Benefits for banks

Participate in the fintech revolution

Leverage new-age fintechs and bigtechs as

distributors to gain additional customers through their digital channels

Incremental revenue

Improve your revenue with SaaS fees, interchange

income and opportunities to cross-sell/up-sell higher-value products such as loans, credit

cards and more, to customers sourced from the partners

Readymade APIs and SDKs

Comprehensive provisioning, payments and account

management APIs and SDKs enable seamless embedding of financial products into apps,

interfaces and experiences of third-party vendors without compromising privacy and security

Sandboxed and secure

Define a separate sandbox per partner, specify the

products, configurations, limits, rules and criteria and leave the enforcement to us

Multi-product support

Fusion enables your partners to distribute and

embed all financial products including credit, debit, prepaid and loans

Built-in compliance

Bundled in with regulatory compliance, so that you

don’t have to worry

about it

about it

Secure

PCI DSS, SOC 27001, AICPA SOC3, ACS 2.0 certified

Infinite scalability

Manage peak loads originating from partners with

our cloud-native, loosely coupled, microservices architecture based platform

Lower Total Cost of Ownership

Digital and cloud-native, Fusion comes with zero

upfront/IT cost — so that you pay only when your partner pays

Create stickiness for your partners

The end-to-end experience for your partners will

ensure that they remain with you as their business grows

Reduce fraud

Mitigate fraud with card controls, Location Shield,

actionable alerts and multi-factor authentication coupled with audit trails

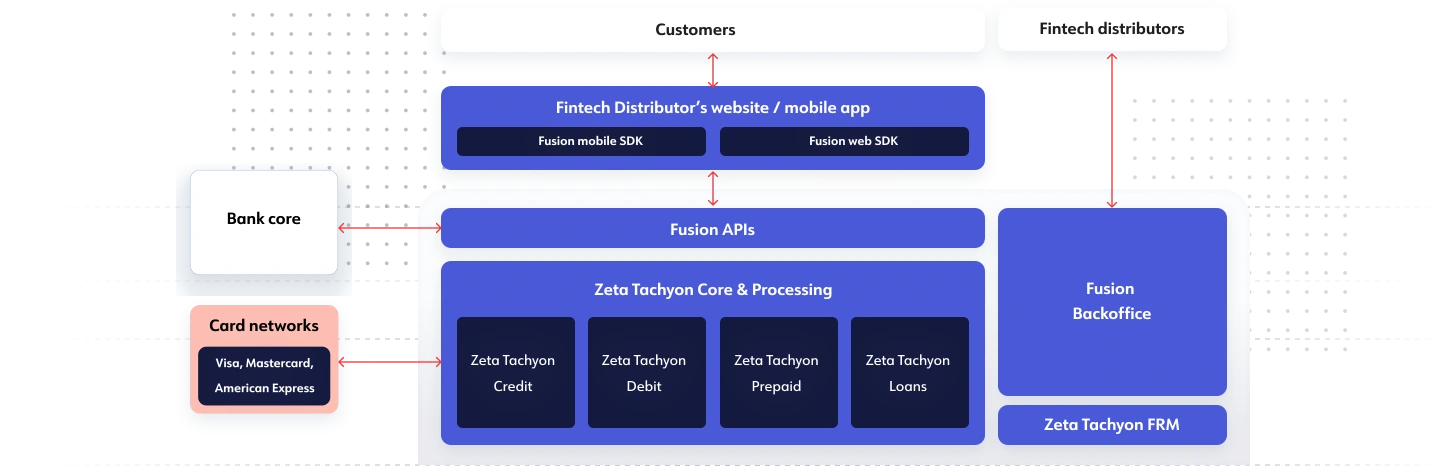

How Fusion works

Fusion exposes secure, sandboxed, permissioned APIs on top of Tachyon enabling your partners to provision and

manage any of your financial products within the sandbox criteria defined by you