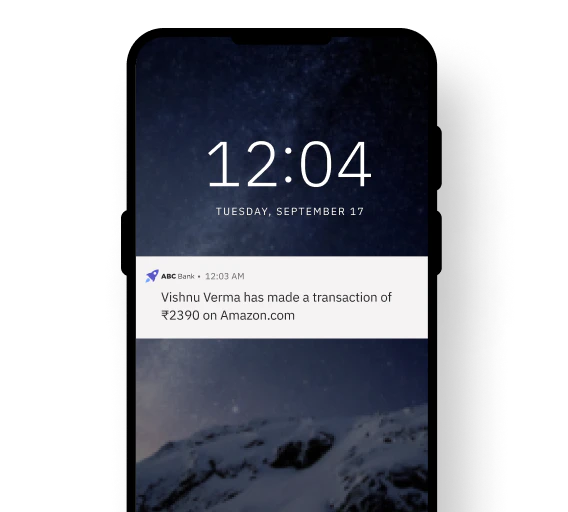

Get real-time notifications on spends

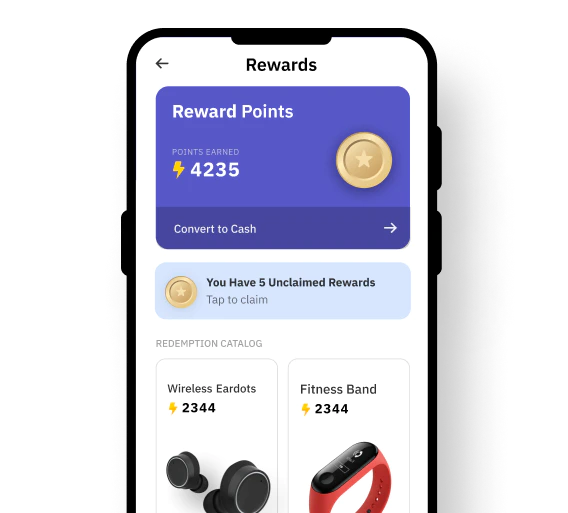

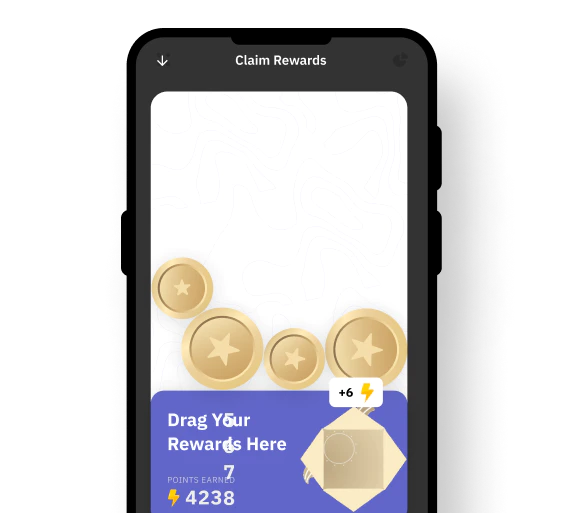

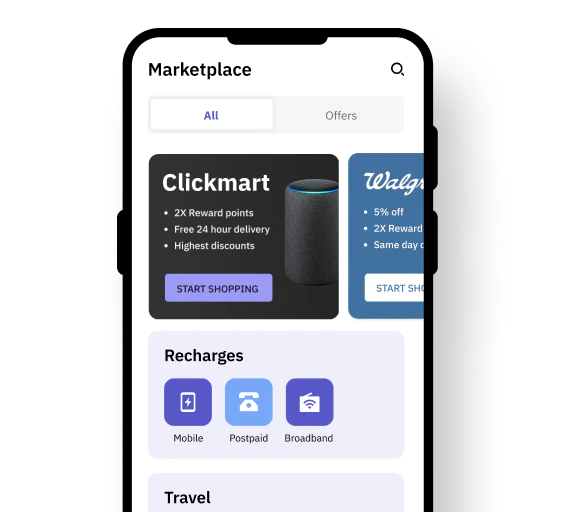

Real-time reward earn and burn engine

Support for plugging in redemption catalogues or convert to cash

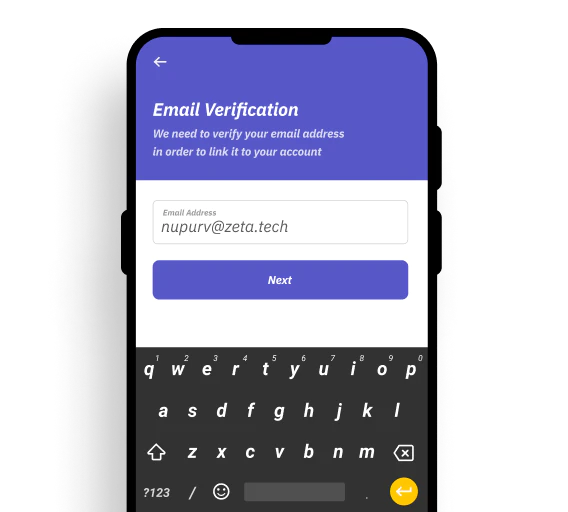

Configure input fields

Real-time or batch processing

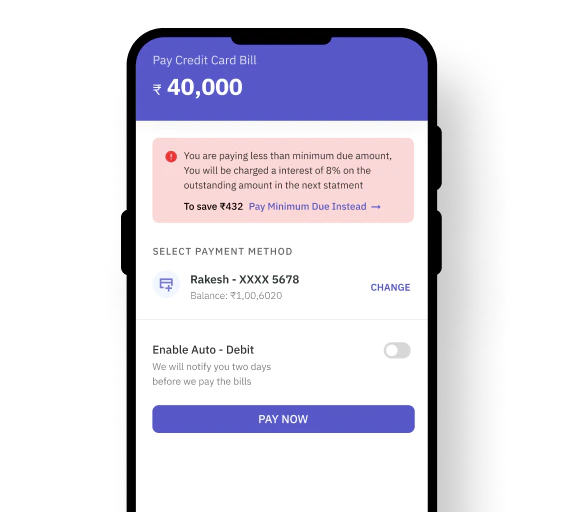

Keep your customers informed along the way

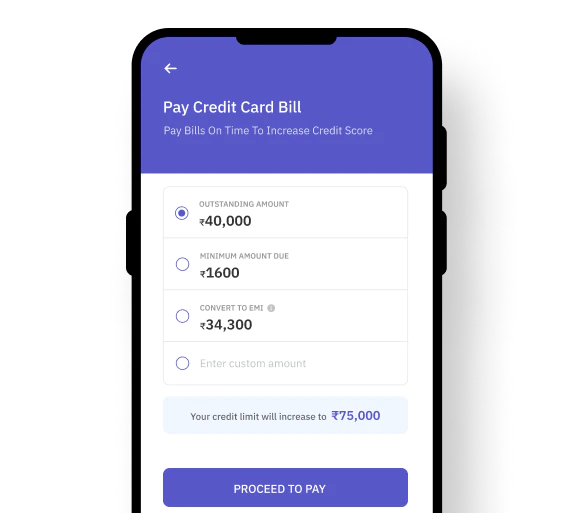

Pay minimum balance due or full/partial outstanding, convert outstanding amounts into instalments

Transparently shows balance and Annual Percentage Rate (APR)

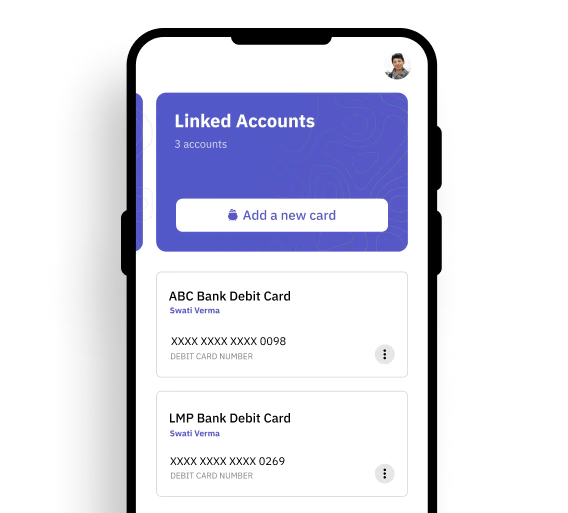

Allow customers to link debit cards from other banks and transfer money seamlessly between third-party bank accounts and Tachyon accounts. Encourage customers to use your mobile app even for accounts of other banks

Zeta Tachyon Mobile was built to deliver on the following principles

Every action by a customer must be possible from a smartphone. No need for branch banking, desktops or phone calls

Responsive modern User Interface (UI) and User Experience (UX) that are engaging and intuitive

Users must have complete control of data privacy. Apps, services, entities and people must be explicitly authorized to access any data for any duration of time

All user data must be available securely, in real time and offline on their mobile devices

User-defined transaction policies that are implemented dynamically during authentication and authorization

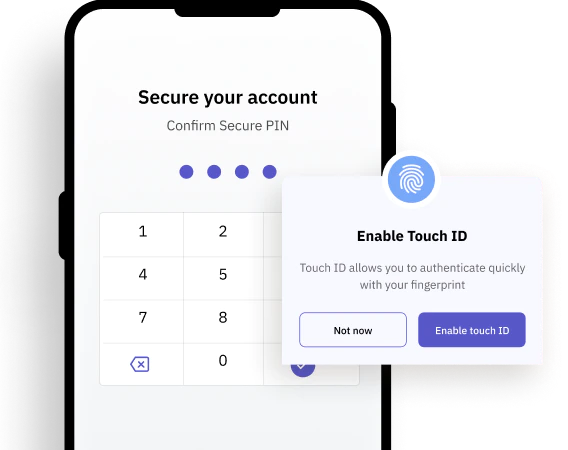

User-defined security policies that are applied for every operation and transaction

Support for multiple combinations of authentication vectors based on who you are, what you have and what you know such as biometric, dynamic PINs, secure tokens, device binding, gestures, passwords and more

Branding, skin, Information Architecture (IA), look and feel can be fully customised to your needs. Customisation can be handled as a bespoke project by us

Select some or all of the above features to create your own personalised experience

Our consulting division can take up customisation projects from one time build and transfer to hiring a long term dedicated mobile app development team for you